Studies are continuously being carried out to discover the true extent of how the current young adult population is coping with saving for the future.

The loose categorization of people who reached maturity in the year 2000, called millennials, are labeled as techno freaks, smartphone addicts, and social media junkies.

But are they fully informed about the consequences of saving for a comfortable future?

And is it within their reach to be able to save $1,000,000 by the time they reach retirement age?

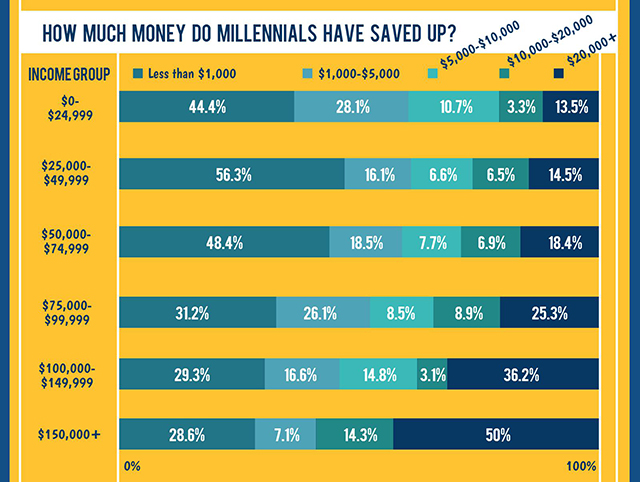

By accessing the information from the chart printed below, it can be seen that saving schemes are a way of life for a considerable percentage of young adults between the ages of twenty-two years and thirty-five years of age.

There is clear evidence that this generation takes planning for the future quite seriously and the higher the salary, the larger the amount it is that is saved.

Recent surveys have been able to pinpoint the factors that contribute to the savings to which millennials have committed.

It further highlights the problems that inhibit a larger proportion of salary from being stored away.

Some of the statistics that have come to light are:

The primary saving aid for this generation is that they have perhaps forty years of savings time stretching in front of them.

That is ample time to be able to source beneficial schemes, low tax options, and refinance student loans.

It is incumbent upon the older generations to bring these opportunities to the attention of the millennial generation so as to optimize their futures and plan for a comfortable pensionable age.

There is a caution that is inherent in most people who experienced the financial crash of 2008.

This should not lead to suspicion and hopelessness in the markets, though.

With the 1,500 people who were recently surveyed, 58% are already planning for their retirement with savings schemes.

38% have sat down and worked out how their way of life can be maintained with inflation in old age.

40% have chosen an age at which they will feel happy to retire.

Some of the planning and saving schemes that Millennials are active in are:

- Personal saving accounts in cash that are earning fixed bank rates

- 401(k) retirement economies that are sponsored by an employer

- Social security

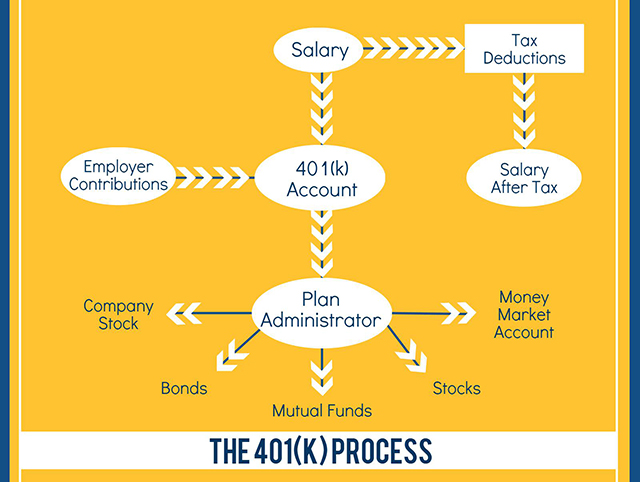

Looking into these plans more closely – the 401(k) is the most popular and economically relevant method.

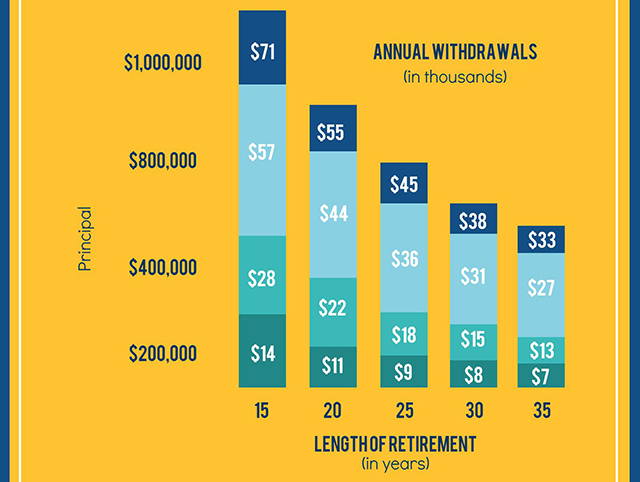

Taking the below chart as a guideline for the amount of $1,000,000 being saved for retirement, the target is easier to access when the contributions are being matched by the employer too.

This is free and extra money for saving and can be started very early on in a worker’s career life.

Moving on to the breakdown of the 401(k) below, the employer contributions are explicitly added extra to the basic salary package.

It is wise to take advantage of the 401(k) savings scheme as early in the work career as possible.

