Utilities are one of the biggest costs of running a household. Do you know what the average American is paying in utilities alone? $304 per month. Knocking just 10% off would save the average household $364 over the course of a year. Luckily, there are many ways you can go about doing that.

Here are 4 tips to save money on utilities.

Water

Did you know that the average American household uses 100 gallons of water per person, per day?

That’s a lot of liquid sloshing around.

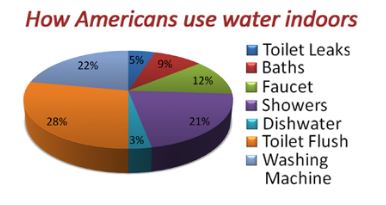

The largest amount is used outside, a national average of 30%. Of course, the simplest way to bring this cost down is not to water the garden so much, but there are other ways. The way water is billed in the average household is for both water in, and sewage out. The assumption is that all the water that comes in will have to be drained away and processed. Obviously, water that’s going in the garden isn’t. Installing an irrigation meter costs money up front, but over a period of time, the 30% of the water you’re not being billed twice for will soon pay for that. Not to mention the money you’ll save going forward.

Source: nngov.com

As this chart shows, 5% of water usage in an average house is due to leaks. Having a qualified plumber check everything over could save money in the long term. Baths use more water than showers, 35 gallons as opposed to 25, on average. Installing a low-flow showerhead will also cut down on water usage, as water flows through at half the rate. You can cut down on the water you use in the dishwasher by not pre-rinsing as modern appliances don’t need it. It’s just a habit ingrained from the early days of less efficient dishwashers.

Electricity

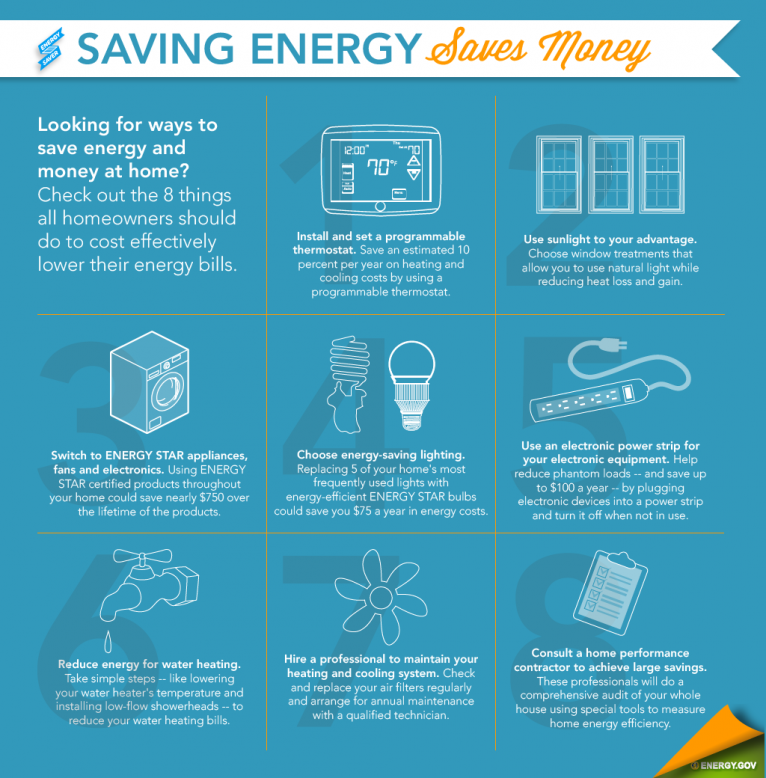

It goes without saying that electricity is a huge part of our daily lives, our homes are constantly using up power. But there are things we can do to reduce that consumption.

Changing light bulbs from conventional incandescent bulbs to LED or compact fluorescent can save the average US household nearly $7000 dollars over five years.

Leaving appliances plugged in when charged, or on standby, also adds to the electricity bill. All appliances in standby mode are still using power, and that power is only being wasted. Remembering to unplug appliances when they’ve finished charging can save a lot of money, as standby power typically accounts for 5-10% of domestic power usage.

That’s a lot of electricity being used to do nothing!

Saving money on your electricity bill is often as simple as being aware of how you use things. Not in a room? Well, why is the light on? Making sure things are switched to off mode when not in use can create significant savings.

Air conditioning is another area where big savings can be made. AC units use 6% of all electricity generated in the United States. Efficient use of your air conditioner (such as keeping the lint screens clear) or switching to a more efficient unit can save between 20-50% of these costs. One way of helping to keep your home cool is to have a cool roof. Painting your roof white can cool it by up to 50˚F, helping you save big on your cooling bills.

Heating

From cooling all the way to heating. But there are ways to save here, too.

Many energy companies will offer you a free energy audit. It’s important to notice where air gets in and out in your house. Maybe it’s a loose window frame or poorly fitted door. Either way, these leaks can be responsible for 25-30% of your heating costs. Go around with some expanding foam or caulk to fill those gaps and watch your heating bills drop.

The companies themselves

Check whether your meter-reading matches up to what the company bills you for. The folks reading them are human too, and mistakes can be made. It’s your responsibility to ensure that they’re charging you for the right amount in the first place.

Don’t be afraid to shop around for the best deals and switch providers if you can get a better price somewhere else. It’s up to you to be a savvy consumer and make sure that you’ve got the best energy deal out there.