The new school year is approaching quickly, which can be scary in and of itself.

It is especially scary when you begin considering all of the things you are going to have to purchase.

Luckily, there are ways that students and their families can make college fit into their budget; even when their budget is already super tight.

The importance of obtaining a college education is only increasing as time passes.

This is in spite of the fact that a degree itself may not hold the same value it once did.

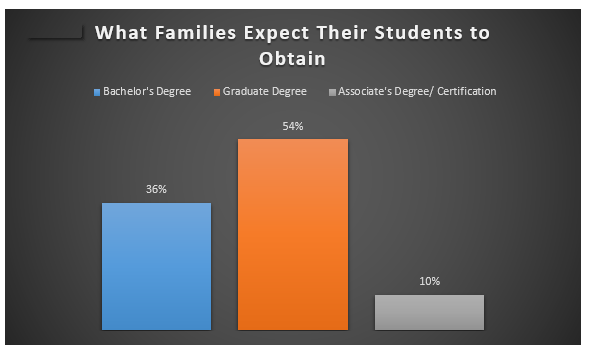

How America Pays for College, a report by Sallie Mae, showed the level of degree that families expect their students to obtain.

These results are shown below.

However, many students are faced with the anxiety over the financial aspects of obtaining a college degree.

Currently, student loan debt in the United States is close to $1.3 trillion.

On top of that, statistics show that years of being underemployed and wage stagnation that doesn’t seem to end awaits numerous college graduates.

However, there is some good news to look forward.

The question becomes how can the student and the family prepare themselves for the awaiting years of overpriced education to prepare for a brighter future?

Here are 5 strategies to make college fit in your budget.

1. Saving Matters

You want to focus on saving your money.

Make sure that you begin saving early and put money into the college savings as often as possible.

There has been research that shows the following:

- Saving for a child’s college not only improves their development in their early childhood years but also increases the financial capability in the future.

- Saving for a child’s college means that greater things can be expected from them in college.

- Saving for a child’s college can mean they will do better on an academic level than children with no college savings.

This study showed a correlation between the amount of success a student has in college and saving for college.

Kids that come from low to moderate income homes that only saved between a dollar and five hundred dollars are three times more likely to enroll in college.

These children are four times as likely as their peers without savings to make it to graduation.

2. Plan

In Sallie Mae’s research study, only two out of every five families that responded to the survey had created a plan on how they were going to pay for their child’s college education.

The families that planned were able to save three and half times more than families without a plan.

This resulted in the families who had a plan in place having to borrow less money to get through their college education.

When you pledge to save money, you receive monthly reminders to put money in the savings account.

You also can make use of advice sent to you aimed at increasing the amount you can save and decreasing the amount you pay for a college education.

3. Keep it Real

As you begin looking at your options for college, be realistic.

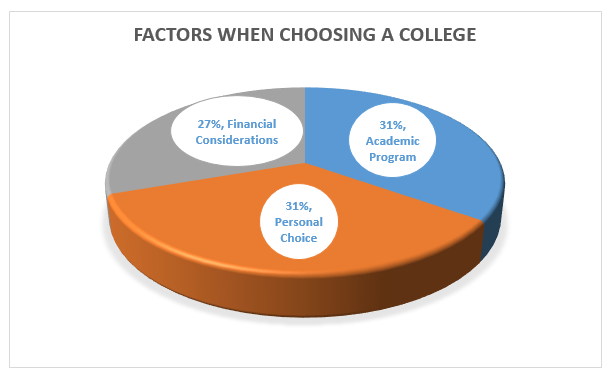

The financial details of a college education and the quality of the program academically are typically secondary reasons people choose a particular university.

The first choice is frequently based on the personal preferences of the individuals going to college.

If you look at the programs provided by the school and the financial opportunities available, you may begin to see things in a new light.

You want to make sure that you can financially afford the college you choose to attend.

You should also remember that students you financially struggle are less likely to do well in college.

You may be focusing on how to pay your bills instead of your next big test.

For this reason, the more financial help you can get, the better.

The following shows what percentage certain factors weigh in on a student’s choice in college, according to the release by Sallie Mae.

4. Cut Back Spending

You want to make sure that you are not splurging on things you do not need.

Consider the fact that purchasing a new textbook has seen a price increase of around thirty percent since 2009.

No matter what you need, there is always a way that you can cut your costs.

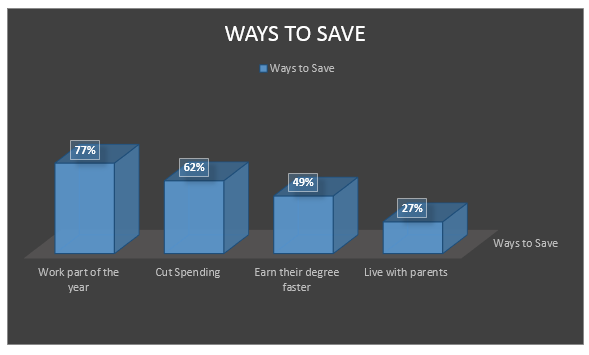

Others figure out ways to complete their degrees in a shorter amount of time.

No matter what you do to save yourself some money, just make sure that you are taking your finances into account and saving money where you can.

5. Make Sure to Explore ALL Financial Options

You want to make sure that you are looking into scholarships and grants that you can use for college.

There are a large number of scholarships students can obtain based simply on their demographics or personal/educational achievements.

Most guidance counselors can provide you with information about these options and are more than willing to help.

You can also find a good bit of information on these topics online.

Ways to Save

If you are unsure where you should start saving or are afraid that it may be too late, don’t worry.

Saving a little late is better than never saving money for college.

The first thing you can do is seek out information about Children’s Savings Accounts and how they can benefit children in low-moderate income homes.

Next, consider a 529 saving plan.

These programs provide tax friendly saving benefits and clear guidelines that can increase how you save.

Finally, you may want to take advantage of ABLE accounts. A

BLE accounts are aimed at serving individuals with disabilities and their families.

The tax-advantaged saving accounts can pay for the education costs and housing for your students.

Regardless of what you choose, there are plenty of ways to fit college into your budget.

Here are how the students that took part in Sallie Mae’s study are fitting college into their budget.