This can lead to an eventual 100% return on the initial money saved.

When an employer offers a matching program, they will equal the amount dedicated every month.

This scheme should be utilized at the earliest opportunity.

An interesting statistic and cautionary fact are that changing from job to job does not always benefit a serious saver.

Some of the reasons for this can be:

- Moving costs

- Starting at the bottom of the corporate ladder again

- No particular degree of financial benefit in job or career changes

People who have shown steady wage increases and savings stability are often the ones who have been in the same job for decades.

The idea that it shows career acumen by changing jobs or vocations is sometimes flawed logic.

Millennials are shrewd, as they are exposed to massive amounts of data made available to them on all the media platforms.

The decadent conspicuous consumption of the eighties decade is considered risible and most people between the ages of 22 and 35 years old are aware that a flashy car depreciates whereas an IRA does not.

They are driven by student debt for the central part.

Shopping around for a better refinancing deal for these loans are a priority – not sports cars.

Millennials are still exposed to luxurious lifestyles that are flaunted on social media.

This could be the cause for some survey respondents claiming that they live paycheck to paycheck, and simply do not have the money to save.

This decision may be driven by over luxurious lifestyle choices.

The fact of the matter is that young adults are bombarded with marketing and advertising that seek to part them with whatever extra money they may have.

It takes discipline in the form of 401(k) and IRA commitments to keep that money where it belongs – accumulating for the future.

Touching on saving methods other than 401(k) and Social Security brings the subject of Roth IRA.

Traditional IRA are where one makes a money contribution one may be able to deduct on tax returns.

Any earnings potentially grow as tax-deferred.

The tax must be paid at the time of withdrawal in retirement.

This can work to an advantage as some retirees are in an automatic lower tax bracket than that which they were in pre-retirement.

Roth IRA is where the individual makes contributions from money that have already been taxed on (after tax funds).

In this way, the money can grow tax-free which includes tax-free withdrawals in retirement.

Certain provisos are attached to this savings method.

Rollover IRA is a Traditional IRA money fund “rolled over” from another retirement fund.

This can encompass moving eligible assets from a 401(k) plan into a different IRA.

The tax benefits affiliated with the above savings schemes allow the savings to potentially grow and compound far more quickly than say a taxable savings or cash account.

Cash accounts are not a smart way to save for retirement.

It is a valid way to save for short term goals, however.

The temptation to access the funds for a glamorous holiday may prove too tempting.

The physiological drawbacks to the “saving for retirement” mindset that Millennials struggle with is, even though large savings are possible in the long term, the fact that the retirement age is so far off makes it difficult for a young adult to grasp the importance, urgency, and significance of the task.

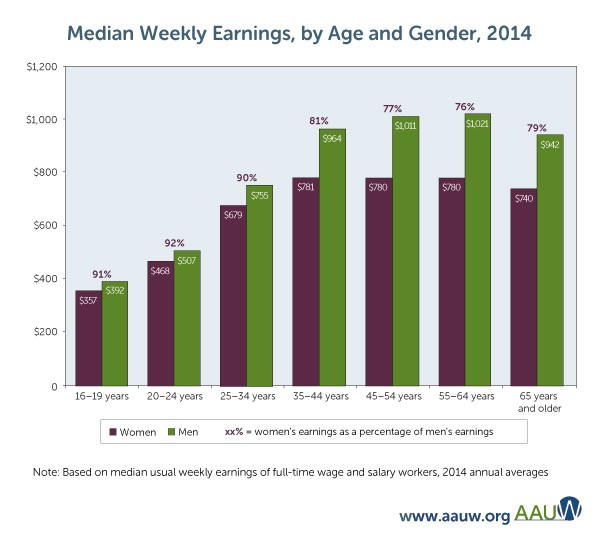

Even though there is a discrepancy between salaries in gender and age – the savings percentages have stayed the same.

This does not necessarily follow that when the wage gap is narrowed, women will save a larger amount.

Please see the chart below for the 2014 discrepancy is salary profile.

All the breakdowns of salaried Millennials savings schemes point to a very realistic scenario of a retirement fund of $1.3 million being entirely attainable.

How it breaks down into easy to follow steps is:

- A 25-year-old Millennial makes $32 000 per annum. Everyone is aware that 15% of the salary must be set aside for a comfortable nest egg. So 7.5% can go into the company’s 401(k) and another 7.5% goes into a money market account.

- After 40 years this uninterrupted savings technique will have risen to an estimated $1.3 million. The taxation on this amount has been addressed in the previous paragraphs above.

This is a very safe way to save and optimize tax breaks.

If the entire 15% had been placed as an investment in mutual funds instead of just 7.5%, the final amount could have risen to $2.3 million.

Many mutual fund management companies offer fixed-income funds designed with long term investment in mind.

So by staying away from undesirable conspicuous consumption and high depreciation expenses, the Millennial is poised to be more than comfortable in retirement.

This has, in itself, become a fluid concept as more people embrace the “You retire – you expire” ethos that has become increasingly popular.

It is very true that the life expectancy has lengthened, and the generation currently forming the workforce may happily continue to work on a full time or part time capacity well into the seventies.

They plan on being able to accomplish this just as they take into consideration an extended savings system.

All that remains for Millennials to do is make sure inflation does not snatch the dream of a comfortable retirement from under them.