Coupons can be difficult to understand.

On one hand, we can see that a lot of coupons are there to make us buy products that we don’t really need.

On the other side, we’ve all seen Extreme Couponing and are aware that it is possible not to spend money on groceries.

For many of consumers, this would be a miracle.

Imagine the amount of money we could save if we figured out how to make the most of couponing, especially considering we could possibly get free products.

If you want to start saving more instead of spending more with the help of coupons, here are a few tips and tricks to getting the hang of things.

Getting The Right Coupons

First of all, get the right coupons.

This is key because you don’t want to end up buying products that you won’t use.

Instead, you want to save on things that you were already planning on buying.

There are two main ways to do this:

1. Sign up for your preferred and frequent brands.

The first step for this option is to identify what products you always get, no matter what deals their competitors may put out.

One example could be cookie dough.

If you always buy a certain brand, try checking their website and signing up for their emails.

You’ll get tons of promotions and coupons.

Don’t let this process overwhelm you.

Start with just a few of your favorite brands.

Before you know it, you’ll end up with tons of rewards programs and coupons for the products that you actually need and use!

2. Another option is using master lists.

When you start using coupons, don’t get discouraged because you think you’ll have to spend hours going through magazines and newspapers to find any deals.

Thinking of it that way is intimidating and, honestly, kind of terrifying.

While there are probably other master lists online, Swagbucks is lovable and a favorite because it gives you the coupons, plus extra points just for using them!

You can then trade those points to get gift cards or cash.

Using Stores That Allow You To Double Coupons

Most couponers use stores that allow you to double manufacturer coupons, as long as they are under $1.

This means that the product must be $0.99 or less.

This can be a huge assistance if you’re using coupons for a product that is already fairly inexpensive.

For example, there are frequently coupons for Gerber toddler meals that take $0.75 off.

When you double this coupon, you end up getting these for free since they normally cost under $2.00.

Pair Your Coupons

The best way to get everything you can from your coupons is to pair them with cashback sites and/or great store deals.

One of the simplest ways to accomplish this is by keeping an eye out for items that have Buy One, Get One Free deals.

These are great because the products are already essentially half price.

If you use a coupon that can double, you have the potential to get these products at a serious discount.

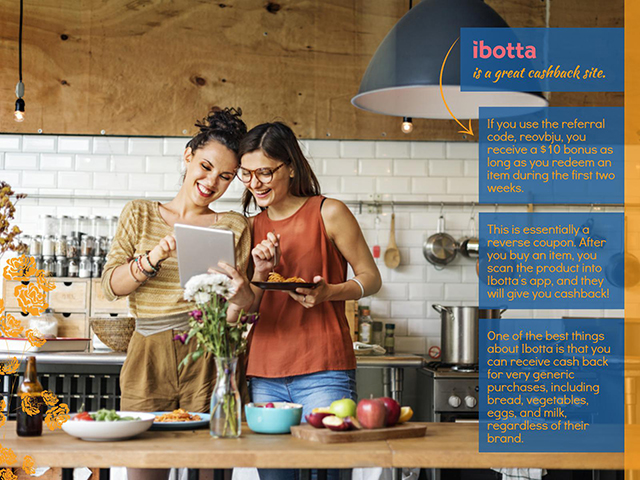

Cashback sites also offer fun bonuses.

When you pair cashback sites with store deals, as well as coupons, you actually have the potential to make money, instead of just saving.

If you like your alcohol, there are also great deals for cashback for these products, which can sometimes be hard to find coupons for.

Prepare And Use Your Grocery List

This is extremely important because not sticking to your grocery list is most likely the largest reason that everyone goes over their grocery budget.

It is perfectly okay to use your coupons as inspiration when you start planning your meals for the week, especially if they can be paired with cashback and store deals.

However, do not go so far as to buy products simply because you have a coupon.

Couponing is used to save money, not spend money on extra products that you won’t use or need.

Be Comfortable Stockpiling Products

Before you get overwhelmed by the idea of stockpiling, understand that you don’t need to resort to hoarding, and you don’t have to be one of those Extreme Couponers you see with overly organized garages dedicated to specific products.

One shelf or single cabinet is plenty.

To make sure that you are always getting these deals, you want to have enough product on hand to last you until the next cycle of sales and great deals comes along again.

For instance, condiments that you find at BBQs are extremely discounted around the 4th of July and Memorial Day.

Cashback opportunities and coupons also appear for these products.

Since most condiments, including ketchup, have a shelf life that tends to be longer than a year, it makes sense to purchase the amount of condiments that you’re aware you will use.

This technique will end up saving you crazy amounts of money long term.

The Bottom Line

Couponing can be scary and looming at first.

However, using coupons, as well as cashback sites and store deals, can save you a ton of money.

For the majority of people, the budget for groceries and food ends up being larger than any other expenses.

When you use coupons to lower that budget, it can have an enormous impact on your spending and savings.