Debt is a nasty little fun sucker, isn’t it?

It doesn’t feel good to be in debt so when you find yourself in debt and you don’t really know where to turn it can seriously become depressing. (Just look at suicide rates in correlation to debt financial problems)

That might be a little dark for some, but it’s also true.

Being in debt sucks and unfortunately it’s affecting 80% of American consumers as of July 2015.

Whether it be massive mortgages or student loan balances, credit cards or car loans, medical or legal bills… or some combination of them all, debt is an ever growing financial strain on the economy and on a consumer’s financial and personal health.

Different types of debt can be considered either good or bad. So when it comes to actually getting out of debt, it’s important to know where you can go to get help when you need it and the best ways to tackle your different “good and bad” outstanding balances.

What we’re going to give you here, is truly a debt survival kit which you can reference to when you need some healthy direction on how to get out of debt.

And by the time you’re done going through this in just a few minutes, you’ll know more about getting out of debt than most Americans. Well done.

So whether you want to go through this article once, twice, three times, bookmark this page, or even print it out and hang it on your bathroom mirror, we recommend not only committing a lot of this information to memory but actually acting on it.

I say that because it doesn’t matter how much you know about getting out of debt. If you never complete the physical actions that will actually get you out of debt, sorry to break it to you, but at the end of the day you’ll still be in debt.

We went through and did all the boring “get out of debt” research for you (wasn’t that nice 😉 ) and put all the vital information we found to be useful in this easy-on-the-eyes and kind-to-your-brain article below…

The funny thing is most people already have free access to a lot of these tools we found… they just never knew these debt survival tools existed or always thought these tools were a pain in the ass to get started with. (But the truth is, consumers can get set up with each of these debt survival tools in about 5 minutes time and the only real pain in the ass is debt itself).

So here we go…

Here are the 8 Survival Tools You Need to Get out Debt:

1. Personal Finance Management Tools

Start budgeting. Now. In fact, I would have said “yesterday” if it were possible.

Budgeting isn’t as boring and terrible as it may sound. Some people make it hard on themselves but getting a personal finance management tool (PFM tool) can make it easy to understand and actually enjoyable since it will help you to save money and stop living in debt.

We’re putting this as the number one survival tool in the kit not only because we have our very own Personal Finance Management tool– and yes, we obviously want you to use ours, but using this tool or a tool like it can single-handedly help manage your money and get you out of debt. The number one reason people get into debt and then continue to get deeper into debt is because they weren’t managing their money the way they should have.

This tool will help. They’re pretty awesome.

