Whether you have young children, older children, or are planning on having children soon, teaching them about money is something that all parents should do.

Ideas on how to manage money can be imparted to children at all ages.

Through all of these ways, the key message is that money is finite.

Here are seven money and finance tips and topics to cover with your children as they grow up.

Each can be adapted based on the age of the children.

- Give children their allowance in cash. This way, there are no abstract notions. Children can concretely see the money they are receiving and think about how they want to use it. The allowance can be divided among different uses. One of these can be a savings jar. This teaches children that just because they have money doesn’t mean that they always have to spend it.

- Most parents decide to give their children an allowance. In some cases, the allowance is given as a reward or remuneration for having done chores around the house. If need be, children can be given the opportunity to earn extra money in addition to their allowance. This can be through extra chores, small jobs for neighbors, or a part-time job.

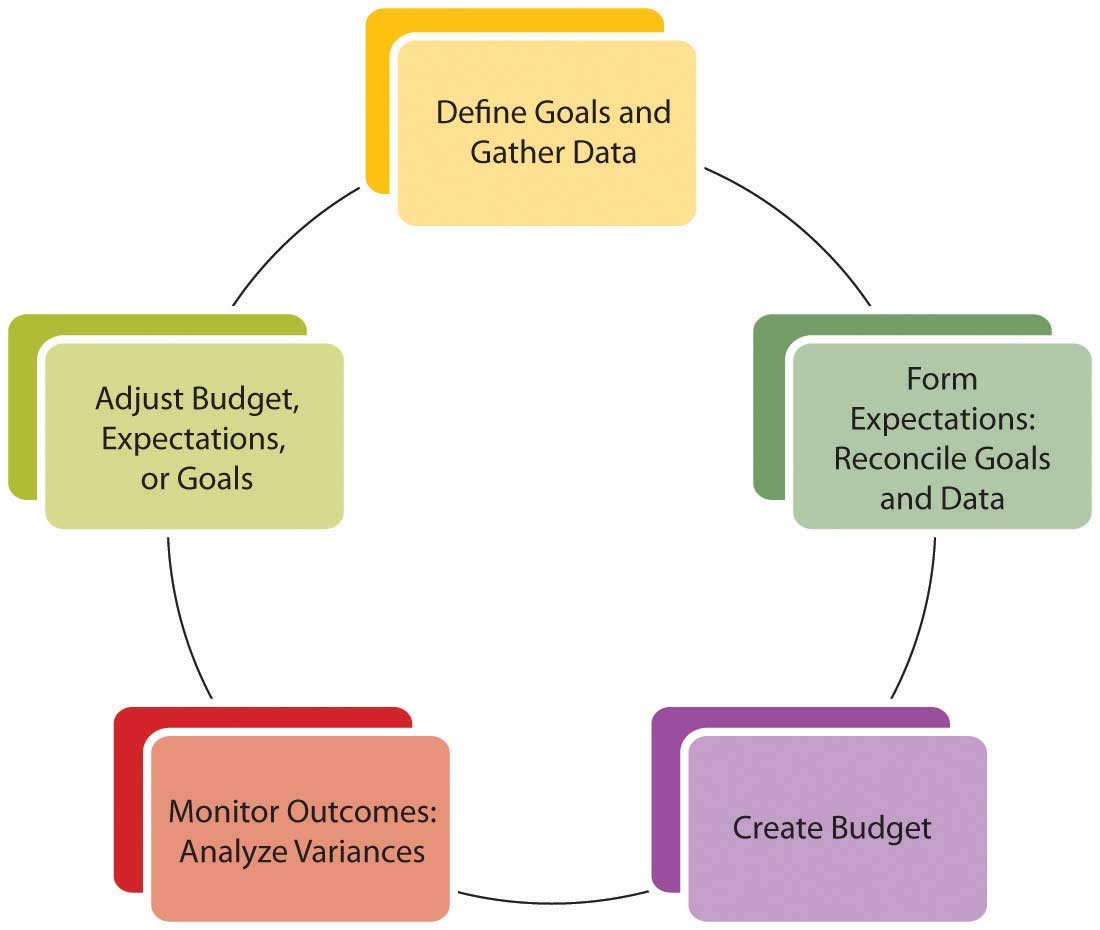

- Sit down with your children and help them analyze their financial goals, expectations, and budget. These may change as children grow up, so it is a good idea to check back often and gently remind your child of their goals if they are straying from their budget.

- If children do not stick to their budget, parents don’t need to cover them. This may sound harsh, but some 40% of millennials still require financial assistance from their parents. Tough love will go far if you don’t want your middle aged child living with you.

- When you go grocery shopping, bring your children with you. Going through the store will open up the discussion to the family budget and how you decide what to purchase.

- For big events, like a party, give your child a fixed price budget and let them decide how to spend the money. You may need to help them at the beginning, but as they get used to it, they will be able to compare prices and items to decide which combination is best.

