For many folks out there, their house is more often than not their most sizeable and valuable asset.

But hanging onto a house in retirement may become a drain on your finances, especially if it has outstanding mortgage repayments.

So what can you do?

Considering and preparing for your future mortgage expenses sooner rather than later, can save you a whole heap of financial burden and worry when it comes to crunching those numbers in your retirement.

And who needs the extra anxiety around at that time?

To assist you in avoiding disappointment, here are a few examples of what you can implement into your mortgage-free retirement strategy:

Try Downsizing to a Smaller House

One of the most common ways to achieve this is to move into a smaller, lower-priced house.

Although this may at first seem extreme, some consider it a no-brainer.

This option would make perfect sense for when the children have moved out and the now suddenly large, vacant nest, with far too many rooms, floors, and stairs, is empty.

But how will you know if this is the right option for you?

As far as your finances are concerned, this option can serve you in some ways:

- The equity gained in your current property may be ample enough to secure the purchase of the smaller property without even having to mortgage it. Buying property with cash is a great way of avoiding extortionate fees and interest rates.

- Downsizing to a more practical wallet-friendly home can benefit you in retirement because, by scaling back a little in size, you will, in most cases, be reducing the monthly payments on your mortgage. This is significant because the difference you’re saving each month can subsequently be used to fund your retirement nest egg, or even be used to pay off your outstanding mortgage balance quicker.

- The benefits – financially – will far outweigh the emotional distress of having to pack up and move house once already in retirement – or fast approaching it, so this may be something for you to consider early on.

Aim At Refinancing Your Mortgage Early

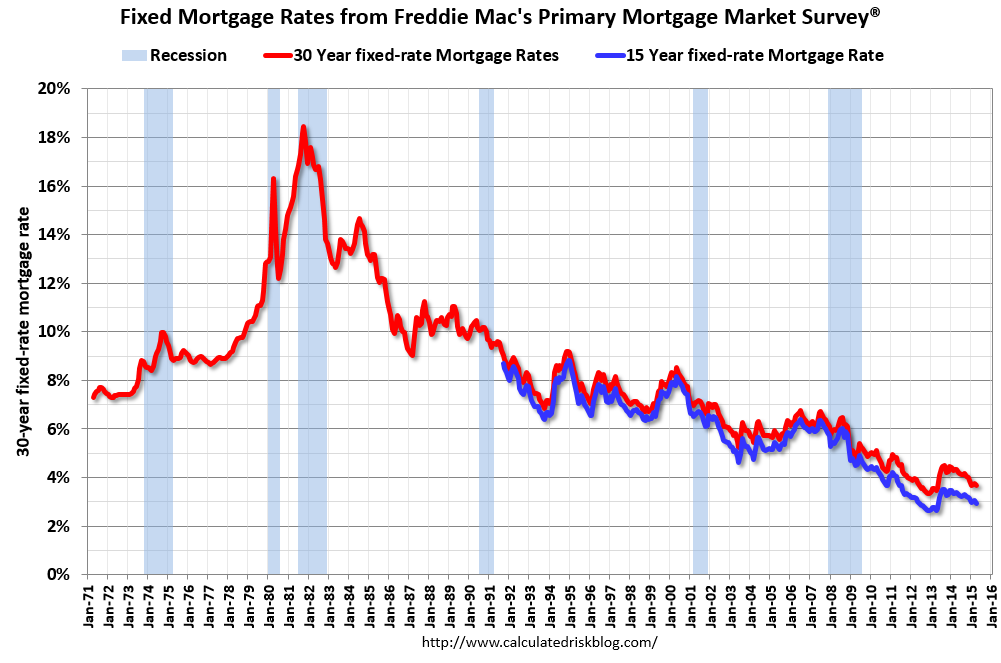

The trick here, and why most people consider refinancing, is to reduce the amount of interest on their current mortgage, which in turn will lower their monthly repayments.

However, to reduce the overall amount paid in the entirety of your mortgage, you could try reducing the length of it from the standard 30-year mortgage to perhaps a few years shorter than that.

One case study of a reduced mortgage range is a 50-year-old woman who had planned to retire at the age of 65.

For her to obtain this goal, she refinanced her 30-year mortgage to one which was 15 years shorter, i.e. a 15-year lease.

And although her monthly repayments were slightly higher, she soon realized that she would save tens of thousands of dollars because she avoided the extra interest charges which her previous – longer – loan would have generated over the course of the proceeding 15 years.

Another sure-fire way to get your mortgage paid off earlier than planned, and granted you’re financially able to do so, is to make monthly payments which are higher than the ones your plan requires as a minimum.

If you gain an influx of cash for whatever reason, or perhaps your boss has been generous enough to offer you a healthy pay rise, then a splendid idea would be to implement that good fortune into making additional payments which were otherwise not possible.

A variety of online mortgage calculators can reveal just how easily – and quickly – the savings can add up.

Positive forward-thinking is paramount to a mortgage-free retirement strategy.

