Most of us need a car. It allows us to get around quickly without being subject to the awfulness of public transportation. But, cars are expensive. Most people are not going to be able to afford to pay cash for one. Instead, they will need to take out a loan. How much car can you afford? Let’s take a look at how much your car payment should be in relation to your income.

A General Guide

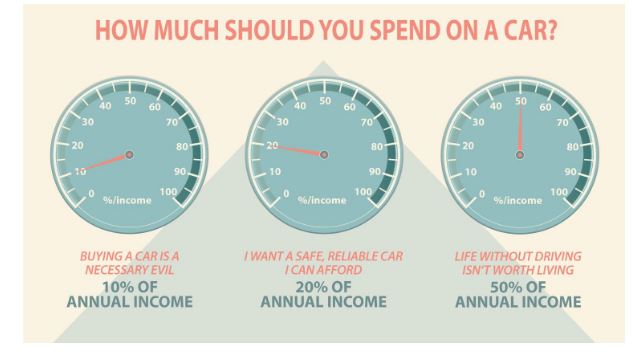

We want to start by pointing you towards the following chart from Money Under 30. It gives you a rough overview of how much you could possibly be spending on a vehicle. However, do not take this as a complete guide. Not everybody is going to be able to afford to part with 20% of their annual income to afford a car. In fact, they may not even be able to part with 10% of their annual income. However, this does give you a rough overview and you should be able to work from these figures.

Source: http://www.moneyunder30.com/how-much-car-can-you-afford

It can be summed up as the following:

- 10% of your income if you need a car to get around but you do not need it to be especially flashy. You just want something that will get you from point A to point B with no hassle.

- 20% if you are going to be using the car frequently and you do not wish for it to break down constantly.

- 50% if the car is your life. Not only are you going to be traveling around constantly, but you also want to use it as a sort-of status symbol.

Breaking it down

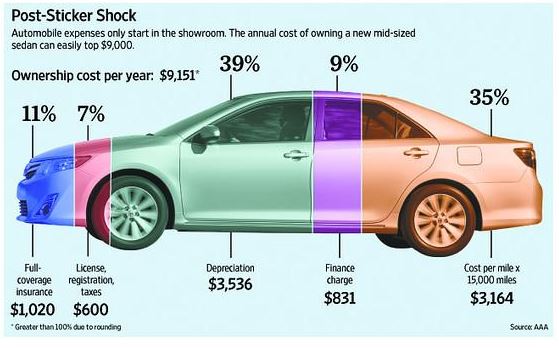

Bank Rate is keen to point out that you should not just think about the actual cost of the loan when you purchase a car. You need to factor in all of the related car expenses, and there will be quite a few of them. This means, say if you dedicate 20% of your annual income to a car, this needs to include the following:

- Cost of the loan

- Insurance costs

- Maintenance costs

- Price of gas

Let’s look at this graph. You can ignore the depreciation. This is the amount of value that your car is going to lose over the course of the first year, on average, if you purchase new. This is not something that you are going to be paying out of your pocket, but you do have to realize that your car will lose value and if you intend to sell the car on at the end of the day, you are never going to get that value back. You can adjust these figures based on your own situation.

Source: http://www.marketwatch.com/story/are-you-spending-9000-a-year-on-your-car-2014-03-19

Working Out How Much You can Afford

This is where you are going to need to be able to work out how much you can afford on your car loan. The Nerd Wallet website breaks it down as the following, which makes things easy to calculate:

- Determine what 20% of your take home pay is (or whatever you are budgeting for your vehicle)

- Estimate how much you will be spending on maintenance of your vehicle, gas costs, insurance costs, etc.

- Subtract the second figure from the first figure. This will be the amount of money you can afford to pay.

- Search for a loan which is in line with your budget.

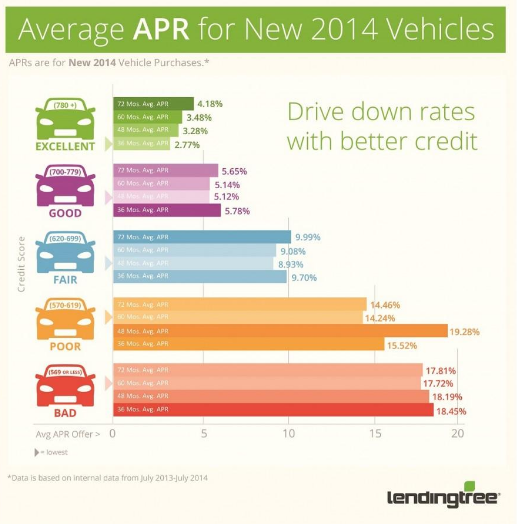

Impact of your credit score on your car loan rate

Finally, you should take a look at this graphic:

This shows you the impact that your credit score will have on your interest rates. You will also be paying back more over the course of the loan.

If you wish to secure the best possible rates on your car loan, and that means you will be able to afford a better car, you may wish to consider whether you can actually wait to buy one. If you can wait a few months, then you may be able to improve your credit score. If it is terrible, then you may wish to purchase a car which may be a bit ‘run down’ and use that for a year or two while you work on improving your credit score too. It is not going to be the most ideal situation in the world, but you will be able to save a substantial amount of cash in the long run, which will be a plus!