If there’s one thing that can save you thousands of dollars when buying a home it’s this: how to get the best mortgage rate.

But how do you get a good rate for the house your buying?

Do you know where to start?

If you don’t…

We want to help YOU!

Buying a home for the first time (or any time) can be a stressful experience.

If you fail to prepare…

Then prepare to fail!

Use the tips below to help you get the best mortgage rate on your new house!

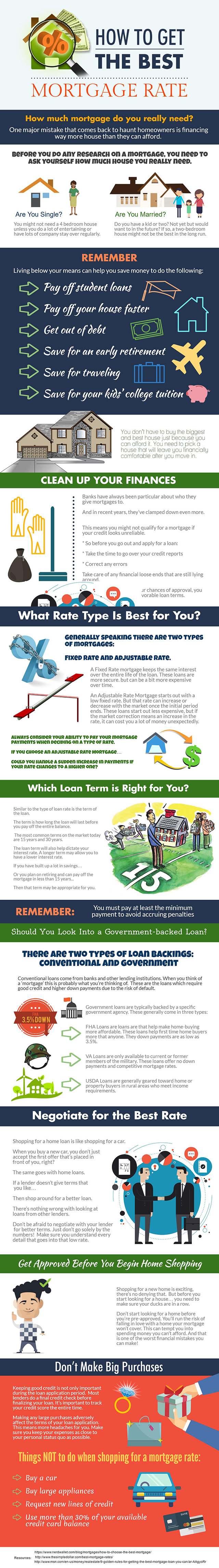

How much mortgage do you really need?

One major mistake that comes back to haunt homeowners is financing way more house than they can afford.

Before you do any research on a mortgage, you need to ask yourself how much house you really need.

Are you single?

You might not need a 4 bedroom home unless you do a lot of entertaining or have lots of company stay over regularly.

Married with two or three kids?

A two-bedroom house might not be the best in the long run.

Remember:

Living below your means can help you save money to do the following:

- Pay off student loans

- Pay off your house faster

- Get out of debt

- Save for an early retirement

- Save for traveling

- Save for your kids’ college tuition

You don’t have to buy the biggest and best house just because you can afford it. You need to pick a house that will leave you financially comfortable after you move in.

Clean Up Your Finances

Banks have always been particular about who they give mortgages to.

And in recent years, they’ve clamped down even more.

This means you might not qualify for a mortgage if your credit looks unreliable.

So before you go out and apply for a loan:

- take the time to go over your credit reports

- correct any errors

- take care of any financial loose ends that are still lying around.

You’ll not only increase your chances of approval, you might also receive more favorable loan terms.

What Rate Type Is Best for You?

Generally speaking there are two types of mortgages:

Fixed Rate and Adjustable Rate.

A Fixed Rate mortgage has the same interest rate for the loan’s entire life. These loans are more secure, but can be a bit more expensive over time.

Adjustable Rate Mortgages start out with low, fixed rates. But that rate can increase or decrease with the market once the initial period ends. These loans start out less expensive, but if the market correction means an increase in the rate, it can cost you a lot of money unexpectedly.

You should consider your ability to pay your mortgage payments when deciding on a type of rate.

If you choose an Adjustable Rate Mortgage…

Could you handle a sudden increase in payments if your rate changes to a higher one?

Which Loan Term is Right for You?

Similar to the type of loan rate is the term of the loan.

The term is how long the loan will last before you pay off the entire balance. The most common terms on the market today are 15 years and 30 years.

The loan term will also help dictate your interest rate. A longer term may allow you to have a lower interest rate.

If you have built up a lot in savings…

Or you plan on retiring and can pay off the mortgage in less than 15 years…

Then that term may be appropriate for you.

Remember that you must pay at least the minimum payment to avoid accruing penalties.

Should You Look Into a Government-backed Loan?

There are two types of loan backings: conventional and government.

Conventional loans come from banks and other lending institutions. When you think of a ‘mortgage’ this is probably what you’re thinking of. These are the loans which require good credit and higher down payments due to the risk of default.

Government loans are typically backed by a specific government agency. These generally come in three types:

- FHA Loans are loans are that help make home-buying more affordable. These loans help first time home buyers more that anyone. They down payments are as low as 3.5%.

- VA Loans are only available to current or former members of the military. These loans offer no down payments and competitive mortgage rates.

- USDA Loans are generally geared toward home or property buyers in rural areas who meet income requirements.

Negotiate for the Best Rate

Shopping for a home loan is like shopping for a car.

When you buy a new car, you don’t just accept the first offer that’s placed in front of you, right?

The same goes with home loans.

If a lender doesn’t give terms that you like…

Then shop around for a better loan.

There’s nothing wrong with looking at loans from other lenders.

Don’t be afraid to negotiate with your lender for better terms. Just don’t go solely by the numbers! Make sure you understand every detail that goes into that low rate.

Get Approved Before You Begin Home Shopping

Shopping for a new home is exciting, there’s no denying that. But before you start looking for a house… you need to make sure your ducks are in a row.

Don’t start looking for a home before you’re approved. You’ll run the risk of falling in love with a home your mortgage won’t cover. This can tempt you into spending money you can’t afford. And that is one of the worst financial mistakes you can make!

Don’t Make Big Purchases

Keeping good credit is not only important during the loan application period. Most lenders do a final credit check before finalizing your loan. It’s important to track your credit score the entire time.

Making any large purchases adversely affect the terms of your loan application. This means more headaches for you. Make sure you keep your expenses as close to your personal status quo as possible.

Things not to do when shopping for a mortgage rate:

- Buy a car

- Buy large appliances

- Request new lines of credit

- Use more than 30% of your available credit card balance

Do YOU know how to get the best mortgage rate?

Tell us how you do it in the comment section.

Or just tell us a story if you feel like it…

We want to hear from YOU!