As evidenced by the chart below, average family income goes through natural fluctuations.

However, current economic circumstances have made the average family income less reliable over time.

Whether you have a low, medium, or high income, managing your budget wisely can make or break your economic health.

There are no simple rules for managing money that will always apply.

However, there are some overarching common goals of budgeting:

- Have enough money saved up for an emergency or other unexpected costs

- Save up money for spending on leisure activities

- Have adequate funds for paying current expenses

- Not spending more money on typical expenses than is necessary, to facilitate meeting the other goals

With these goals in mind, take a look at the following couple of tips for optimizing your budget to make your dollars stretch as far as possible.

Choose which ones will work best for your family, and try to implement them in your day to day life.

Keeping track of your spending is the easiest way to make sure you are getting the most bang for your buck.

Keeping a cash notebook or an Excel sheet to track your spending can be really helpful.

Enter all of your expenses at the end of the day.

Then, at the end of the week or month, see how much you have spent on various items.

This way, you can clearly see where unnecessary spending on random things occurred, and remember not to do it so much in the future.

However, don’t judge yourself by your cash book.

Simply use it as a piece of data to help you adjust your spending in the future.

Without clearly laid out priorities and goals, it is easy to allow yourself to spend on unnecessary things.

Write down your goals, which things are most important to spend on, and the things you spend money on but aren’t that important.

Then try to minimize spending on the last category.

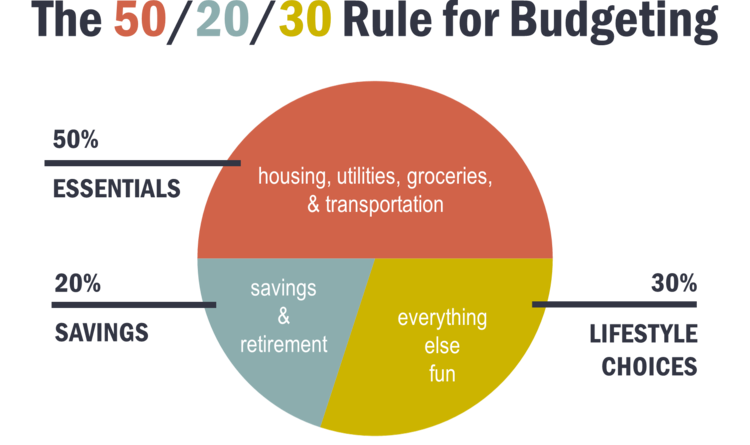

The 50/20/30 budgeting rule is a great way to prioritize your spending habits.

Here’s a glimpse of what it entails:

After all, you are the one who wrote down that those things weren’t important, so it’s easier to stick with it than arbitrary priorities set by someone else.

It can also help to divide up how you want to spend your income before you get your paycheck.

Having a little extra in your wallet can sometimes skew your priorities because you forget how you were feeling when you were more strapped for cash.

Plan out exactly how you will spend your money, and capture it down in writing so you have to stick with it.

It seems straightforward, but it’s easier said than done.

This is why you need to set your budget out in detail in advance.

Many of us don’t write out our budget because we don’t think we need it, or because it is truly boring.

However, it is a small time investment with massive rewards down the line- most millionaires keep a written budget!

You can often purchase gift cards (from sites like Zeek) for less than they are actually worth.

Instead of giving them away as gifts, buy these and then use them like cash.

You will save a small amount on purchases that you were going to make anyway, and those small amount eventually add up.

This is perhaps the most important money tip.

Most of us eat three or more times a day.

It is tempting (and tasty) to buy something at a restaurant instead of cooking, especially if you are busy and out all day.

However, cooking delicious meals at home and then bringing them to work saves an incredible amount of money, and is usually healthier.

Many people believe they don’t have time to cook.

But, if you take two or three hours a week to prepare meals, you can eat for days, and you save a lot of money.

Think of it as if each hour you spend cooking, you are working for an hourly wage.

If you “pay yourself” for cooking with the money you save from eating meals out seven times a week, you could be “making” almost a hundred dollars an hour!

Here is a good site with delicious, easy-to-cook recipes.

Not only are bikes the most fun method of transportation, but the cheapest (besides walking).

If you spend $100 on a nice used bike and helmet, and bike a few miles to work every day, you will save a ton of money on gas, plus get yourself in nice muscular shape.

Even if you choose to bike on sunny, warm days, and drive when it rains and in the winter, you still save at least half of the money you would on gas.

Plus, you are doing your part to help reduce global warming and your own personal carbon footprint.

One more thing you can use to feel good about yourself at the beginning and end of every workday.

Everyone loves giving and receiving gifts.

However, if you are breaking the bank by giving someone a gift, the benefit they will receive from it will usually not outweigh the financial stress it causes you.

Plan your gifts carefully, and try to incorporate more experiences and time together into your gifts, and less material objects.

There are some handy sites to help you save money on great gifts.

In emergencies, we often spend beyond our means and not in the most responsible manner.

This makes sense, because usually money is the last thing on our mind during an emergency.

If you have an emergency fund set up for times like this, you can avoid putting thousands of dollars in medical bills or other expenses on your credit cards.

Putting these charges on a credit card will rack up high-interest debt and cause even more stress in the situation.

There are many high yield online saving accounts you can use to build up this emergency fund.

It can’t be helped that sometimes your washing machine breaks, or you simply have to get a new mattress because your back is killing you.

However, don’t just treat these big purchases like losses immediately.

You can avoid spending more than you have to by getting most things “gently used” rather than brand new for a fraction of the cost.

If you automate some basic routine transactions, you have no choice but not to mess it up, because now you don’t have the option to!

As much as possible, try to set up automated payments for things like cars, rent, utilities, and other expenses.

Set up automatic deposits into your savings account from your paycheck.

There are many different paths for doing this.

Check your bank’s overdraft fees, and if they are not severe, use overdraft protection to avoid withdrawing too much from your accounts.

There are plenty of ways to earn extra money to add to your pocket spending or savings that don’t require much extra time.

Some examples include:

- Volunteering to be part of medical research studies (many pay up to $2000!)

- Sell products on Etsy

- Sell random things you never use on craigslist or at a garage sale

- Switch employers. This is more difficult, but the payoff can be very rewarding

- Ask for a raise. You would be amazed how many bosses would give a small raise or bonus if simply asked. Most of us are just too afraid.

- If you have time, get a second job.

Money management is not always easy, but if you follow common sense rules, and stick to your budget rather than your instincts, optimizing your budget can be pretty straightforward.

Simply save more than you spend, get your budget in writing, and get an emergency fund started, and you are already on your way to better financial health now and far into the future.