Learning how to invest your money can help you build wealth over time.

It takes years to grow your investments to the level you want them to be at…

But it only takes hours to learn how to invest your money.

And that’s the first step many people need to take.

You might want to start investing now…

But you don’t know where to start.

So we want to help you figure out where you want to start!

Below are some tips on how to invest your money.

So don’t keep waiting…

And start watching your money grow TODAY!

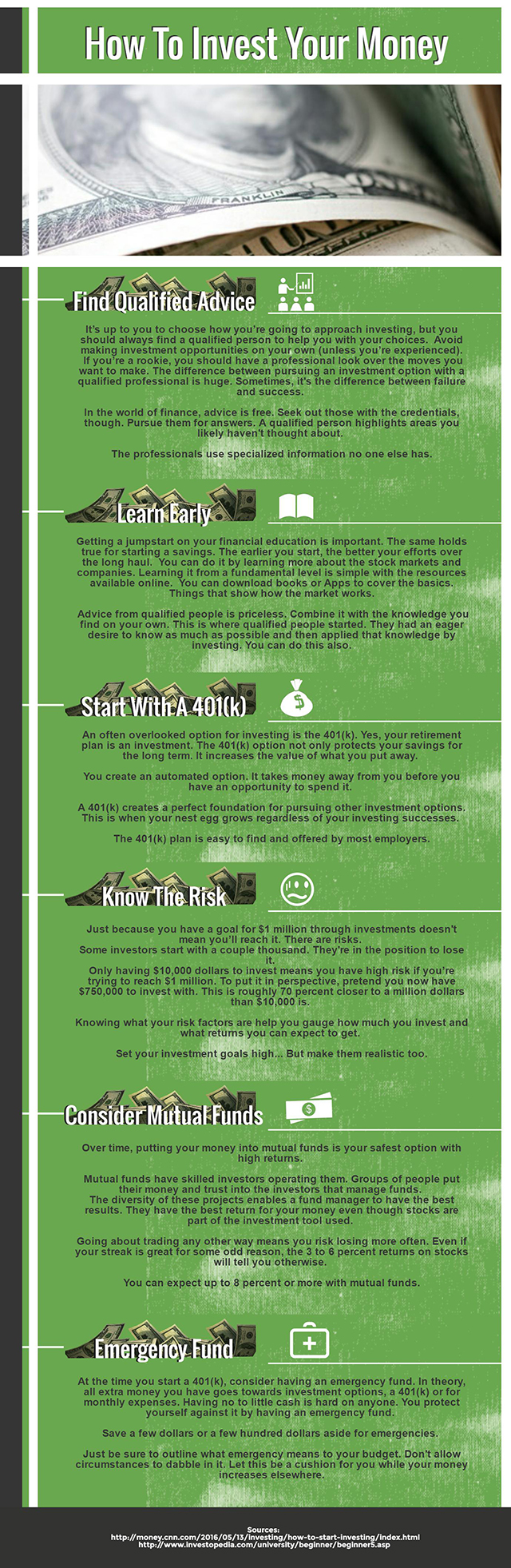

Find Qualified Advice

It’s up to you to choose how you’re going to approach investing…

But always find a qualified person to help you with your choices.

Avoid making investment opportunities on your own (unless you’re experienced).

If you’re a rookie, you should have a professional look over the moves you want to make.

The difference between pursuing an investment option with a qualified professional is huge. Sometimes, it’s the difference between failure and success.

In the world of finance, advice is free. Seek out those with the credentials though. Pursue them for answers. A qualified person highlights areas you likely haven’t thought about.

You won’t even know some of the options. The professionals use specialized information no one else has.

Learn Early

Getting a jumpstart on your financial education is important.

The same holds true for starting a savings. The earlier you start, the better your efforts over the long haul.

An early start is what we want. That’s a great advantage.

You can do it by learning more about the stock markets and companies. Learning it from a fundamental level is simple with the resources available online.

You can download books or Apps to cover the basics. Things that show how the market works.

Advice from qualified people is priceless. Combine it with the knowledge you find on your own. This is where qualified people started. They had an eager desire to know as much as possible and then applied that knowledge by investing. You can do this also.

Start With A 401(k)

An often overlooked option for investing is the 401(k). Yes, your retirement plan is an investment. Let’s cover a few reasons why.

First, the foundation of any investment is preparing for the future. The 401(k) option not only protects your savings for the long term. It increases the value of what you put away.

You create an automated option. It takes money away from you before you have an opportunity to spend it.

A 401(k) creates a perfect foundation for pursuing other investment options. This is when your nest egg grows regardless of your investing successes.

The 401(k) plan is easy to find and offered by most employers. So see what you can do to get it started today!

Know the Risk And What Your Tolerance Is

Just because you have a goal for $1 million through investments doesn’t mean you’ll reach it. Maybe you can’t because of the risk involved.

Some investors start with a couple thousand. They’re in the position to lose it.

Others do it with a few hundred thousand.

Only having $10,000 dollars to invest means you have high risk if you’re trying to reach $1 million.

This doesn’t mean you can’t invest or reach a million dollars. But turning $10,000 into $1 million is pretty darn hard.

To put it in perspective, pretend you now have $750,000 to invest with. This is roughly 70 percent closer to a million dollars than $10,000 is.

Knowing what your risk factors are help you gauge how much you invest and what returns you can expect to get.

Set your investment goals high…

But make them realistic too.

Consider Mutual Funds

Over time, putting your money into mutual funds is your safest option with high returns.

Mutual funds have skilled investors operating them. Groups of people put their money and trust into the investors that manage funds.

The diversity of these projects enables a fund manager to have the best results. They have the best return for your money even though stocks are part of the investment tool used.

Going about trading any other way means you risk losing more often. Even if your streak is great for some odd reason, the 3 to 6 percent returns on stocks will tell you otherwise.

You can expect up to 8 percent or more with mutual funds.

Now Look At An Emergency Fund

At the time you start a 401(k), consider having an emergency fund. In theory, all extra money you have goes towards investment options, a 401(k) or for monthly expenses. Having no to little cash is hard on anyone. You protect yourself against it by having an emergency fund.

Save a few dollars or a few hundred dollars aside for emergencies.

Just be sure to outline what emergency means to your budget. Don’t allow circumstances to dabble in it. Let this be a cushion for you while your money increases elsewhere.

Would you be so kind to share you secrets to the rest of us?

Tell us how you invested your money and what worked out for YOU!

Or just stop by and say hi…

Either way…

We just want to talk to YOU!