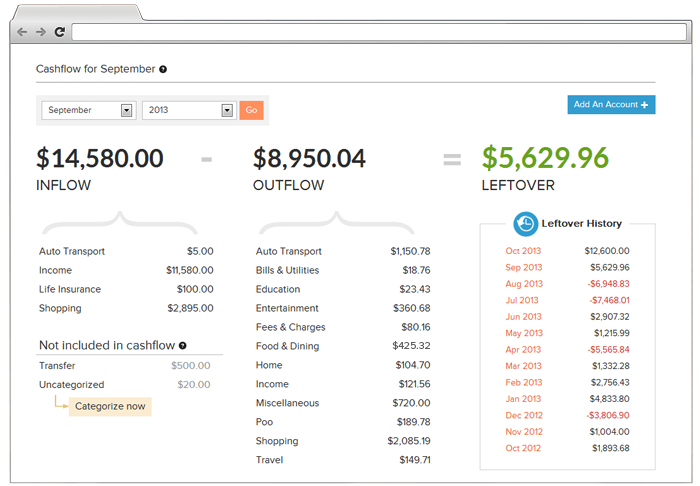

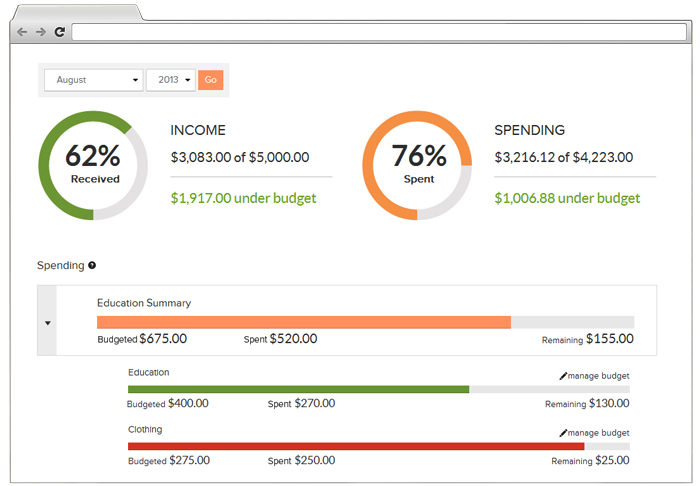

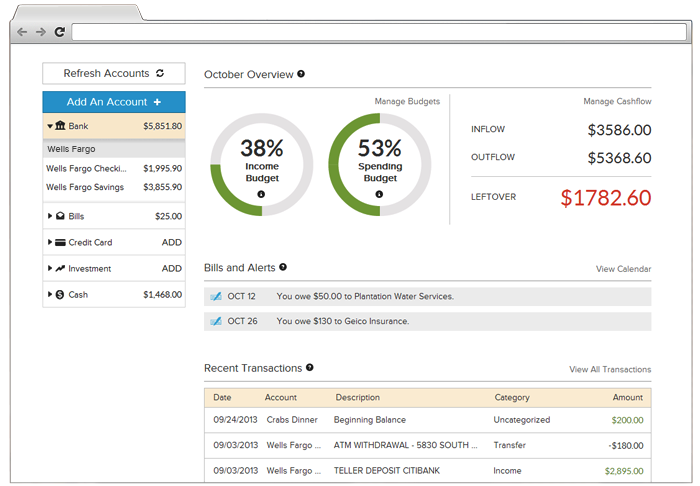

⇒You can track all of your in-going and outgoing cash flows so you know where your money is actually ending up.

⇒You can set up your budget for long-term, middle-term, short-term or even right-now-term goals to keep you on track for financial success.

⇒You can hook up all of your accounts in one spot

⇒They show you where to cut back, how much to spend and on what.

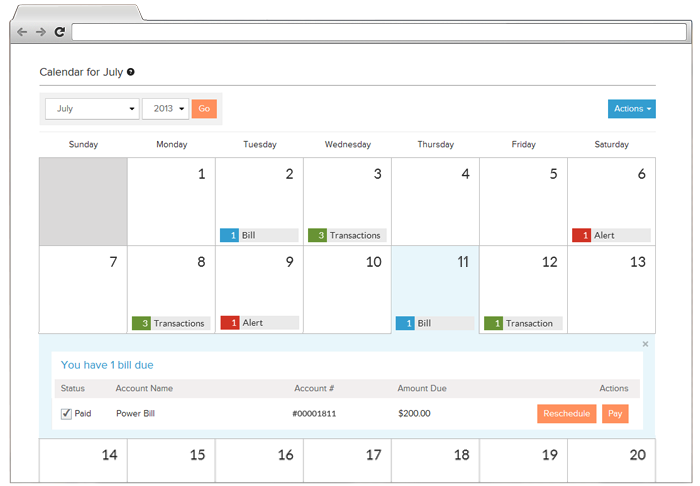

⇒You can schedule all of your bills out in a nifty little calendar so you can stop trying to remember that your car payment is due on the 15th and your student loan payment is due on the 22nd of the month…

…or is it the other way around? …Who knows?

Your Personal Finance Management Tool (PFM), that’s who!

Anyways, we’re a big fan and even made all of our employees start using our PFM tool. Whether they wanted to or not at the time, they are all the more thankful they did!

