There are many reasons people choose FHA loans instead of “traditional” loans when purchasing a home.

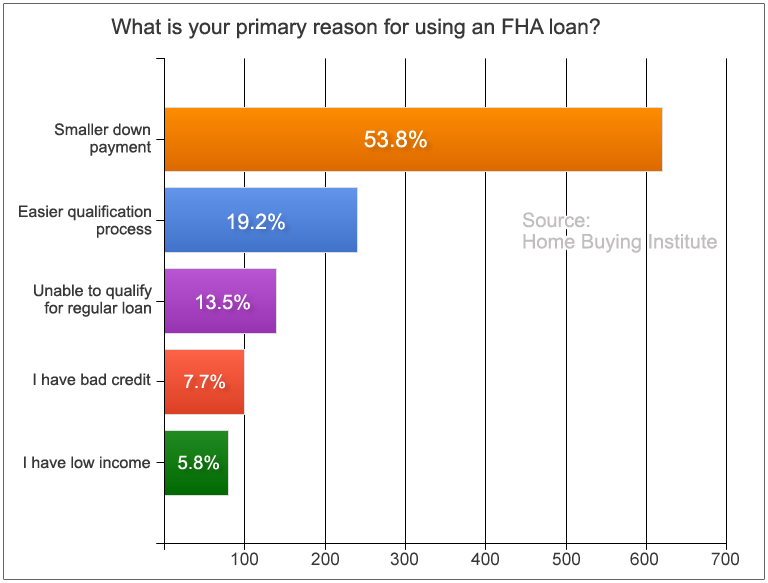

By looking at the chart below, you can see that the majority of people who choose FHA loans, do so because of the smaller down payment requirement.

However, it is worth considering all your options when it comes to getting a home loan.

This article will help you understand the key differences between FHA and conventional loans.

As well as helping you decide which option might be best for you.

First Time Homebuyer?

FHA loans are often considered the ideal loans for first-time homeowners, and most people choose to take this route when mortgaging their first home.

But what is an FHA loan anyways?

Essentially, it is a loan that is backed by the Federal Housing Administration.

The reason for their popularity is that they are usually less strict since they have the added flexibility of government fulfillment to lenders.

FHA-approved lenders are issued loans to reduce the lender’s risk of loss should the borrower be unable to fulfill the terms of repayment.

Many people sue these loans in order to purchase a home if they have not had adequate time to establish a good credit score and credit history.

It is easier to qualify for FHA loans with a low credit score than if you were to apply for a standard loan.

If your credit score is 580 or higher, you can qualify for an FHA loan with a down payment as low as 3.5% of the total home cost.

Even those with lower credit scores can qualify.

Scores between 500-579 can qualify, but they must pay a hefty 10% down payment.

However, this is still great in comparison to the rates on a standard loan, which usually require a 20% down payment.

Government-subsidized loans help lenders foot the costs, and that is what enables them to keep these low rates.

The Catch: Mortgage Insurance

The perks of an FHA loan come with a catch.

Borrowers absolutely must have mortgage insurance in order to qualify.

What is mortgage insurance?

It is a combination of an upfront insurance premium, as well as monthly payments in order to continue being insured.

The upfront mortgage insurance premium is 1.75% of the home loan.

It does not matter what your credit score is, and every individual must do this.

The monthly payments come out to a percentage that differs person to person.

It is based on the combination of your loan value and duration.

Longer and bigger loans will have higher monthly rates.

These still come out to less than a typical loan, and many private lenders require mortgage insurance for borrowers anyways.

It is usually somewhere between .45% and 1.05% of the total home cost per month.

Benefits of FHA mortgage insurance vs. traditional private mortgage insurance

Surprisingly, even though it is required, the FHA mortgage insurance is much better than private insurers overall.

That’s because most private insurers automatically decrease the level of coverage as the loan is paid off over time.

That means that towards the end of your mortgage, you will have far less coverage than you initially paid for.

This usually happens when the Loan to Value Ratio drops to about 78%.

