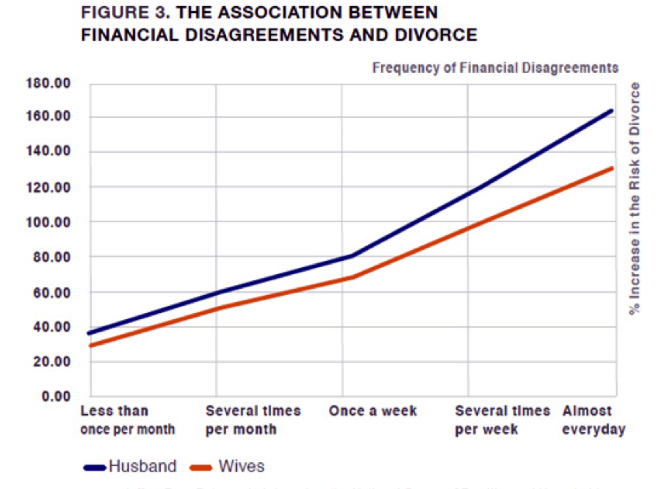

It has been proven that the more a married couple argues about finances, the more likely they are to end up divorced. There is similar research showing that unmarried couples who argue over money are also less liable to have a happy relationship and maintain it in the long run. It is obvious that being able to communicate and have healthy finances together is an important part of a long-term relationship.

The easiest way to stop arguing over money is to make sure you are saving enough that you don’t keep ending up in stressful financial situations. Any stressful situation will put pressure on a relationship, but luckily there are some tips you can use to save as a couple and avoid economic arguments.

Go for Cheap Dates!

In an attempt to impress each other and demonstrate their love, many couples try to plan extravagant and expensive dates. Luckily, your love is built on much more profound things than what you wear and where you go to eat. There’s no shame in splurging once in a while, but you should try to tone back your dates to make them enjoyable without breaking the bank.

The more date night is about spending actual time engaged with each other and talking, the more you will value it. An expensive date simply isn’t necessary, and in fact, the added stress of an expensive bill can make things awkward, or put too much pressure on the night. Cheaper dates are more relaxed. Here are 101 great cheap date ideas.

Staycations

Instead of going on a glamorous vacation, try for a staycation instead. Coop up in your house and enjoy time together after agreeing to do nothing else. Put away your cell phones and computers. Curl up with tea and board game at night. And go hiking and try some adventurous cooking in the daytime. Here are some other great staycation ideas.

Tracking your Savings

Now that you are combining your finances, it can be hard to keep track of all your expenses and earnings. Even if you never did this by yourself, you should start by making a written budget. It can be as easy as setting up an excel sheet where you both put your projected earnings each month, your individual spending, and joint expenses. Don’t assume you will both spend the same. Everyone has different needs, and it can put a strain on the relationship to try to control each other’s spending too much.

Insurance

Combining your insurances can be a major plus. In some cases you do have to be married. But, more and more places are making it regulation to treat live-in couples and married partners the same.

Communication

You’ll have a much clearer picture of your finances as a couple if you aren’t afraid to talk about them. It will be way easier to manage when you understand what each other’s concerns are. It will also help you avoid a huge amount of stress in your relationship. Make sure to talk about small financial issues together before they grow into enormous and hard to tackle monsters.