Hackers and fraudsters are becoming smarter, and their methods are becoming more complicated.

We may not be able to prevent fraud altogether, but we can take steps to avoid fraud from happening to us.

The devastating impact of fraud does not only include the financial aspect, but there are also emotional aspects of being a victim of fraud.

Victims of fraud are often left feeling stressed, lonely, and embarrassed.

Many victims also feel a loss of dignity, security, and self-esteem.

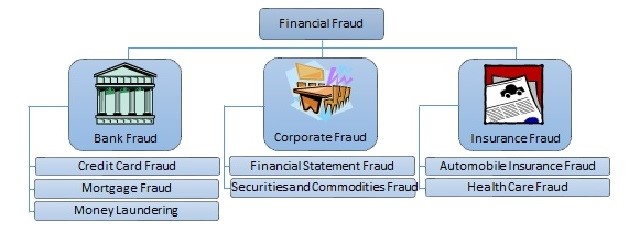

What is financial fraud?

Financial fraud occurs when an individual or organization takes money or property, or uses these things illegally, with the aim to benefit at the expense of the other person.

Fraud often involves an individual or organization deceiving their victim by building a level of trust and then betraying them.

Financial fraud can take many forms, some of the most common are:

- Bribery

- Mortgage fraud

- Racketeering

- Embezzlement

- Securities fraud

- Identity theft

- Tax evasion

- Money laundering

Fraud is often an under reported crime, and despite efforts to tackle crime, greater support is needed to achieve a real impact.

Reports suggest that due to the massive scale of fraud there is a need for a governing body or establishment to put into practice various countermeasures.

Common steps to prevent fraud

There are many different ways to prevent fraudsters from targeting you, some of the most standard advice includes:

- Research common scams

- Be careful who you give personal information to

- Change pin numbers and passwords regularly

- Keep track of your credit reports

- Shred documents containing personal information

- Look out for unusual transactions

- Report any unusual or suspicious activity

Below we have listed other ways to prevent fraud that you might not have previously considered:

Use chip and pin

Chip and pin cards generate a unique code for each purchase you make.

This means that fraudsters will be unable to use this information.

Chip and pin, however, is not available everywhere yet.

Many retailers either do not have chip and pin terminals, or do not have them fully functional.

Be wary of using public wifi

Public wifi is often insecure, so it is important that you do not give out any personal or bank account details when using public wifi.

If you must give out these details, then ensure that the web address displays https before it, instead of the standard HTTP.

This means that the website is using the highest levels of security.

Switch to electronic statements

Paper documents are easy to intercept.

If you switch to electronic documents then the risk of interception drops.

If it is possible, then try to switch your accounts to electronic statements instead of paper.

An online account will also allow you to check your account for unusual or suspicious activity regularly; you may also be able to download a mobile app for monitoring purposes.

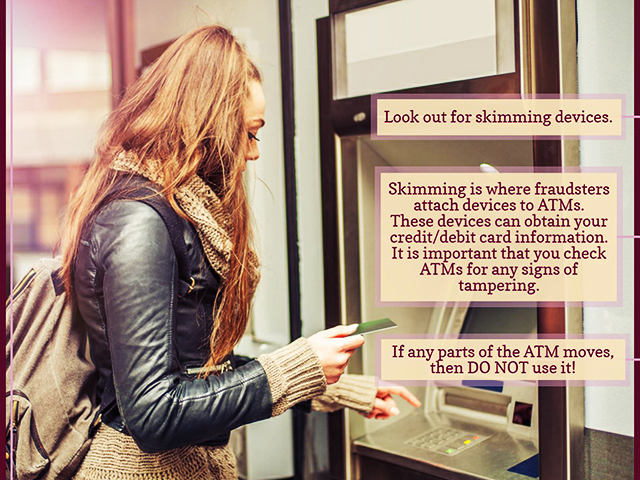

Look out for skimming devices

You should also be aware of hidden cameras when entering your pin number.

You should cover the pin pad as some fraudsters also install cameras to record people entering their pin numbers.

Check your post

There are many companies and institutions which prefer to send certain documents through the post.

One of these are insurers.

If you are expecting important documents through the post, then ensure that you keep an eye out and follow up with any documents that fail to arrive.

You should also keep an eye out for mail that is unexpected.

For example, confirmation of something that you did not do.

If you receive mail like this, then it is critical that you report it.

Conclusion

Victims of fraud are not only affected financially, but also emotionally.

The emotional effects of fraud can range from feelings of stress to a loss of self-esteem.

Fraudsters are becoming smarter, and the methods they adopt to scam you are becoming more sophisticated.

There are many types of fraud, including credit card fraud, mortgage fraud, and money laundering.

Fraud is often going unreported, and it is felt that despite efforts to tackle fraud not enough is done.

Many believe that the implementation of a governing body could devise ways to combat fraud.

Many standard methods protect against fraud.

These include researching common scams, changing passwords and pin numbers regularly, and reporting any activity which you were not expecting, and looks suspicious.

There are also less common methods like using a chip and pin device, avoiding revealing personal or financial information when using public wifi, switching to electronic documents, looking out for skimming devices, and checking your mail.

Chip and pin cards have added security which makes it difficult to obtain information from them.

Public wifi is often insecure if you must reveal personal or financial information when using it then ensure that the web address has https in front of it.

Paper documents can be intercepted easier than an electronic document; you should attempt to switch all accounts from paper statements to electronic.

Fraudsters can attach skimming devices and cameras in ATMs to obtain your card information and pin numbers, check all ATMs for signs of tampering and cover the pin pad when entering your pin number.

It is important that you regularly check and monitor your mail, you should ensure that you receive all expected mail and chase up anything that fails to arrive.