- When the children reach a certain age, they can have a bank account. From there, they can start a savings account and use a debit card. This will also teach them how banking and interest rates work.

You may feel overwhelmed looking at the tips above.

However, not everything has to be done at the same time.

These are just some guidelines, so feel free to add in your own ideas.

Furthermore, if you already have some nifty budgeting and finance tips, be sure to share those too!

From the Very Beginning

Parents can begin teaching their children about finances around the age of 3.

The key with young children is to have a visual representation of the money.

In most cases, this will mean giving your child a cash allowance.

From there, sit down as a family and cover what expectations you have for your child.

Is their allowance considered payment for chores done?

If so, list and illustrate the simple tasks you have for them, like making their bed and tidying their toys.

It is also a good thing to teach your children what money looks like and how it works.

One hundred pennies make a dollar; a nickel is worth five cents, five dimes have the same value as two-quarters, and so on.

As your children age, you can renegotiate their allowance and chores together.

When they start to gain independence, talk to them about their goals.

What do they want to use their money for, and what do you expect them to use their money for?

Your child may want to buy big or small items, and proper planning will help achieve their goals.

A trick that some parents use is to divide the allowance into four parts: spending, saving, investing, and giving.

Money in the spending jar can be used at any time.

The saving category is used for short-term, possibly lower value goals.

Investments are for long-term, high-value goals.

Donating money to a good cause will teach your children to think of others and observe how their money can make a difference in someone’s life.

Gently Guiding Children during their Teenage Years

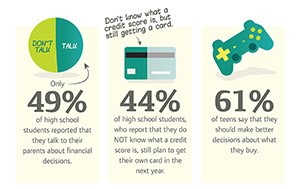

Most banks will allow preteens to get a debit card, and this is the next step in learning about finances.

Teenagers may be tempted to spend more as they do not visually see their money leaving the bank account.

However, having a bank account will allow them to learn about interest rates and investment options.

At some point, parents will want to cut back on how much money they spend on their teenager.

Sitting down and talking about the family’s budget and the teen’s budget will put everyone on the same page regarding who is paying for what expense.

If the teen decides that their allowance is not enough, it is the perfect time to suggest that they get a part-time job!

As teens earn money, they have more disposable income.

It is a good idea to sit down again and see what their goals are.

Do they want to start saving for a car?

What about college?

Maybe they want to be able to go on shopping sprees, or buy as many books as they want.

As a parent, you do not want to decide their goals, but rather guide their thoughts to areas that you think are important.

However, the more involved the teen is with their goal, the more they will stick to their budget.

There are many budget apps on the market today, and your teenager may prefer one of these to handling cash or spreadsheets.

Some apps will encourage an emergency fund, a special pool of money that is not to be touched unless absolutely necessary.

As teenagers begin to have property, like a laptop or a car, they will have to deal with accidents or other forms of unexpected costs.

Be sure to remind them to replenish the fund if they use the money!

Teenagers are known to be feisty.

They want independence from their parents, they are exposed to peer pressure, and they want to fit in with their friends.

Spending habits can quickly get out of control.

Teens often place more emphasis on items they want, like clothing from the latest fashion trend, rather than things they need, like school supplies.

So what happens if your teen can’t pay for everything they want?

Most experts suggest giving your teen some tough love.

Let your child accept that they will not be able to buy everything they want all the time.

Their money is finite, and it takes time to build their savings.

By paying for every item that your teen “needs,” they won’t fully understand that there are consequences to their behavior.

And accepting these consequences are what will make them think twice before they blow their paycheck.

When parents cave and give into their teenager’s wants, the teen can become spoiled or entitled.

They might get into the habit of always asking for you to pay for their things.

Their spending behavior is reinforced, and they will have a harder time learning how to be financially independent.

Moving into the College Years

For students who are not living at home during college, the cost of residence or an apartment can equal the cost of tuition.

Living away from home gives teenagers freedom to spend money how they wish.

They can easily go over budget.

In preparation for your child going to college, teach them about credit cards.

It is important to have a good credit score when buying things like cars or houses.

Teenagers can work up a good credit score by always paying off their card at the end of the month.

Credit cards may give the impression of having more money than you think, but high interest rates can set in quickly.

Remind your teen to think ahead when they want to make large purchases.

How long will it take for them to pay off their credit card if they don’t have the money when the bill comes?

Financial Stability Takes Time

No matter the age of your children, there is always a financial lesson to share with them.

Starting young gives your kids a sound basis to understand safe financial behavior.

Children will pick up a lot of your own habits, so use the time you spend teaching them to assess your decisions and see how you can improve your budgeting.

Financial stability won’t happen overnight.

Money does not appear out of thin air just because we wish for it.

Building an emergency fund, a good credit score, and responsible budgeting tricks take practice.

Eventually, and with some encouragement from parents, these behaviors will become habits.