Sometimes taking out loans or other lines of credit can be more of an investment than debt in the long run.

This especially applies to certain types of debt, like student loans.

But at the end of the day, debt is debt, and you’ll have to pay it back sooner or later.

This is why you need to be smart about how much you borrow, as well as what you’re borrowing for.

It’s all too easy to find yourself in debt and not know how you got there.

Here are a few general tips to avoid falling into the debt trap (see a complete list here):

- Create a budget, and stick to it. You’ve undoubtedly seen this before. But seriously, careful financial planning can be your saving grace when it comes to keeping yourself out of debt. Check out this comprehensive budget worksheet from the Debt Advice Foundation to help you plan your financial present and future.

- Identify your needs and your wants. These should be clear and absolute. You might need a new laptop, which is a significant expense if yours is broken. However, you don’t need a new laptop if yours works perfectly fine, but you want the latest edition.

- Don’t be fooled by sales or “bargains”. That swanky sales ad for the latest Gucci watch might trick you into thinking you’ll save 20%. In reality, if you buy it, you’ll spend 80%, and won’t be “saving” any money.

- Pay in cash when you can. Credit cards make it too easy to swipe and go these days. In fact, a study by Dun & Bradstreet shows that consumers will spend anywhere from 12% – 18% more when using a credit card compared to cash. This is because consumers won’t immediately realize how much they’ve spent until they receive their statement. Combine that with daily interest that accrues, and you end up spending far more than you might think.

- Leave your credit card at home. This is the easiest way to avoid the temptation of charging to your card. If you’re going on a routine grocery shopping trip, chances are you won’t need your credit card at all. And if you do need your credit card to fund these types of necessary purchases, you need to re-evaluate your spending habits.

- Say “no” to that impulse buy. Stores are smart – they lure us into buying things we don’t need on impulse while we’re waiting in line. These are usually small items, but small things add up. On your next shopping trip, take care to make a list of everything you’ll need. Make sure you stick to that list; nothing more, nothing less.

- Keep track of all purchases on your credit card. Banks make this easy for us these days through the e-statement. But make sure you remember to look at that statement carefully. Not only will you be more aware of unauthorized purchases, but you’ll also see what you tend to spend more.

Now that you know how to better avoid debt, let’s look at what you shouldn’t swipe that credit card for:

- Holidays

That getaway to the Bahamas is going to cost you a pretty penny.

While the shore and sunshine may be calling your name, it’s best not to listen unless you’ve saved up a significant sum for your vacation fund.

Taking out a new line of credit for your trip will almost definitely cause you even more stress in the long run.

(More stress will mean you’ll need another vacation, starting to see the pattern here?)

You never know what kind of financial mishap could be waiting for you when you come home, so you’ll want to be prepared.

- Frivolous shopping trips

This one will go hand in hand with avoiding the temptation of sales.

While you might need a new work shirt or new athletic shoes, don’t go overboard with retail therapy.

It’s important that you don’t charge more to a card than you can afford to pay off in a month.

The same principle applies when you’re buying anything, not just clothes or shoes.

But it’s especially important when it comes to shopping trips.

What’s the point in looking fashionable if you’re broke?

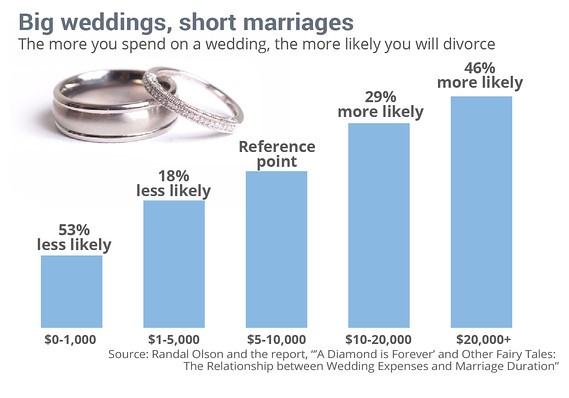

- Weddings

Many of us have dreamed of a lavish wedding to a beautiful princess or handsome prince charming.

