If there is one thing everyone would like to know it’s this: habits that can make you rich.

Who doesn’t want more money?

Excess money?

Well the people that are already rich…

They all share similar habits that got them where they are today.

It’s not luck that made them wealthy.

They found the ways to build their own wealth.

SO PAY ATTENTION!

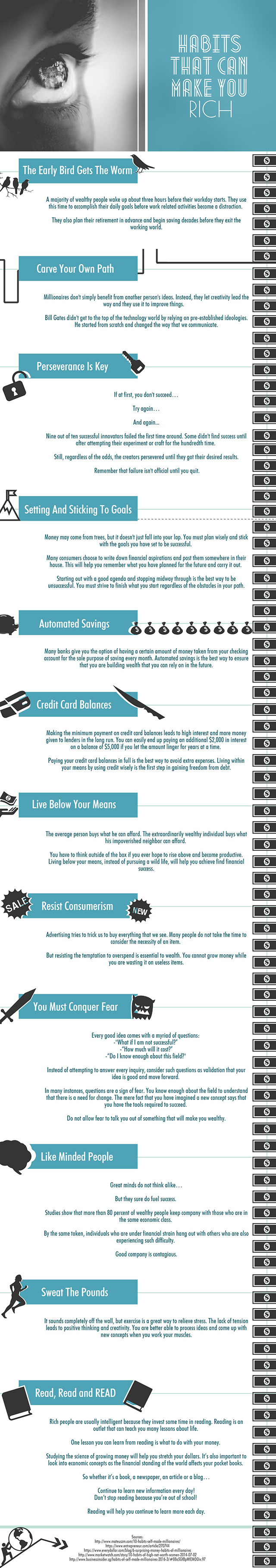

Here are 12 habits that can make you rich:

The early bird gets the worm

A majority of wealthy people wake up about three hours before their workday starts. They use this time to accomplish their daily goals before work related activities become a distraction.

They also plan their retirement in advance and begin saving decades before they exit the working world.

Carve your own path

Millionaires don’t simply benefit from another person’s ideas. Instead, they let creativity lead the way and they use it to improve things.

Bill Gates didn’t get to the top of the technology world by relying on pre-established ideologies. He started from scratch and changed the way that we communicate.

Perseverance is key

If at first, you don’t succeed…

Try again…

And again…

Nine out of ten successful innovators failed the first time around. Some didn’t find success until after attempting their experiment or craft for the hundredth time.

Still, regardless of the odds, the creators persevered until they got their desired results.

Remember that failure isn’t official until you quit.

Setting and sticking to goals

Money may come from trees, but it doesn’t just fall into your lap. You must plan wisely and stick with the goals you have set to be successful.

Many consumers choose to write down financial aspirations and post them somewhere in their house. This will help you remember what you have planned for the future and carry it out.

Starting out with a good agenda and stopping midway through is the best way to be unsuccessful. You must strive to finish what you start regardless of the obstacles in your path.

Automated savings

Many banks give you the option of having a certain amount of money taken from your checking account for the sole purpose of saving every month. Automated savings is the best way to ensure that you are building wealth that you can rely on in the future.

No credit card balances

Making the minimum payment on credit card balances leads to high interest and more money given to lenders in the long run. You can easily end up paying an additional $2,000 in interest on a balance of $5,000 if you let the amount linger for years at a time.

Paying your credit card balances in full is the best way to avoid extra expenses. Living within your means by using credit wisely is the first step in gaining freedom from debt.

Live below your means

The average person buys what he can afford. The extraordinarily wealthy individual buys what his impoverished neighbor can afford.

You have to think outside of the box if you ever hope to rise above and become productive. Living below your means, instead of pursuing a wild life, will help you achieve find financial success.

Resist consumerism

Advertising tries to trick us to buy everything that we see. Many people do not take the time to consider the necessity of an item.

But resisting the temptation to overspend is essential to wealth. You cannot grow money while you are wasting it on useless items.

Conquer fear

Every good idea comes with a myriad of questions:

- “What if I am not successful?”

- “How much will it cost?”

- “Do I know enough about this field?”

Instead of attempting to answer every inquiry, consider such questions as validation that your idea is good and move forward.

In many instances, questions are a sign of fear. You know enough about the field to understand that there is a need for change. The mere fact that you have imagined a new concept says that you have the tools required to succeed.

Do not allow fear to talk you out of something that will make you wealthy.

Hang out with like-minded people

Great minds do not think alike…

But they sure do fuel success.

Studies show that more than 80 percent of wealthy people keep company with those who are in the same economic class.

By the same token, individuals who are under financial strain hang out with others who are also experiencing such difficulty.

Good company is contagious.

Sweat the pounds

It sounds completely off the wall, but exercise is a great way to relieve stress. The lack of tension leads to positive thinking and creativity. You are better able to process ideas and come up with new concepts when you work your muscles.

Read, Read and Read Some More

Rich people are usually intelligent because they invest some time in reading. Reading is an outlet that can teach you many lessons about life.

One lesson you can learn from reading is what to do with your money.

Studying the science of growing money will help you stretch your dollars. It’s also important to look into economic concepts as the financial standing of the world affects your pocket books.

So whether it’s a book, a newspaper, an article or a blog…

Continue to learn new information every day!

Don’t stop reading because you’re out of school!

Reading will help you continue to learn more each day.

Have you already picked up some of these daily habits?

We want to hear what helps YOU.

Are you getting the promotions or raises you want?

Tell us about it in the comment section!