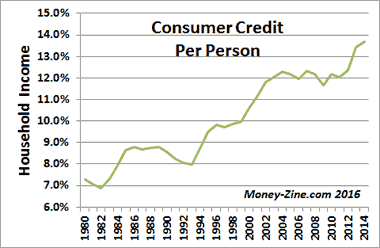

As consumer credit use increases, there is more need to consolidate debt and try to find lower interest rates.

However, it is estimated that about 78% of people who consolidate their debt eventually end up regrowing that debt.

There are many reasons for this.

Often, debt consolidation is treating the symptoms of debt, rather than the underlying cause of the debt in the first place.

On the other hand, consolidation can work in your favor in a variety of situations.

Understanding the debt consolidation process will help you make the best decision for managing your debt.

What is Debt Consolidation?

Since having lingering debt in your portfolio is harmful to your credit score and your wallet, it is in everyone’s best interest to get rid of it immediately. But when paying so many different bills each month, it’s easy to fall behind and miss payments, leading to even more debt and increased interest from your poor credit score.

That’s where consolidating your debt comes in.

It has the dual purpose of reducing the interest rate you pay each month, and simplifying the payment process.

Making minimum payments takes a long time and are considered one of the least efficient ways to pay off debt.

So debt consolidators try to make it so you pay less interest, and faster.

But how?

The process is sometimes not ideal because even though you might obtain a lower minimum payment, you stay have to pay off the full loan, so you are just extending the process.

Even though you have a lower monthly interest rate, you may pay more interest in the long run since now it takes longer to pay off the loan.

The Debt Consolidation Process

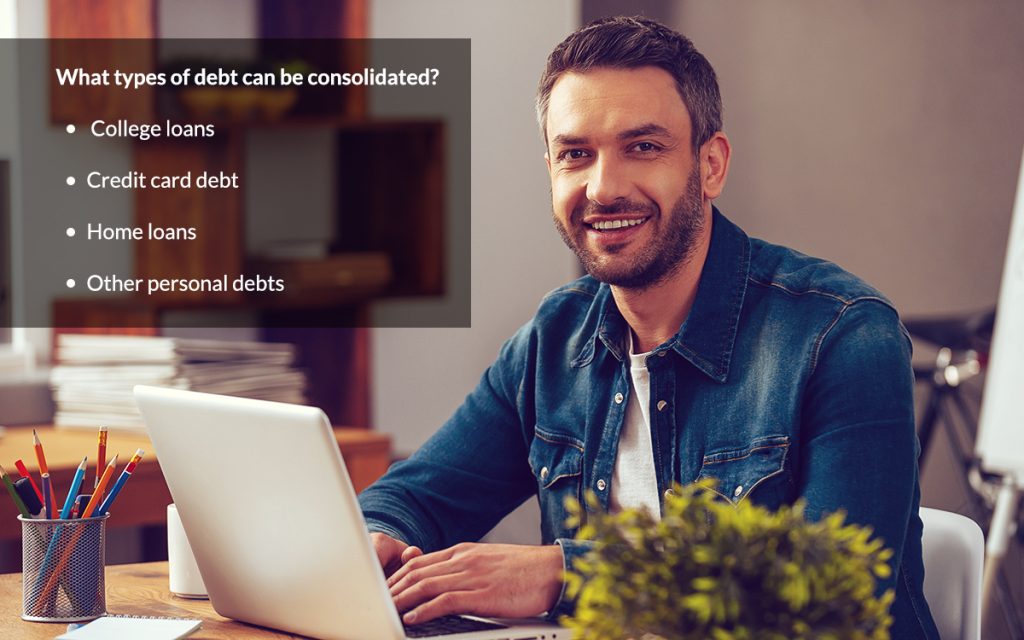

Many companies provide debt consolidation loans, which can be used on all types of debt, such as student loans, credit card bills, mortgages, and many others.

Mortgage lenders, peer to peer debt managers, credit card companies, credit or debt counseling companies, and large and small banks all offer debt consolidation loans.

However, it is worth noting that all these categories of debt must be grouped together.

For example, you cannot consolidate college loans with credit card debt.