Many lenders bury this deep in the agreement documents and do not inform buyers.

FHA mortgage insurance, on the other hand, is the same cost every month and maintains the same level of coverage throughout the entire term of the loan.

What are the Requirements for an FHA loan?

Even though the requirements are less stringent, there are still a few necessary ones:

- You must be planning to use the home as your primary residence- not a second home or a business

- You must have the property appraised by an appraiser approved by the FHA

- You must have an absolute minimum credit score of 500 to qualify for the loan with 10% down payment; You must have a minimum of 580 to qualify for a down payment of 3.5%. Scores under 500 are not accepted.

- Most borrowers must be at least two years out of bankruptcy. In that time, you must have reestablished a good credit history. Exceptions can be made in certain cases, such as extenuating circumstances and responsible money management.

- The property must meet certain appraisal standards. If there are safety concerns for the house, they must be fixed prior to approval for the FHA loan.

- Borrowers must not have been foreclosed upon for three years prior to the loan application. Again, there are exceptions for some circumstances where you have established good credit afterward.

- The back end ratio must be less than 43%.This is the ratio of your average monthly debt to your average monthly income, including all long-term debt such as school loans, etc.

- The front end ratio must be under 31% of your gross annual income. This means that the mortgage, homeowners insurance, and all other home associated costs, must not be higher than 31% in proportion to your income.

- Borrowers must have a social security number and valid residence in the United States. They must be of legal adult age.

- Borrowers must have a steady history of employment, or have worked for the same employer for at least the past two years.

The loan cannot finance a home worth more than about $729,000.

This varies state by state as well.

Traditional lenders such as Fannie Mae usually cap at around $600,000

How to Know when I should get an FHA loan

The circumstances that make the most sense for use of an FHA loan are when you have very little equity to use for your home, or when your financial situation is unique.

If you are divorcing, have a previous foreclosure, or bankruptcy under your belt, or if you have a great credit score but not a lot to use for a down payment, the FHA is the best route.

On the other hand, the best time to go for a traditional loan from a private lender is when your credit score is at least 680, and when you have enough money for at least a 5% down payment.

If your credit score is lower, you can still qualify, but you will likely get a much higher interest rate than an FHA.

Also, if you are trying to purchase a McMansion or a second or vacation home, traditional lenders will be more able to negotiate this with you.

FHA loans are aimed towards the average citizen buying a single family home.

Before making a decision, you must know “how much house” you can afford.

You also must know your credit score- by law, you are entitled to three free credit checks per year from different providers.

Use one of these close to when you are applying for your loan, so you can make sure you have the best possible score to achieve a low-interest rate.

Beneficial Nooks and Crannies of the FHA loan

Federal Housing Administration loans don’t necessarily only have to be for first-time homeowners.

They can also be used in a variety of other circumstances.

They are great for situations such as refinancing a current home loan.

Multiple different FHA loans can be used towards a home purchase or refinancing.

Another additional feature of the FHA loan is something called “streamline financing.”

This means that refinancing your loan is quicker, cheaper, and easier to achieve a reduced interest rate.

Essentially, it is easier than refinancing on a traditional loan because you will not have to verify your assets and income all over again.

This means that even if your financial situation has worsened since the start of your loan, you can take advantage of trends which make the average interest rate lower.

Then, you can have that new low-interest rate without having to prove your current financial situation.

Another added perk is that FHA loans are what is called “assumable loans.”

This means that if you sell your home, you can use the selling advantage of including the current interest rate and loan terms.

Whatever your interest rate and monthly insurance premium were, they will be transferred to a new owner.

This makes it much easier to get the house off the market quickly.

It increases the ease of transferring the mortgage to a new owner.

Most private lenders with fixed rate loans do not allow for this transfer.

Conclusion

FHA loans are best for those with low credit scores, unable to make a large down payment, or who are hoping to sell their home with the same interest rates.

Traditional loans are best for second homes, those with high credit scores, or high equity for home purchasing.