It’s important to learn the most common retirement planning mistakes before it’s too late.

It’s one thing to not save enough money for retirement.

But it’s another thing to save your money the wrong way.

We’re here to help you avoid those retirement planning mistakes.

So we found some of the most common mistakes and how you should avoid them.

Find out how YOU can have a wonderful retirement in the sections below.

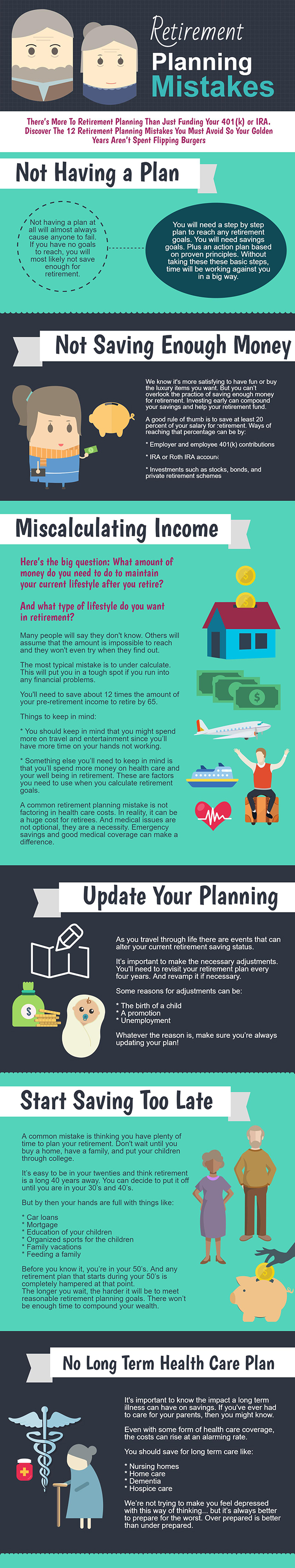

Not Having A Plan

Not having a plan at all will almost always cause anyone to fail. If you have no goals to reach, you will most likely not save enough for retirement.

You will need a step by step plan to reach any retirement goals. You will need savings goals. Plus an action plan based on proven principles. Without taking these these basic steps, time will be working against you in a big way.

Not Saving Enough Money

We know it’s more satisfying to have fun or buy the luxury items you want. But you can’t overlook the practice of saving enough money for retirement. Investing early can compound your savings and help your retirement fund.

A good rule of thumb is to save at least 20 percent of your salary for retirement. Ways of reaching that percentage can be by:

- employer and employee 401(k) contributions

- IRA or Roth IRA account

- investments such as stocks, bonds, and private retirement schemes

Miscalculating Income

Here’s the big question: What amount of money do you need to do to maintain your current lifestyle after you retire?

And what type of lifestyle do you want in retirement?

Many people will say they don’t know. Others will assume that the amount is impossible to reach and they won’t even try when they find out.

The most typical mistake is to under calculate. This will put you in a tough spot if you run into any financial problems.

You’ll need to save about 12 times the amount of your preretirement income to retire by 65.

Things to keep in mind:

- You should keep in mind that you might spend more on travel and entertainment since you’ll have more time on your hands not working.

- Something else you’ll need to keep in mind is that you’ll spend more money on health care and your well being in retirement. These are factors you need to use when you calculate retirement goals.

A common retirement planning mistake is not factoring in health care costs. In reality, it can be a huge cost for retirees. And medical issues are not optional, they are a necessity. Emergency savings and good medical coverage can make a difference.

Update Your Planning

As you travel through life there are events that can alter your current retirement saving status. It’s important to make the necessary adjustments.

You’ll need to revisit your retirement plan every four years. And revamp it if necessary.

Some reasons for adjustments can be:

- the birth of a child

- a promotion

- unemployment

Whatever the reason is, make sure you’re always updating your plan!

Start Saving Too Late

A common mistake is thinking you have plenty of time to plan your retirement. Don’t wait until you buy a home, have a family, and put your children through college.

It’s easy to be in your twenties and think retirement is a long 40 years away. You can decide to put it off until you are in your 30’s and 40’s.

But by then your hands are full with things like:

- car loans

- mortgage

- education of your children.

- organized sports for the children

- family vacations

- feeding a family

Before you know it, you’re in your 50’s. And any retirement plan that starts during your 50’s is completely hampered at that point.

The longer you wait, the harder it will be to meet reasonable retirement planning goals. There won’t be enough time to compound your wealth.

No Long Term Health Care Plan

It’s important to know the impact a long term illness can have on savings. If you’ve ever had to care for your parents, then you might know.

Even with some form of health care coverage, the costs can rise at an alarming rate.

You should save for long term care like:

- nursing homes

- home care

- dementia

- hospice care.

We’re not trying to make you feel depressed with this way of thinking… but it’s always better to prepare for the worst. Overprepared is better than underprepared.

NOW IT”S YOUR TURN!

We want to hear about any retirement mistakes you’ve made… if you’re willing to tell us!

You can also tell us if you’ve been successful too. Share your tips with everyone!

Let’s have a friendly discussion in the comments!