Whether we like it or not, credit reports and credit scores are crucial indicators for financial institutions.

When we apply for a mortgage, credit card, student loan, etc. our credit score will dictate our eligibility to most financial institutions.

Anyone currently in college needs to understand the impact that their student loan has on their credit reports or score.

Those who are college-bound might not understand the effects that loan debt may have on their future credit score, and may need some useful advice.

But what exactly are credit reports and credit scores?

It also includes current credit accounts such as bank accounts, car loans, mortgages, etc.

Finally, it takes into consideration any accounts in arrears, e.g. overdue bills.

There are 3 main institutions with whom your credit scores and reports are documented and held:

- Equifax

- Experian

- TransUnion

Each of their respective websites offers you the chance to request your documents for review, should you wish to do so.

The reason these credit reports are so vital, and why you should pay close attention to them, is that they’re calculated using a mathematical formula which lenders heavily rely on.

They believe it gives them a clear view of your credit history.

The mathematical equation may be complex but, simply put, the more debt you have, the lower your score will be.

And the lower your score is, the less chance you’ll have in obtaining a substantial loan from any institution worth their salt.

With the intricate cogs, which make up a credit score out of the way, we swiftly delve into the score itself.

Usually, somewhere between the 300 and 900 range, you would want your credit score to be closer to the latter because anything over 720 will grant you the best interest rates on credit cards, car loans, and such.

Beware, however; your high score can quickly plunge if you find yourself in arrears (late or missed payments especially).

Where do student loans fit into my credit score?

First off – and a few words of caution here – haphazardly searching for comparisons on private student loans may negatively affect your score.

Secondly, don’t be fooled by the notion that if you pay off your debt (student loan, mortgage, car, etc.) in record time, it’ll positively affect your score.

The reason for this is that these financial institutions – the lenders – earn capital from the interest your loan generates.

In a nutshell, if you pay it off too quickly there’s less money on the table, and therefore less incentive, for the lender to consider you for future loans.

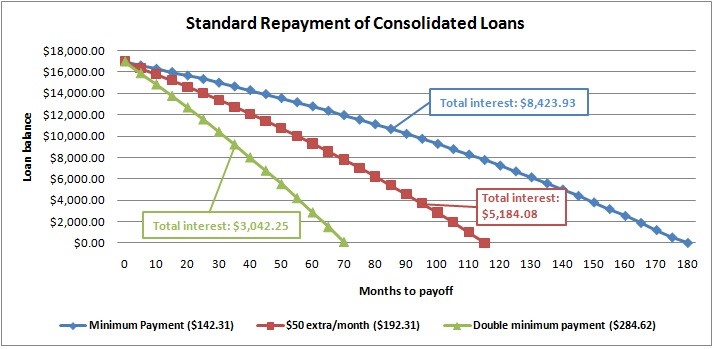

Now, you might be thinking that perhaps it’s just best to stick to the payment plan set out by your lender.

For instance, you take out a student loan for X amount and the repayment period is 15 years.

As long as you pay it off within that timeframe, you’re fine, correct?

Well, not quite.

It suggests that you take too much time to pay off your debt which, of course, negatively affects your score.

This may seem like a lose-lose situation, but don’t worry, there’s a balance that can be found with repaying your student loan that will ensure a happy credit score.

How can I manage my student debt and not hurt my credit score?

A good way to get a head start is by paying off the interest on the loan while you’re still in college.

Of course, this means you may need to find some part-time work.

If you’re already employed part-time, perhaps request a few extra hours’ work each week from your employer.

Another great tip is to work full-time, if possible, during summer break.

After graduation day there are also some helpful tips for protecting your credit score.

More often than not there’s a grace period of anywhere between 6 and 12 months post-graduation which allows the graduate the opportunity to find a full-time job.

Finding a steady job before the grace period ends is ideal.

This is because you get the chance to save every penny possible, guaranteeing you’re prepared for the first few payments when the grace period’s over.

What happens if I miss payments on my loans or default?

Missing payments on your student loan, or any loan, is detrimental to your credit score.

Be sure to set up payment reminders anywhere and everywhere to make sure it never happens.

The consequences – the subsequent heavy drop in your score – will be tough to bounce back from.

The default will also be visible on your score for the next seven years.

But don’t struggle in silence.

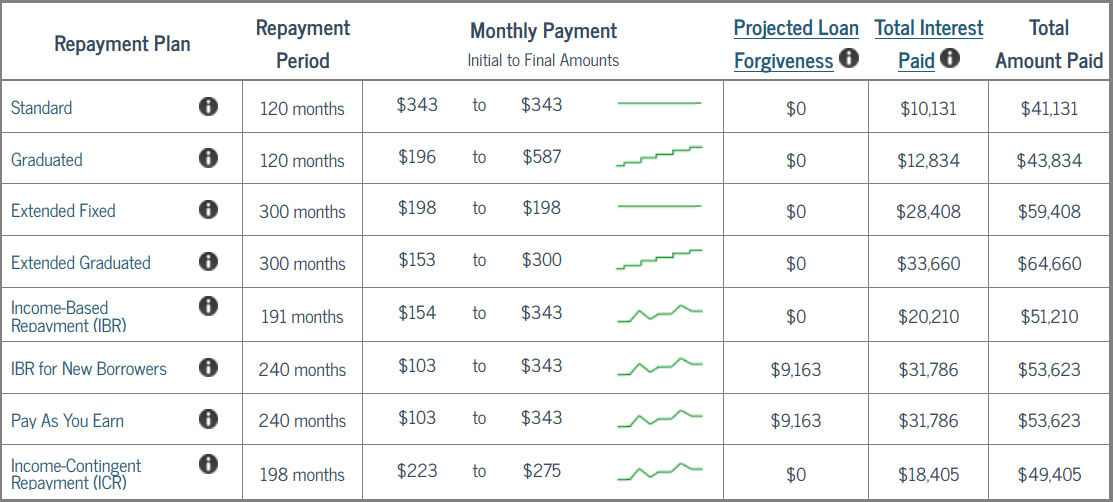

If you’re having difficulties repaying your loan, get in touch with your lender ASAP, because most, if not all, will try to help you in some way, e.g. restructuring your payment plan to suit your situation better.

If all else fails, turn to family or friends, or maybe find some extra work to alleviate the pressure.

The time to be considering your financial future can never be too early.

All it needs is a bit of forethought and strategic planning, and with those two in mind, you can drastically reduce the chance of falling foul to an unfavorable credit score.