In light of the coming election, there has been a great deal of debate as to what impact it will have on the market.

In particular, a great deal of debate as to how the Fed will respond in terms of the interest rates, and how that response might differ depending on the elected candidate.

The Fed lately

Before really getting into looking at how the Fed will respond to the election, it might be better to have a more coherent grasp of what the Fed has been doing recently, and what the Fed does in general.

First, let’s look at what the Fed does in general.

By law, the Fed has two main responsibilities – to promote employment and keep prices stable. This is what is know as its ‘dual mandate,’ and it’s this balancing act that makes interest rates such a delicate question.

To raise the interest rates too high may spell stable prices, but likely also spells unemployment.

On the other hand, to keep the interest rates low may make inflation get out of hand.

This only changed moving into 2016 when in the preceding December, the Fed raised interest rates for the first time in seven years.

This moment marked the end of an era- the zero-interest rate policy.

However, this is not to say that we have wholly departed into another era.

No, just like the interest rate, the economy is on the rise but only incrementally so.

Since the Fed announced the new target interest rates, i.e. the aforementioned higher interest rates, we’ve seen a sharp slowing of the economy.

Counter intuitively, this is actually part of the plan, at least in that it is consistent with the logic of the Fed

To raise interest rates makes for expensive mortgages and makes loans more difficult to obtain, so essentially, people and businesses spend less.

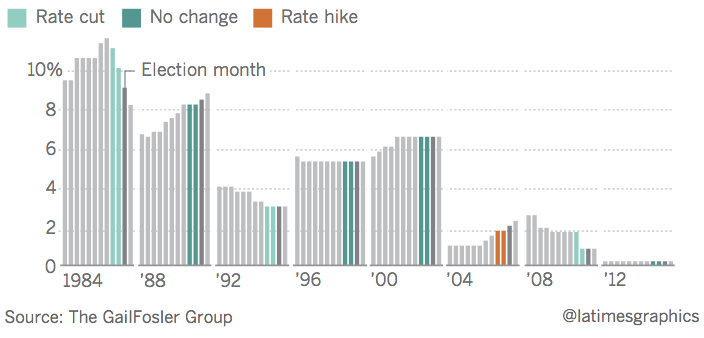

The Fed more historically

In meetings leading up to the election, however, the Fed has moved to punt decisions regarding interest rates.

The theory behind this is predicated on really a reversal of what the title of this article takes for granted– that the election affects interest rates (and by extension, the market).

Rather, it presupposes that it’s the market that affects the election, not the other way around.

And there is maybe something to that questions of biases on the part of the Fed aside.

There have been 22 presidential elections since 1928

Of those, 14 were preceded by gains (in the market) prior to the election, and of those 14, the incumbent won 12 times.

In seven of the eight elections that were preceded by losses, the incumbent lost.

This is to say then that at this point the Fed has not moved to raise interest rates because doing so would further slow the market, which would lead to losses in the market, and a loss for the incumbent.

It is a neat set of correlations, and causation even seems reasonable.

However, there is little in the way of evidence of malpractice on the part of Janet Yellen, chair of the Fed.

Trump or Clinton?

It is common knowledge by now that the election has an effect on the market.

Such has been the case for the past 182 years.

However, there still remains a great deal of confusion as to whether the changes that follow the election are determined by the candidate actually elected, or whether they are changes that happen regardless.

Conventional wisdom would have it that a win for Republicans would spell a boom for the market, as they are ostensibly more business friendly than Democrats.

But in looking at the data, it becomes clear that really it makes no difference in one’s portfolio whether the winner is a Republican or Democrat.

In fact, the data leans more on the side of the Democrats, but not in such a way as to really suggest a difference.

It is Super Tuesday however, and the presidency is not the only office in question.

There is a line of conventional wisdom that would have it that a divided government is a boom for the economy.

It is said that in such instances, i.e. when the government is frozen, then the market will have ‘room to spread its wings,’ so to speak.

The data on the matter is inconclusive, or rather suggests that it ‘might make a difference, but also might not.’

What is the line then?

So, we have rolled through a number of points.

For one thing, there’s the role that the Fed has in general.

It is body meant to support the economy by determining (among other things) interest rates.

The rate of interest is to be predicated upon the two pillars of the Fed– to see to wider employment and to see to maintenance on inflation.

To raise the interest rates keeps inflation in check, but does perhaps shrink the economy in that business might be less likely to expand.

On the other hand, to keep the interest rates low makes for growth, but with the caveat that this growth is undercut by inflation.

What we have seen since 2008 are near zero interest rates, but as of December 2015, interest rates are on the rise, or at least target interest rates are on the rise.

The move to raise interest rates has slowed the economy to a certain extent, but again this back and forth is the nature of the beast.

In recent months the Fed has held off from making any decisions with regards to interest rates.

There has been speculation as to why that might be, or rather many have implied corruption or even explicitly stated it. However, the evidence suggests that the conduct of the Fed has been par for the course.

What does the ‘course’ dictate further down the road?

The consensus for now is that there will be no hikes in the interest rate until at least after the election.

Not only that, it is unlikely that a rise in the interest rate would even be seen months down the line, much less immediately thereafter.

In the past, the years following a presidential election or the first two years of a president’s term see relatively small gains in the economy, whereas the last two years see relatively large gains.

Lately, this typology has seen some hiccups, e.g. in 2008 rather than seeing the average small gain of 2.5%, the Dow fell 34%, but again the data points to interest rates staying around where they are.