It has become increasingly evident in the last decade that saving for the future has never been more important.

It is essential to embrace the saving mindset as early in life as possible.

Humans are living longer and expecting a commensurable comfortable lifestyle – this has to be planned for while residing in a country that expects its population to fend for itself.

The truth is that saving money is not a practical option if there are any outstanding debts.

Simply put: The interest on savings is less than the interest accumulating on debt.

So true savings are not possible until all debt is eliminated.

Never factor in the spending limit of a credit card into the scheme.

This plan should rely solely on what one earns and what one spends.

It is easier to form this by looking at a monthly projection.

Breaking these categories down will further the steps required to tackle the expenditure.

Income

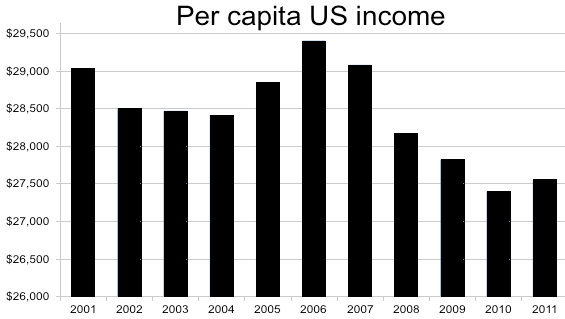

Below is a chart that displays the average single person’s salary/personal income in America for the last decade.

To explain the term “per capita” is to say “by the head count.”

When formulating what one’s personal income is per month, one must total up the last six month’s salary slips and divide by 26 weeks.

That will give an accurate figure of the cash in-flow of standard remuneration.

If one is paid hourly, tally up the last six paychecks and divide by six.

This will give an average total amount.

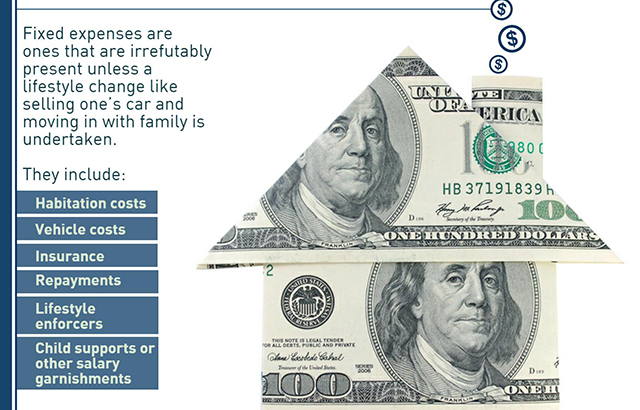

Fixed expenses

Habitation costs : Addressing the occupancy obligations which include rent or mortgage is never the monolithic drain on the salary that it may first seem.

If it is evident when budget mapping that it would be financially responsible for selling one’s house, or changing down to a more affordable rent;, these are entirely possible scenarios if debt elimination is of paramount concern.

Vehicle costs: The same can be reasonably said for vehicular expenses.

It is vital to stringently work out the costs of running and maintaining personal transport and then question the validity of the possession of a vehicle.

The maintenance must factor in gas consumption, insurance, garage costs, cleaning, parts, and repayments.

Price this against the cost of public transportation and the health benefits of maybe ridding oneself of monthly gym fees as walking is part of the public transport solution – and it may become clearer.

Below is a chart that shows U.S. lowest vehicle loan rates for the year 2012.

Please note that public transport is a tax deductible expense.

Insurance: Moving from car insurance to insurance in general, which includes life, health and rental monthly debits.

All forms of this kind of insurance are a lifestyle enforcer.

One sleeps better at night knowing that it is there.

This enables one to keep a positive outlook and should be nurtured and prioritized when calculating the necessary budget.

Life insurance usually has a payout at retirement and should be considered a form of savings.

Repayments: Debt repayments are an essential and integral financial commitment once they have been signed up for.

It is superfluous to add that they should be avoided in the first place.

Insisting upon one’s bank issuing a debit card as opposed to a credit card is a positive step.

Cutting up all store cards and refusing further solicitations from other companies is a good move too.

Periodic expenses

A new trend that can be freely optimized here is that re-gifting is becoming increasingly popular.

If the clause in one’s rental agreement is more beneficial for the landlord than for the renter, this can be open for renegotiation at the renewal of the lease time.

Landlords would rather be open to a suggestion of being responsible for blocked drains then to go through the trouble of re-advertising for a new tenant.

Extended warranties are not worth the paper they are printed on as appliances are usually replaced instead of repaired.

It is recommended that solutions and costings are researched for online.

Many local repair people who can source inexpensive replacement parts.

Variable expenses

The list below will quantify the essential commodities and services and address their cost.

This is the easiest facet of the budget that can be shrunk.

Swapping out imports and luxuries for local and seasonal is immediately beneficial to the budget.

Water bills can be reduced by showering instead of bathing and putting a brick in the toilet cistern to reduce refill capacity.

Turn down the geyser setting and insulate.

Shop around for a less data heavy cellphone deal.

Compare prices online and use your current plan as leverage to strike a deal.

New companies are launching live stream and package deals every month.

