You can monitor just about everything with a mobile app these days, and your finances are no different.

From apps designed to keep track of the status of your bank balance, credit card debt and student loans, to planning and monitoring your personal budget, staying on top of your financial situation using your mobile phone is easy.

Here are some things to consider when you’re searching for the right mobile application to keep track of your money.

Suitability and Synchronization to your needs

With such a large variety of budgeting and finance apps available, deciding the best one for you depends on what you want.

Some budgeting apps are designed to do one thing and do it well, while others amalgamate some or all of these features.

If you want all of your financial information in one place, an app like Mint or PocketGuard that synchronizes your bank balance, credit card debts and loans along with your daily spending would be the most suitable.

If you want to track spending within a family or household, an app allowing you to synchronize your collective budget and track household spendings, such as HomeBudget or GoodBudget may be the most useful.

You don’t want the security of your data to be jeopardized!

Putting all of your financial information in one place can be worrying, so it’s important to be sure that your choice of mobile app keeps your details secure.

Popular apps such as PocketGuard and Mint keep data in a read-only format, meaning that the app cannot transfer money or make purchases.

In addition to this, existing credit card or bank protection – such as that offered by MasterCard or Wells Fargo – should extend to the use of financial apps.

Tracking Spending Patterns

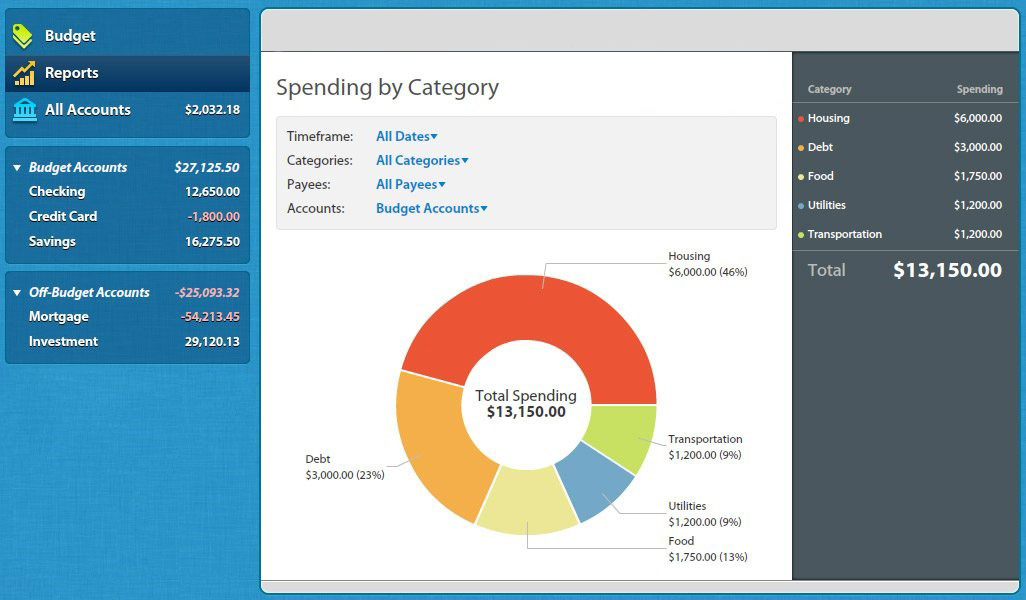

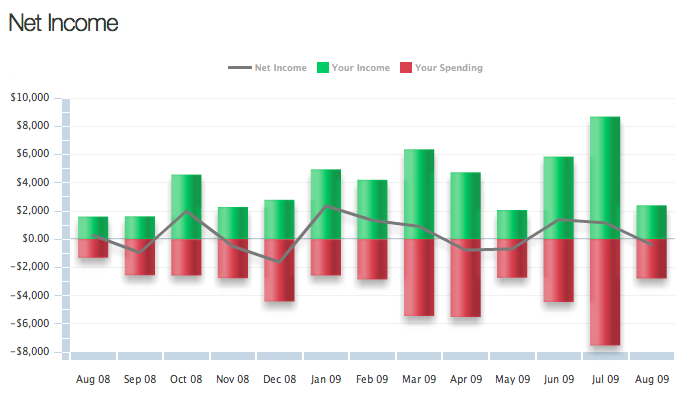

Almost all budgeting apps will allow you to compare income against spending, while some such as You Need A Budget (YNAB) allow you to categorize purchases separately.

Many apps also provide a thorough analysis of the expenses with the use of charts and infographics.

This makes it easier to see where your money is going.

Here’s a chart showing the spending percentage in different categories:

The chart above shows the spending pattern month-wise across a year

Uploading and Managing Receipts

It may seem like a simple thing, but the management of receipts can be a significant draw for one budgeting application over another.

While some apps require purchases to be entered manually, some such as Spendee and Expensify can link to the camera on your phone, allowing you to photograph receipts or bills.

If your choice of app does not have this function, it may be useful to use a mobile scanning app such as CamScanner or Genius Scan.

While you may still be required to enter data from bills and receipts manually, being able to save them quickly as a PDF file on your phone should make the process much easier, and save you the stress and annoyance of hauling receipts around.

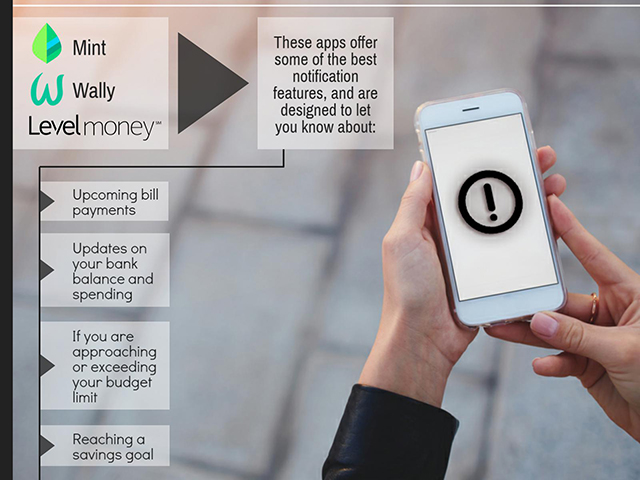

Notifications – Help to keep a check on your spending habits

Notifications are another seemingly minor aspect of financial apps that can make a big difference.

While you might have the best of intentions by tracking your finances through an app, timely and appropriate reminders are vital to keeping on top of your spending and bills.

Some budget apps even allow you to customize your notifications, making it possible to select the reminders that are most useful to your financial situation and goals.

With such a variety of options to offer, choosing the right mobile app for your financial situation can be tricky.

Keeping in mind the features discussed above and considering your own personal and financial needs should allow you to select the app that’s right for you, and make managing your finances much easier.