But, no matter how much you might love your soon-to-be spouse, you won’t want to max out that credit card to pay for your walk down the aisle.

Weddings can be expensive, there’s no doubt about that.

One in eight Americans spends more than $40,000 on their “I do”.

Remember, marriage is about the lifelong connection that you’re trying to establish with your spouse, not the glitz and glamour of a ceremony that lasts less than a day.

- New technology

Smartphones have become a staple in our lives.

They help us stay organized; they keep us in touch with important people, and they help us relax after a tough day at work.

But let’s face it – the biggest names in tech are conning us just a little bit.

You might think the latest iPhone is worth that $600, but Apple is likely already set to release a new one next year.

Tech is constantly changing, faster than consumers can keep up.

So don’t try, unless you can afford it with your hard earned cash.

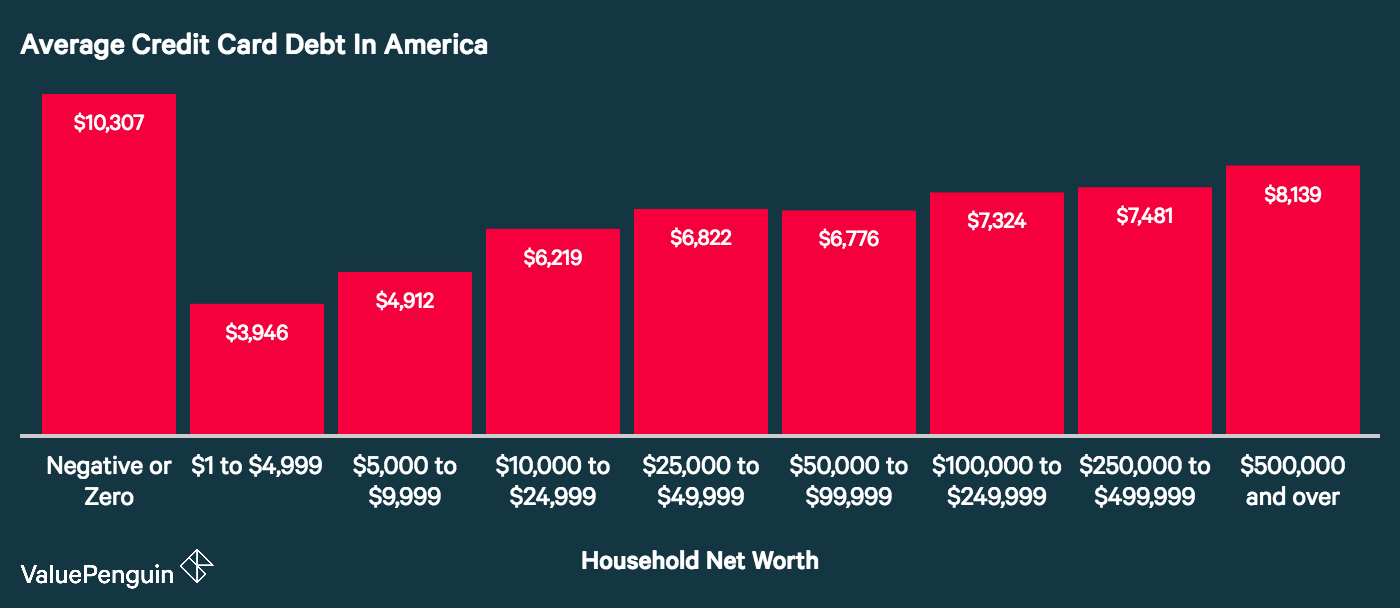

After looking at the chart below, is it really worth going into credit card debt for a new gadget?

The main takeaway is that you should save going into debt for the big, important stuff in life – buying a house or a car, taking out student loans, or keeping a credit card for emergencies.

It’s a good idea to make small purchases on your card that you can quickly pay off each month so you can maintain a good credit score.

However, a little foresight goes a long way.

Make sure you’re swiping that credit card for good reasons, and not accruing massive amounts of debt for fleeting extravagances.