2. Credit Card Debt Payoff Calculator

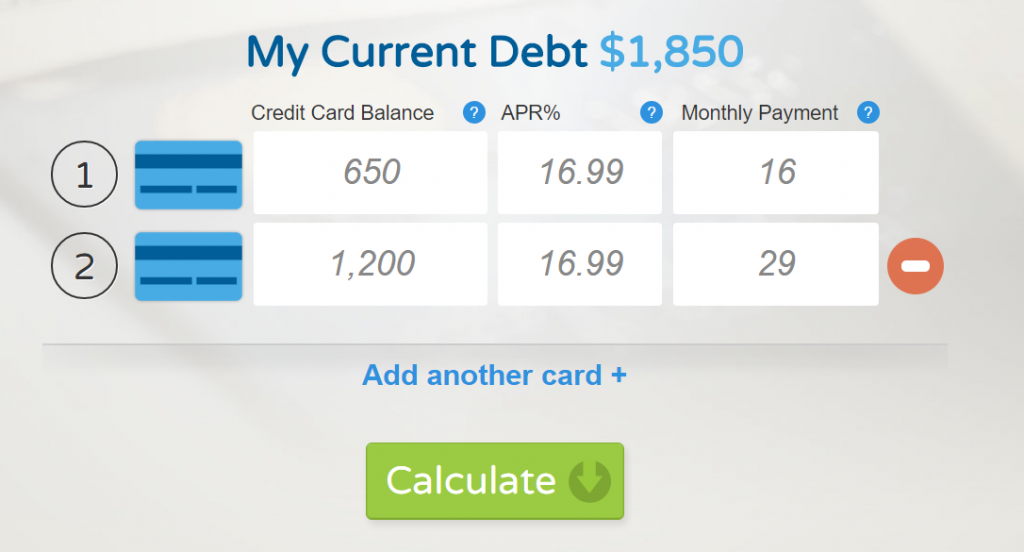

This handy little tool will tell you how long it will take you to pay off your credit card debt. We like this one on credit.com because it’s very simple and if you want to pay off different dollar amounts each month, it allows you to view your different projected outcomes. It also allows you to see what your monthly payment would need to be if you wanted to be out of debt by a desired month or time and how much interest you will accrue throughout that time… which is really helpful for everyone who hates doing any kind of math.

You can play around with different monthly payments which your budget may allow, then pair this tool up with your PFM of choice to set your debt relief goals.

Here’s how it works and what it looks like:

Step 1- Enter your Credit Card Balances and Info.

Step 2- Select your payoff date goal or desired monthly payment by playing with the toggles and see what happens!

3. Student Loan Debt Consolidation Calculator

Student loans are like leeches. For a lot of people, their student loans just stick around forever and ever, and even though they make high monthly payments each month they just can’t seem to get the balance down. Most of the time this is because their interest rates are too high or their monthly payments, while also high, are still too low to make a dent in the principal amount.

One of the very few ways graduates and former students can find student loan debt relief is through a student loan consolidation. A consolidation will weigh out high interest rates with low ones and open up an array of student loan repayment options. Consolidating also can lower a monthly payment, which allows the student to free up $100’s of extra disposable income each month for other expenses.

You can consolidate and enter these repayment programs all on your own here, but we advise getting professional help instead.

Much like doing your taxes, if you don’t know exactly what you’re doing, file incorrectly, miss a due date, or consolidate the wrong two student loans together you’re missing out on benefits and probably even making things financially worse for yourself.

You can calculate approximately how much you’d save each month by consolidating here or go straight to the source and ask for help.

4. Debt Snowball Method

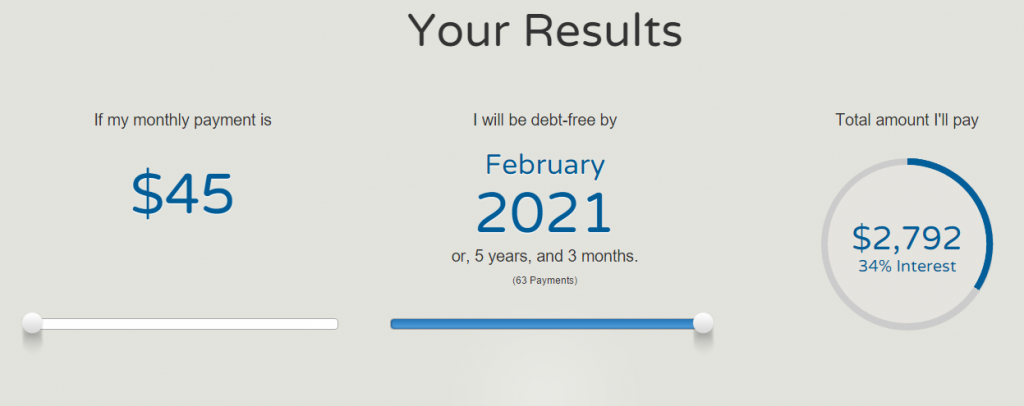

This one comes from Dave Ramsey. Whether you like him or not, the guy knows what he’s talking about. We totally stand behind him on a lot of what he has to say about getting out of debt (other times, not so much).

Debt Snowballing, a term coined by Ramsey, takes the common knowledge of how a snowball is made and relates it back to paying off debt balances.