You can consolidate multiple credit cards, or multiple college loans, but not the two together.

However, you can consolidate multiple debts and get multiple consolidation loans at once.

You can take a do it yourself approach, mostly with respect to credit cards, or you can work with the help of a debt counselor, which may be necessary if you are extremely in debt to multiple different lenders.

The Different methods of consolidating debt

There are multiple approaches to debt consolidation, each requiring different levels of effort and research.

However, it can be broken down for descriptive purposes into a few basic categories.

Keep in mind that many of these are loans which are used to pay off your other loans.

Most companies will allow you to transfer debt from another card when you open a new account.

Plus, depending on your credit score, when you open a new account you will likely be able to achieve a much lower interest rate, and possibly even 0% APR.

You can also use this method without any outside help.

Debt management programs are run by debt counselors, and for a fee help to consolidate different kinds of revolving debt.

This can include credit cards, medical debt, personal debt in collections, store accounts, payday loans, or any other similar debt.

The unsecured debt consolidation loan is a very versatile option since it combines many different sources and approaches.

The money from the loan can be used towards any source of debt, such as credit cards, personal debt to others, auto loans, and any other debt. However, sometimes the loan is released directly to creditors, so you cannot choose where it goes.

But in other cases, it is given to the borrower directly, so they have the discretion of which loans and debts to prioritize.

Direct Consolidation Loans are specifically for student loans only.

This is a more legitimate, safe approach since it is dealt with by the government and not sketchy middlemen.

If you have one FFEL or Direct loan in your debt collection, then you are in the clear to be eligible for a direct consolidation loan.

There are also private student consolidation loans.

These are not usually recommended since they consolidate public and government student loan debt together, therefore taking tax money into the private sector and making it less reliant on federal rules and regulations.

In fact, in some cases they are illegal, and you can lose the benefits of your student loan if you violate the terms of the loan.

If you use privatization techniques, you may not be eligible for student loan forgiveness in the future, and you will not benefit from the treasured payment plans which make federal loans so advantageous.

Finally, there are federal tax debt installation agreements.

This is specifically for tax debt you may owe to the Internal Revenue Service.

Multiple years of tax debt can be grouped together in one repayment plan to ease the process of having multiple years’ debt weighing down your mailbox.

What is the best debt consolidation option?

Many hold the opinion that peer to peer debt consolidation is the best way to facilitate debt consolidation in the long run.

You can get better interest rates than you would get at a bank sometimes, and there are supposedly no hidden fees, although you always have to be careful since these companies are run for a profit, after all.

How will debt consolidation impact my credit? Will it harm my credit score? Does it matter?

This is always done, but it will dock your credit score down a few points for two years.

However, compared to the damage done to your credit score by carrying a large debt burden for a long time, and consistently missing payments and upping your interest rate, it’s a decent trade in the long run.

Know Before You Go: The other side of the debate

In some cases, it is clear that debt consolidation is useful.

However, in many cases, it is not, and only gets people to stay in debt for longer by decreasing the interest and minimum payment while the loan amount stays the same.

Some analysts compare debt consolidation company promises to diet pills since they advertise that they can work miracles when truly they are accomplishing little.

The truth of the matter is that many of these companies do claim to work miracles and get rid of debt faster.

However, they cannot simply get rid of your debt, or even decrease it, because debt consolidation requires new debt.

To put it another way, you are borrowing money to pay back other money you borrowed from a new source.

Then, you just owe the money to someone else, and likely have paid fees to have the service done.

It doesn’t exactly sound like the best deal.

Hidden fees may worsen your overall financial health and put you further in the debt hole.

Getting out of debt requires hard work, not miracle solutions.

You need a combination of good budgeting, timely payments, and changing bad economic habits in order to get out of debt.

Debt consolidation can be useful in doing this: it might help you miss fewer payments due to forgetfulness, or help you keep making minimum payments when you are struggling to meet them due to an abnormal financial situation.

However, it is only one part of the process, and it will not miraculously solve your financial problems.

When entering the process, do so carefully and read all the fine print before signing anything to ensure that you do not end up with costly fees and even more debt, and just the illusion of a solution.