Compare all the deals and choose the cheapest with the most user-friendly content.

Remember that the more entertainment one makes available for oneself at home, the less one is likely to go out and pay for other activities.

Apparel is considered one of the undeniable essentials needed for a functioning lifestyle.

A fashion writer recently wrote about taking stock of their closet contents and deciding not to purchase any more clothing for two years.

This did not affect their lifestyle in any way.

The savings from doing this are almost incalculable.

Online sites are dedicated to passing along information on how to concoct window cleaner from vinegar and toothpaste from baking soda.

Search around and you’ll be able to find a lot of DIY tricks that will save you lots of cash.

Tuition is the ultimate form of planning for the future.

There are a surprising number of tutors who are prepared to offer professional tutorials on a quid pro quo basis.

Place a notice online or on one’s local news posting to make inquiries.

The same can be said for paying doctor and dentist appointments.

This is when the lifestyle enforcer insurance payments begin paying for itself.

Flu shots before winter flu season onslaught commences is a proactive precaution with the cost of the shot outweighing the loss of income from illness.

Simply by informing everyone that you are in strict saving mode can assist one in avoiding unnecessary entertainment expenses.

By going straight home to a free live stream TV show instead of drinks and movies, is sending a message to those close to you that settling debts has been duly prioritized.

It is easy to buy a bottle of wine and calculate the markup incurred by purchasing it in a restaurant.

Other ways to tighten one’s hold on finances is to get a second job or cancel that upcoming vacation.

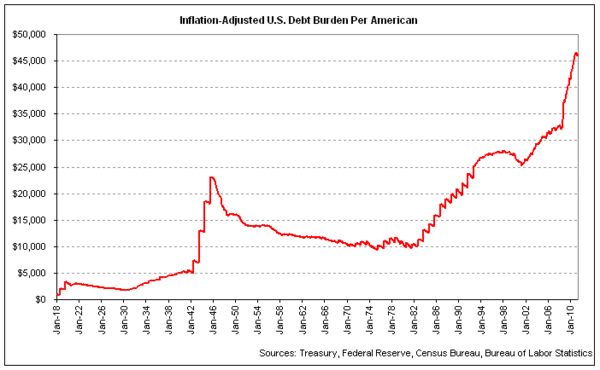

As can be seen from the chart printed below, debt is on the rise, and it is incumbent upon each to face this in any way possible so as not to jeopardize one’s future.

Some of the debt repayment options that one can consider at this juncture is:

- Either to pay off the accessible and smaller debts first, thus eliminating the gradual erosion from one’s salary in that way

- Pay debts with the highest interest rates first as these drain monthly earnings the fastest.

Both options have positive benefits in a mental and financial capacity.

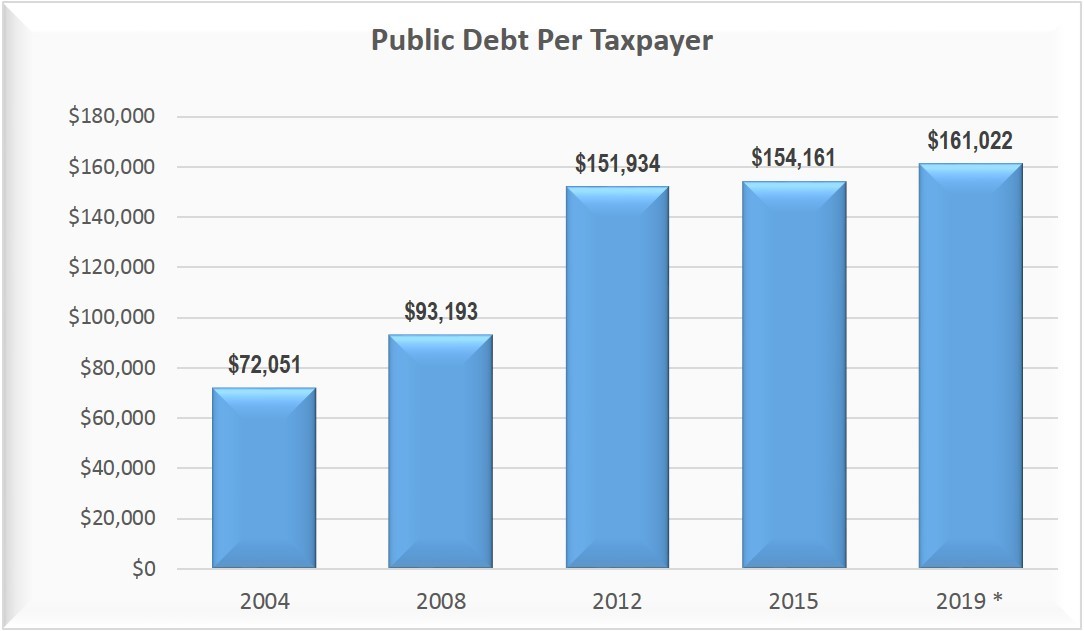

A final graph of the average per capita national debt is posted below.

This is factual evidence that, instead of saving for the future, the American public is, in fact, paying off huge interest rates to loan companies.