For anyone who has lived in Florida their whole lives and were deprived of Winter like I was, so therefore needs an explanation: the best way to make a snowball is to first pack some snow together and start with a small little snowball you formed with your hands. Then to make the snowball larger, instead of packing on more snow with your hands, you’d just roll the snowball along the ground. As you gained momentum the snowball would take on more snow and become large enough to make yourself your very own Frosty the Snowman.

Just like starting small with the snowball, Ramsey suggests starting with your smallest debt amount, ignoring what the interest rates are. You would then pay the minimum payments on all your other debt balances except your “smallest snowball/debt.” Doing this will allow you to free up extra disposable income to aggressively attack your smallest debt balance and pay it off quickly. Once you have the smallest balance paid off, you’d then take the money and the momentum you were using to pay off the smallest debt and start aggressively paying off the next smallest debt.

>> In the example above, say you are able to take the $40 Medical Bill payment and scrounge together the extra income of $360 a month to pay the Medical Bill off fast. You would then take both the $40 medical payment and the extra $360 plus whatever else you can contribute to paying off Credit Card #1. By the second month you would have already paid off your medical bill and most of your Credit Card #1. Once Credit Card #1 is paid off, you would then take what you were paying for the medical bill and Credit Card #1 and put it towards Credit Card #2… you would continue doing this tactic until you will have paid off the total debt balance.

Just like snow sticking to a snowball, when people have stuck to the debt snowball method, they’ve been able to come out on top of their debt. You can learn more about debt snowballing here.

** Pro tip: Since student loans are usually a high debt balance for people and a student loan consolidation can lower monthly student loan payments, a loan consolidation can be a great tactic to utilize when debt snowballing. You can take advantage of the lower monthly payment generated from consolidating and put more of your money towards the smallest debt amount.

Here is a really good Dave Ramsey Video about how debt snowballing works:

And, here’s Dave again talking about why and how you should stay motivated while debt snowballing:

5. A Debt Accountability Partner

Accountability partners work. They are commonly used in business, classrooms, religious establishments, mentoring programs, and rehabilitation programs. Why don’t more people use them in their finances? And I don’t mean getting a financial planner. Because sadly, a lot of financial planners don’t have you or your money’s true interest at heart. But a good friend will.

It can be kinda weird sometimes to talk about your finances with other people, especially when you’ve got some serious debt problems, but talking about your goals and your progress with a close friend, brother, sister, parent, or someone else you trust and care about will help you stay on track.

It’s a mental thing. You’ve told them you’re going to achieve something and by doing that, you’re already subconsciously wanting to seek their approval. They will also be there for a support when you’re losing steam and become your own personal cheerleader.

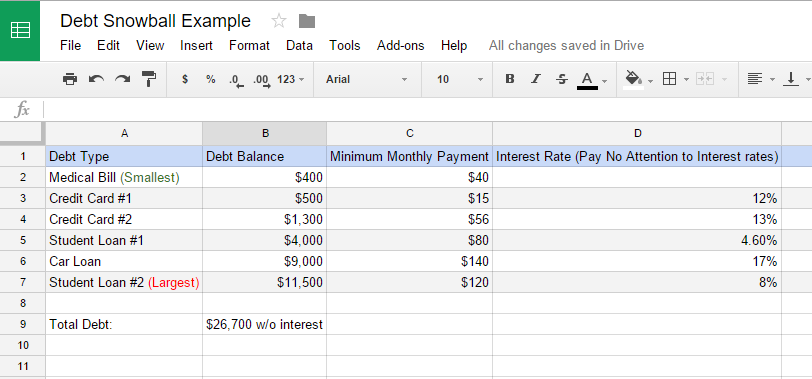

6. Udemy Courses

Udemy is awesome. I’ve recently started using it, and I can’t believe it’s taken me this long to do it.

Udemy is a collection of courses you can take to help learn more about whatever you want. It’s all online and you can complete the courses at your leisure.

Whether you want to sharpen your know how knowledge or get some extra tips, the instructors are all pretty credible and knowledgeable. Reading the reviews and going through the course overview is a good way to find the courses other people have found helpful. While creating an account is free, the courses themselves usually are not. However, from what I have seen they are are usually pretty affordable and offer great content.