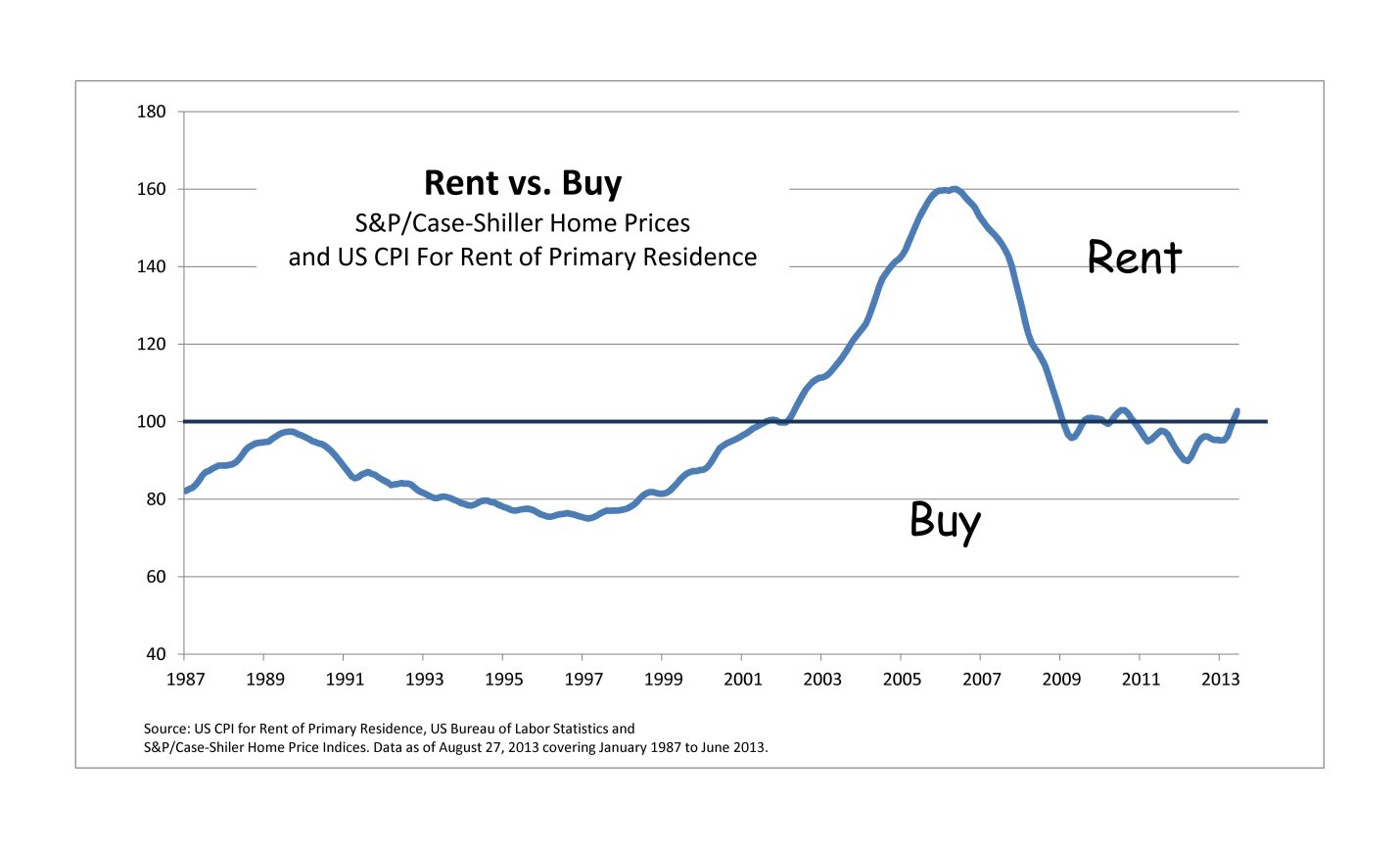

Renting May Well Be the Way Forward

Owning your home is as popular now as it ever was.

It is something that appeals to everybody of all ages.

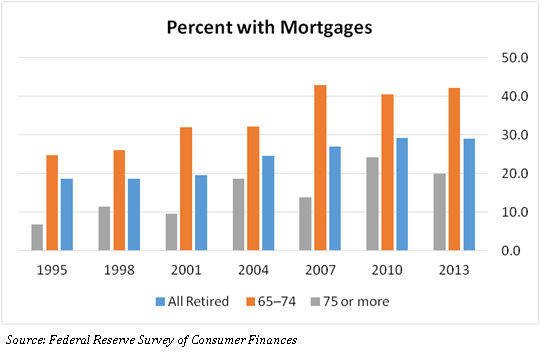

A recent survey found that almost 80% of people in retirement stated that they owned their current home.

However, with owning a home so far up the priority list of most folks nowadays, that doesn’t necessarily mean it’s the path everybody has to choose.

In fact, a lot of people are quite content with renting homes and properties their entire lives.

Here are a few reasons why one might consider renting instead of owning:

- Renting offers flexibility; you aren’t tied down to a particular location and can experience new cities or towns without the commitment of a long-term mortgage.

- Maybe you like traveling; short-term leases (6-month renting contracts) might be for you. Spending half the year on one side of the world and then packing up to spend the other half on the opposite side is a definite possibility.

- You can test the water by moving into a fantastic apartment short-term to see what it is. Perhaps you’re unsure about an area, or you’re looking at different schools for your future (or current) children.

Something else you might consider, depending on your circumstances, is selling your house when retirement comes.

The equity could provide you with the opportunity to live a very comfortable retirement on your terms with financial freedom – granted you use the equity wisely.

Quite often you’ll find that retirees have preset plans in place to travel the world, spending most, if not all, of their days on the road which makes renting a very attractive option for them.

Some others, in retirement, may be tired of the years maintaining a home, with repair costs being a major consideration, and would only prefer the tediousness and cost be taken care of by their landlord.

Whichever way you may choose to go, when aiming at a mortgage-free retirement, planning is the most important key to your success.

By laying the foundation early, you’re giving yourself a significant chance at a financially stable future.