It happens to all of us.

We do our research, select a product, and eventually make a purchase, completely convinced it’s the right thing to do.

But, as soon as the money has changed hands, the seeds of doubt appear.

Did I really need this?

Was forking over that money the right thing to do?

What if I regret it?

This is obviously never a good mindset to be in, but, when it comes to what may very well be your biggest ever purchase, a new home, it can be distressing.

With that in mind, here are a few ideas to consider if you start to regret the purchase of your first house.

Don’t Worry About Things Out of Your Control

We live pretty chaotic lives, and it can be easy to worry about things out of our control.

Once the final steps of a house purchase are complete, lamenting the final settling price, worrying about another crash in the housing market, or complaining about the imperfect location will probably do more harm than good.

Instead, consider the things you can control and make a start on them.

Focus on setting up your mortgage repayments or organizing home insurance.

Once a few seemingly daunting tasks have been completed, you will likely find yourself feeling much more relaxed and confident.

Congratulate Yourself

You own a house now!

A – hopefully – fully functional abode where you can start and finish your day, and make any improvements or changes you desire without going through the tedium and frustration of dealing with a landlord.

It’s a position that you have probably dreamed of being in for years, and you should congratulate yourself on the hard work and sacrifices made to achieve it.

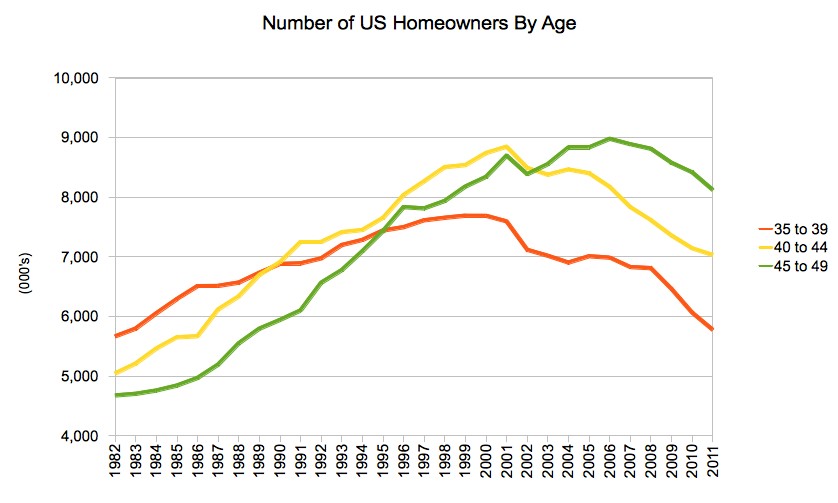

Owning your own house in the USA puts you with around 70% of the population, maybe even less depending on your demographic and location (see below graph and chart).

If you are experiencing any doubts about your purchase, be sure to remember that this is a fantastic position to be in, and commend yourself for getting here.

