Anyone in debt should know about the different types of debt you should pay off before the other types.

Debt needs to be prioritized and paid off in the least damaging way to your bank account and credit.

And the worst types need to be your priority.

These types will keep you in debt longer if you don’t pay them off fast. And they’ll damage your credit fast too.

So how do you know if your debt is bad? Or really bad?

We made up a list below that shows you the types of loans you should stay away from.

If you can’t find a way to stay away from them then the order will tell you how fast you should pay the debt off.

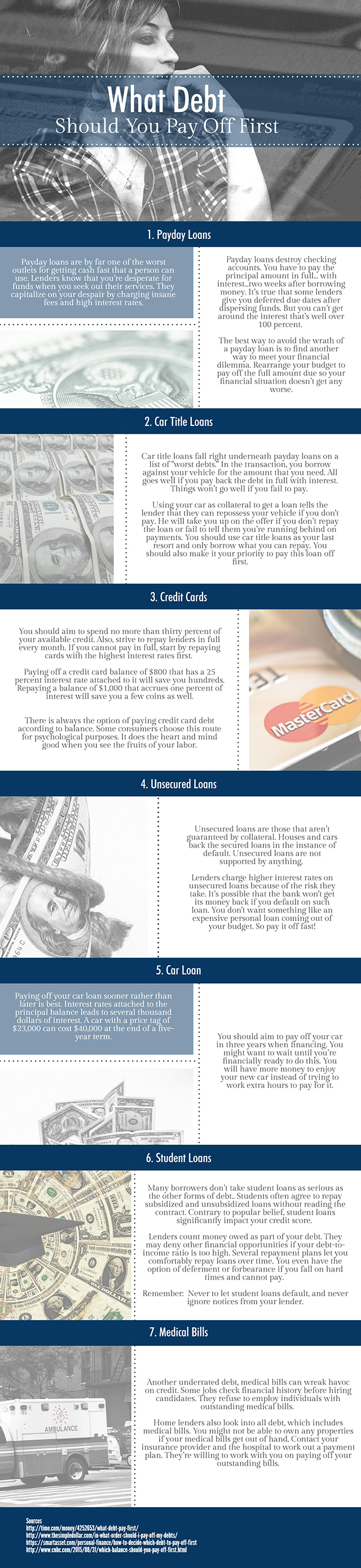

Payday Loans

Payday loans are by far one of the worst outlets for getting cash fast that a person can use. They’re so bad for your budget that we recommend avoiding payday loans by any means necessary.

Lenders know that you’re desperate for funds when you seek out their services. They capitalize on your despair by charging insane fees and high interest rates.

Payday loans destroy checking accounts. You have to pay the principal amount in full… with interest…two weeks after borrowing money.

It’s true that some lenders give you deferred due dates after dispersing funds. But you can’t get around the interest that’s well over 100 percent.

The best way to avoid the wrath of a payday loan is to find another way to meet your financial dilemma. Rearrange your budget to pay off the full amount due so your financial situation doesn’t get any worse.

Car Title Loans

Car title loans fall right underneath payday loans. In the transaction, you borrow against your vehicle for the amount that you need. All goes well if you pay back the debt in full with interest. Things won’t go well if you fail to pay.

Using your car as collateral to get a loan tells the lender that they can repossess your vehicle if you don’t pay. He will take you up on the offer if you don’t repay the loan or fail to tell them you’re running behind on payments.

You should use car title loans as your last resort and only borrow what you can repay. You should also make it your priority to pay this loan off first.

Credit Cards

It ‘s not easy to stay debt-free in a society fueled by consumerism. Advertisements that urge us to buy now and pay later are all around. But using a small amount of your credit limit and paying off debt on time is the only way to live debt free.

You should aim to spend no more than thirty percent of your available credit. Also, strive to repay lenders in full every month. If you cannot pay in full, start by repaying cards with the highest interest rates first.

Paying off a credit card balance of $800 that has a 25 percent interest rate attached to it will save you hundreds. Repaying a balance of $1,000 that accrues one percent of interest will save you a few coins as well.

There is always the option of paying credit card debt according to balance. Some consumers choose this route for psychological purposes. It does the heart and mind good when you see the fruits of your labor.

Unsecured Loans

Unsecured loans are those that aren’t guaranteed by collateral. Houses and cars back the secured loans in the instance of default. Unsecured loans are not supported by anything.

Lenders charge higher interest rates on unsecured loans because of the risk they take. It’s possible that the bank won’t get its money back if you default on such loan. You don’t want something like an expensive personal loan coming out of your budget. So pay it off fast!

Car Loan

Paying off your car loan sooner rather than later is best. Interest rates attached to the principal balance leads to several thousand dollars of interest. A car with a price tag of $23,000 can cost $40,000 at the end of a five-year term.

You should aim to pay off your car in three years when financing. You might want to wait until you’re financially ready to do this. You will have more money to enjoy your new car instead of trying to work extra hours to pay for it.

Student Loans

Many borrowers don’t take student loans as serious as the other forms of debt.. Students often agree to repay subsidized and unsubsidized loans without reading the contract. Contrary to popular belief, student loans significantly impact your credit score.

Lenders count money owed as part of your debt. They may deny other financial opportunities if your debt-to-income ratio is too high. Several repayment plans let you comfortably repay loans over time. You even have the option of deferment or forbearance if you fall on hard times and cannot pay.

Remember: Never to let student loans default, and never ignore notices from your lender.

The health of your credit score depends on your responsiveness.

Medical Bills

Another underrated debt, medical bills can wreak havoc on credit. Some jobs check financial history before hiring candidates. They refuse to employ individuals with outstanding medical bills.

Home lenders also look into all debt, which includes medical bills. You might not be able to own any properties if your medical bills get out of hand. Contact your insurance provider and the hospital to work out a payment plan. They’re willing to work with you on paying off your outstanding bills.

So start prioritizing your debt today!

Start paying off the highest interest rates as soon as you can. The faster you pay it off, the less money you’ll have to pay over time.

Have any questions or stories to share? Let’s start a friendly discussion down in the comment section!

See you there!

Did you find this information useful? Then click to learn How To Get Out Of Debt!

Do you have any question about your debt?

Or any success stories about how you got out of debt?

Leave us a comment down below!