Budgeting might seem like a difficult task at first.

Budgeting may be especially daunting for individuals who have no experience with scheduled savings.

But, there are many simple ways to implement an effective budget in your life.

Do You Know About The 50/20/30 Rule?

For those new to the practice or those who have struggled in the past, the 50/20/30 rule may be extremely helpful.

By following a few simple guidelines, you will be on your way to financial bliss.

What do the numbers mean?

The 50/30/20 simplifies budgeting by giving you a flexible formula for success.

Senator Elizabeth Warren and entrepreneur Amelia Warren Tyagi advocate this system.

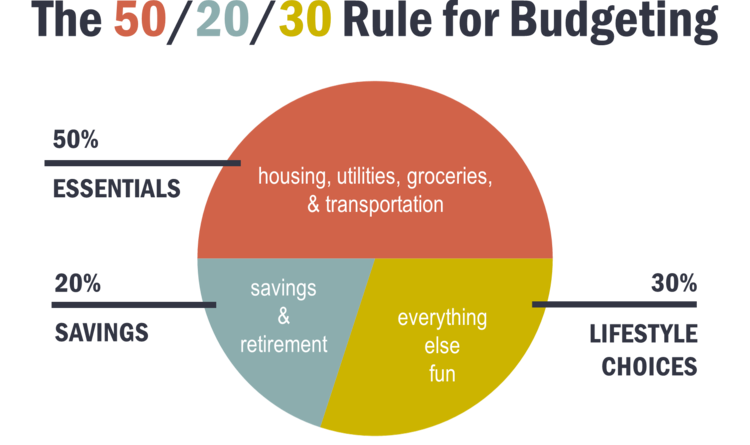

The graph below shows the numerical breakdown of how much of your overall budget you should spend on each category.

Breaking down budgeting into these three simple categories makes it easy for anyone to implement this rule in their daily lives.

1. Fixed Costs

When following the 50/20/30 rule for budgeting, you set aside 50% of your overall budget for fixed costs.

Simple Tip for Scaling Back

Once you identify which of your expenses are fixed costs, you can attempt to re-evaluate your spending by cutting back on things that are unnecessary.

Doing this can help you to create an even healthier budget.

Be sure to distinguish the things you want from the things that you actually need.

2. Future and Emergency Savings

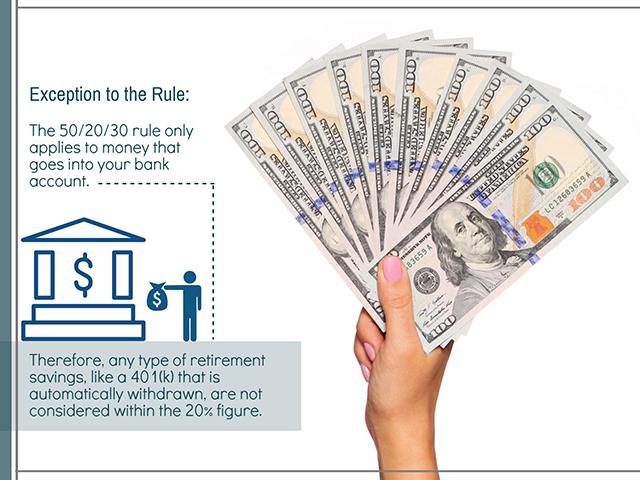

The next thing you should do to follow the 50/20/30 rule is to set aside 20% of your overall budget for savings.

These savings can then be used in the future when you retire, or if you are ever in an emergency.

These savings can also be used to pay off credit card debt.

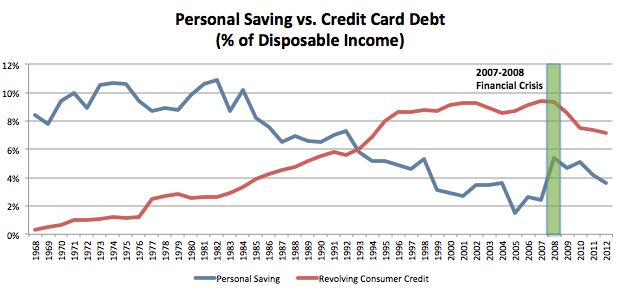

The graph below shows the way in which credit card debt has been steadily increasing over time.

Therefore, it is extremely imperative to contribute some portion of your overall income to pay off these kinds of debts if you have them.

Savings accounts can also be used for future investments such as buying a home.

By allotting 20% of your overall budget for savings, you set yourself up for a productive and prosperous future.

3. Personal Expenses

The third category is personal expenses.

Following the 50/20/30 rule, you should use 30% of your overall budget for personal expenses.

These expenses can be any extra spending that is not included in the previous two categories.

Some examples are clothing, gas, and sport or movie tickets.

Food is one expense that can become confusing.

Although food is a necessity, the amount that you spend on food changes from month to month based on where you are eating and what kinds of food you are eating.

Because the amount you spend varies, food falls within the personal expenses rather than the fixed costs category.

These are often expenses that do not have a set rate and vary by month.

Because this category is much more flexible, you need to be certain not to overspend.

Set a limit for personal expenses and be sure not to exceed it.

How to Track the 50/20/30 budget

There are multiple ways to keep track of the amount of money you are spending.

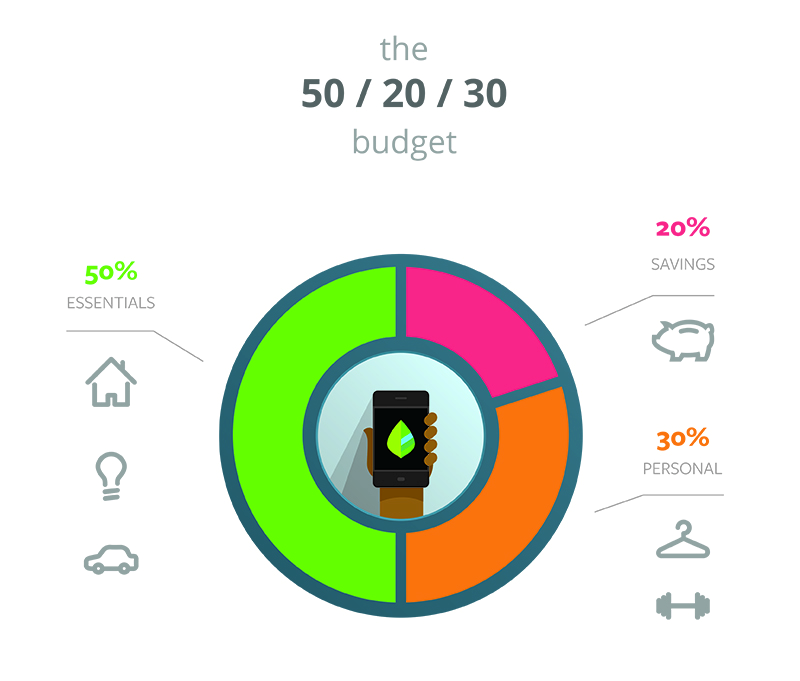

For example, a new budgeting software called Mint, pictured below, allows you to track your budget using the 50/20/30 rule.

Anyone can use the 50/20/30 rule to maintain a healthy budget no matter your age or income.

Knowing how much you are spending and what you are spending it on gives you financial freedom.

The simplicity of the 50/20/30 system allows you to streamline the budgeting process and save successfully.

Although budgeting might seem complicated at first, with this straightforward system you will become a master in no time.