Learning how to make the right investment moves can help you build wealth over time.

But making the wrong investment moves can force you to work for the rest of your life.

Are you an investing newbie?

Or have you already made some bad investment moves?

Well, we try to steer people in the right direction when it comes to finances.

And we’ve heard plenty of stories from people that made costly mistakes with their investments.

Don’t be those people.

Learn from their mistakes and start building wealth off of your investments.

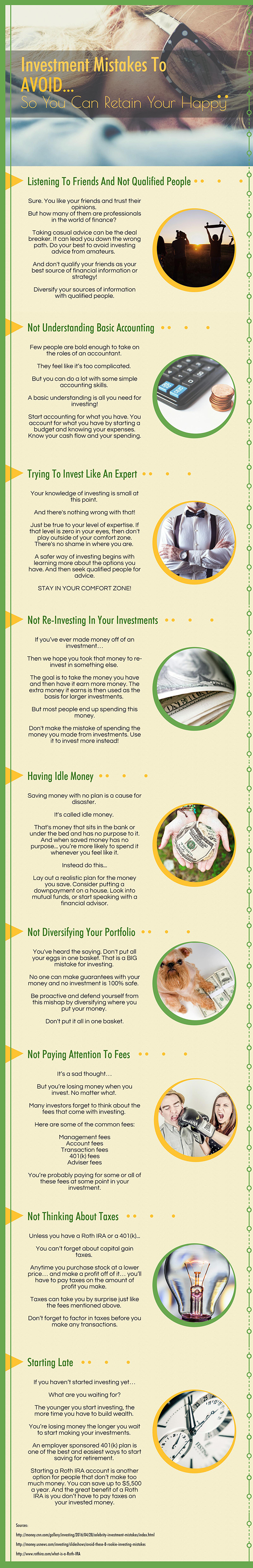

Listening To Friends And Not Qualified People

Sure. You like your friends and trust their opinions.

But how many of them are professionals in the world of finance?

Even an entry level financial expert isn’t worth the time.

Taking casual advice can be the deal breaker. It can lead you down the wrong path. Do your best to avoid investing advice from amateurs.

And don’t qualify your friends as your best source of financial information or strategy!

Diversify your sources of information with qualified people.

Not Understanding Basic Accounting

Few people are bold enough to take on the roles of an accountant.

They feel like it’s too complicated.

But you can do a lot with some simple accounting skills.

A basic understanding is all you need for investing!

Start accounting for what you have. You account for what you have by starting a budget and knowing your expenses. Know your cash flow and your spending.

Compare your daily, monthly and weekly progress with your financial goals. Then make changes as is necessary.

Trying To Invest Like An Expert

Your knowledge of investing is small at this point.

And there’s nothing wrong with that!

Just be true to your level of expertise. If that level is zero in your eyes, then don’t play outside of your comfort zone. There’s no shame in where you are.

Wealth builds from a tiny seed. It takes many years. No matter what level of knowledge you have.

A safer way of investing begins with learning more about the options you have. And then seek qualified people for advice.

The excitement of new opportunities can take us off track.

But stay in your comfort zone instead!

Not Re-Investing In Your Investments

If you’ve ever made money off of an investment…

Then we hope you took that money to re-invest in something else.

The goal is to take the money you have and then have it earn more money. The extra money it earns is then used as the basis for larger investments.

But most people end up spending this money.

It gets spent for various reasons.But one prominent cause is the delusion of more money. Making more money makes everyone ecstatic. And it leads us to feel more secure than we actually are.

If that sense of security influences us, then we lose what we earned from investing.

Don’t make the mistake of spending the money you made from investments. Use it to invest more instead!

Having Idle Money

Saving money with no plan is a cause for disaster.

It’s called idle money.

That’s money that sits in the bank or under the bed and has no purpose to it. And when saved money has no purpose… you’re more likely to spend it whenever you feel like it.

Instead do this…

Lay out a realistic plan for the money you save. Consider putting a downpayment on a house. Look into mutual funds, or start speaking with a financial advisor.

Just don’t let your money sit there with no purpose or reason. You’ll end up spending it on the wrong reason if you do.

Not Diversifying Your Portfolio

You’ve heard the saying. Don’t put all your eggs in one basket. That is a BIG mistake for investing.

No one can make guarantees with your money and no investment is 100% safe.

Be proactive and defend yourself from this mishap by diversifying where you put your money.

Don’t put it all in one basket.

Not Paying Attention To Fees

It’s a sad thought…

But you’re losing money when you invest. No matter what.

Many investors forget to think about the fees that come with investing.

Here are some of the common fees:

- Management fees

- Account fees

- Transaction fees

- 401(k) fees

- Adviser fees

You’re probably paying for some or all of these fees at some point in your investment.

All of these fees add up and eat into some of your return.

So you might not have as much money as you think you have. And you need to plan your investment goals around these fees.

Not Thinking About Taxes

Unless you have a Roth IRA or a 401(k)…

You can’t forget about capital gain taxes.

Anytime you purchase stock at a lower price… and make a profit off of it… you’ll have to pay taxes on the amount of profit you make.

Taxes can take you by surprise just like the fees mentioned above.

Don’t forget to factor in taxes before you make any transactions.

Starting Late

If you haven’t started investing yet…

What are you waiting for?

The younger you start investing, the more time you have to build wealth. Starting investments at age 25 will allow your investments to grow off of compound interest for decades.

You’re losing money the longer you wait to start making your investments.

If you think you don’t have enough money to invest…

There are still options for you to get started!

An employer sponsored 401(k) plan is one of the best and easiest ways to start saving for retirement. Get yours started today and try to have at least 15% of your paycheck go into your 401(k).

Starting a Roth IRA account is another option for people that don’t make too much money. You can save up to $5,500 a year. And the great benefit of a Roth IRA is you don’t have to pay taxes on your invested money.

Are YOU willing to share your secrets?

Tell us about the investments that worked for you.

Or tell us about a mistake if you’re brave enough!

We’ll be waiting in the comment section. See you there!