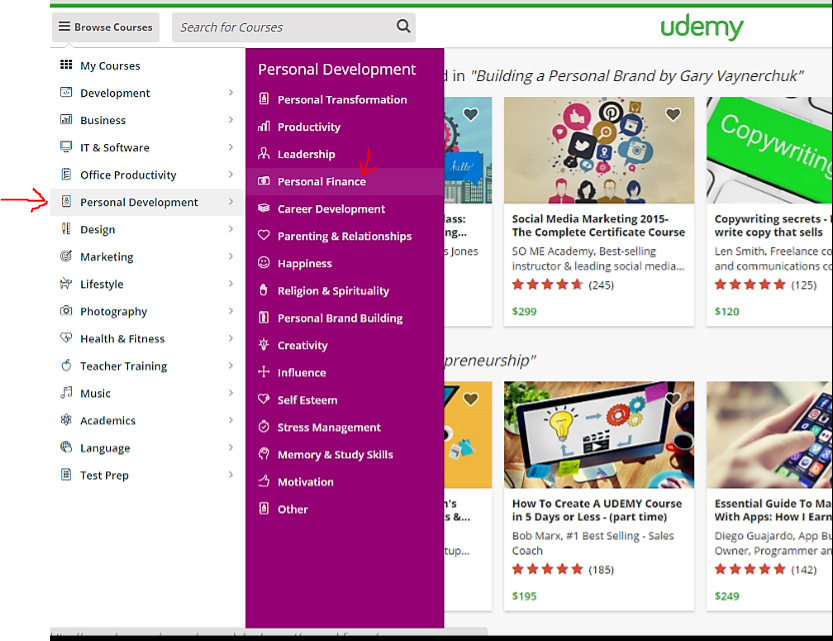

Simply by creating a free account, clicking on “Browse Categories”, then scrolling down to “Personal Development”, and then clicking on “Personal Finance” you can find tons of courses on managing your debt and getting out of debt.

This is what it looks like:

Then hover over “Personal Development” to make “Personal Finance” pop up! Super easy, right?

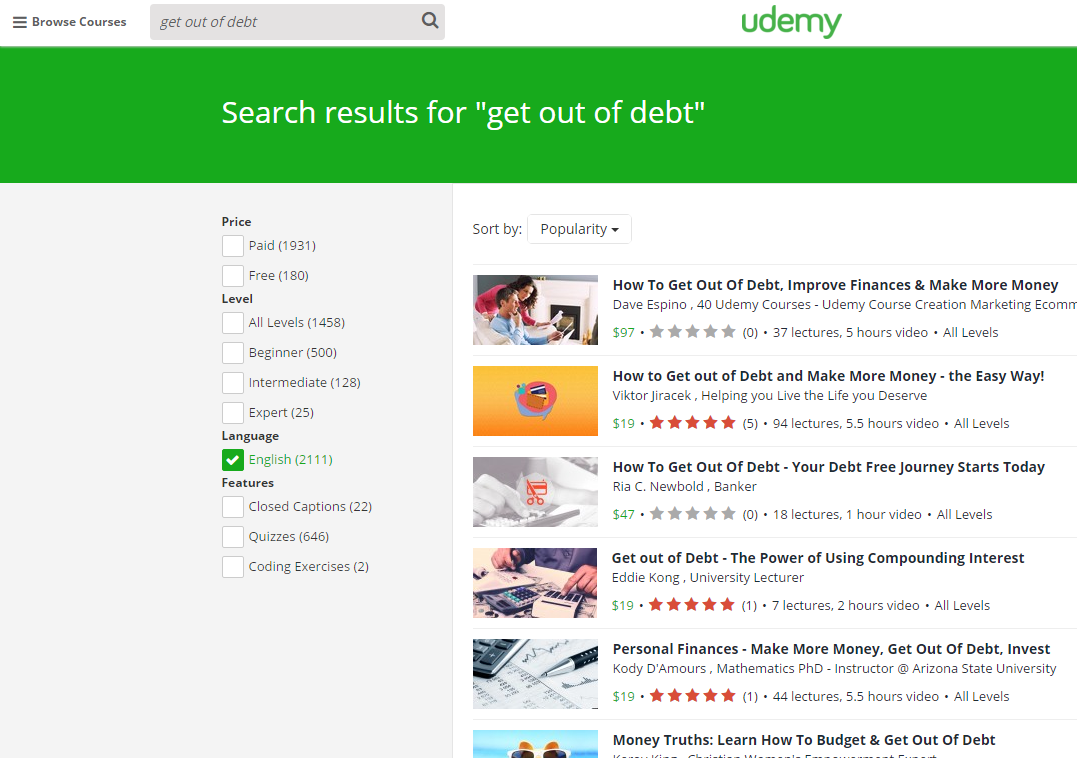

You can also just simply search for keywords like “get out of debt” in the search bar and find what you’re looking for then separate courses out by difficulty or popularity:

7. Suze Orman’s Get out of Debt Calculator

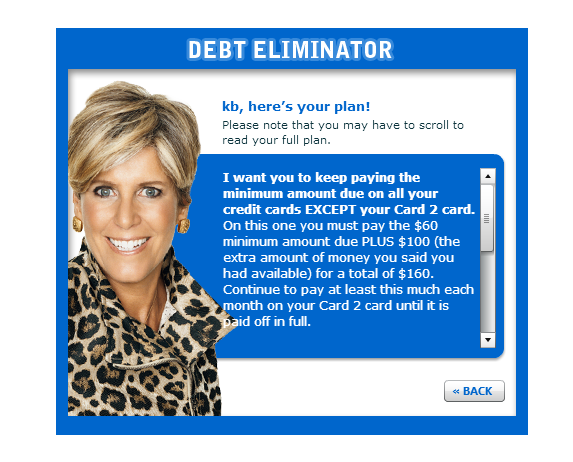

Suze Orman can be a tool just on her own. She puts out great content and she’s earned a spot in the financial world as one of the authorities. However, her Debt Eliminator tool is the one “Suze Tool” we like for this.

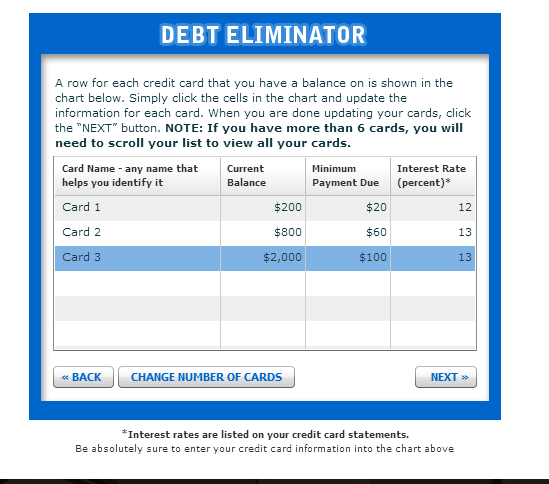

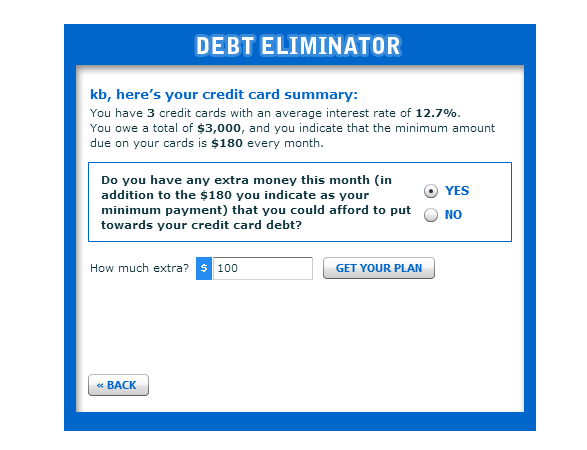

The Debt Eliminator prompts you to put in all of your different credit card names, balances, interest rates, and minimum payments. Suze then will give you her advice on how to best tackle your current credit card balances and get out of debt.

It’s personalized and as you pay off your different amounts, she also advises you to go back and use the debt eliminator again, and again, and again until you have paid down all of your debt.

Here’s some examples:

Step 1:

Step 2:

Step 3:

8. Invest in yourself

The other side of the equation to getting out of debt is staying out of debt. That means keep budgeting as well as saving for your financial future.

Each paycheck you should be taking at least a portion of it and putting it back into yourself. That doesn’t mean putting yourself into a new pair of shoes or a new sports car. That means putting it into savings.

Whether it’s opening up a simple savings account with your bank or opening up an IRA or 401K, investing in yourself this way will help you manage your money better and keep yourself out of debt the smart way. You can easily open up a TD Ameritrade account here and start putting some of that hard earned moola back into you and your future!

By utilizing these debt survival tools, and sticking to them you can see yourself successfully overcome your debt. Most of these tools are free for you to use and easy to set up. Combining the power of these debt survival and reduction tools will help you manage your income, your monthly payments, and different balances ultimately helping you to get out of debt.

So use them. They work 🙂