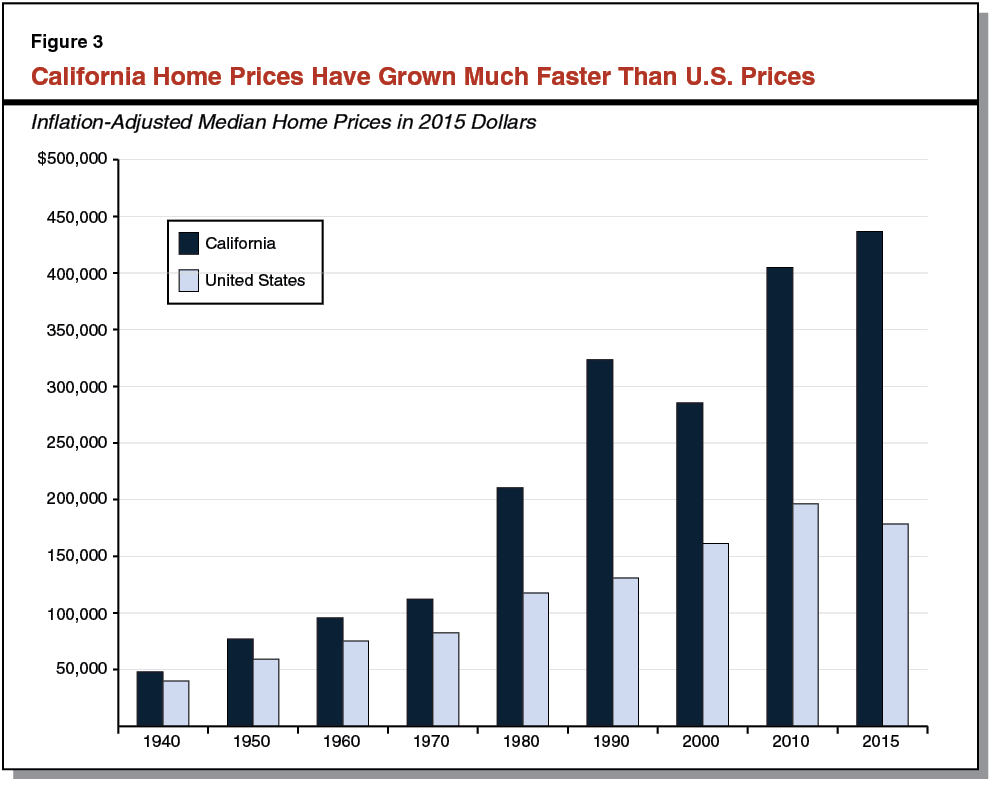

Price of housing in California compared with median USA prices.

Start Decorating

Nothing says negative like empty space.

Making your new house more vibrant and suited to your style will go a long way towards feeling better about the place, and make it feel much more like a home.

For easy decorations with a big impact consider:

- Displaying some favorite photos of friends and family

- Hanging some artwork

- Displaying souvenirs and mementos

The very act of decorating your new home will make you happier and more comfortable, and drive away any negative thoughts you may be harboring about the purchase.

Make a Plan

For many of us, the purchase of a new home is the start of an exciting new chapter that we can write ourselves.

Whether you bought a near-perfect house or a fixer-upper, it is likely that you will have at least a few improvements in mind.

Make a list of what needs to be done and check off at least one thing – the rest will probably start to feel much more attainable as a result.

Make The First Hammer Stroke

It’s all well and good to mentally rationalize the purchase of your new house, but nothing will quite relax you like physically transforming it into your own home.

Apart from the satisfaction you get from making the house your own, these small renovations will also give you the confidence to start on some bigger projects.

Laying a deck in the backyard or installing a counter in the kitchen are great ways to add significant value to a house, and you can have a great time while doing it.

Warm the House

Throwing a party is always a great way to feel excited about something, and a new house is certainly no exception.

Making memories is also a great step towards transforming a house into a home, so get some people around and take advantage of that great outdoor space or dining room that made you want to buy the house in the first place.

It’s called a house-warming for a reason, and you are sure to feel more positive and comfortable in your new space after spending a great night with friends and family.

Think About The Investment

After signing up for a mortgage and paying a hefty down payment, it can be easy to get caught up in worrying about the short term.

If this happens, remind yourself that buying a house is a long-term investment.

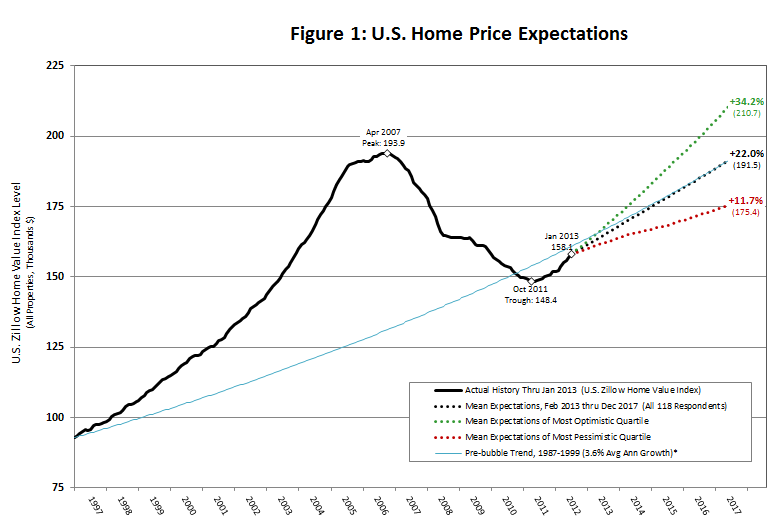

Even the most pessimistic predictions look pretty good for home-owners in the USA (see below graph).

Find Your Favorite Space

Now that you own a house, take some time to seek out your favorite location.

Go through your new space slowly, take everything in, and consider what you love.

Maybe your favorite place drew you to the house in the first place, or maybe you will find yourself falling in love with an area you didn’t previously notice.

Regardless, identify this space and make it your safe haven.

If you do still find yourself getting stressed out by the purchase, come back to this spot you love and remember that it, and the rest of the house, is your new home.