Millennials make up the largest population of any U.S. generation in history. They account for roughly 90 plus million people.

But the number of millennials certainly aren’t helping.

They need jobs. They need to get paid more. They need to buy houses. They need to prepare for retirement. And Social Security is up in the air.

Their habits are different from their parents. “Keeping up with the Joneses” holds no more weight. White picket fences are not selling. A college degree does not mean an automatic job anymore.

The United States needs new ways to accommodate this generation.

So how do you reach Millennials today?

Transforming Millennial Habits

The key to stimulate the prosperity of Millennials is with understanding.

Who are they?

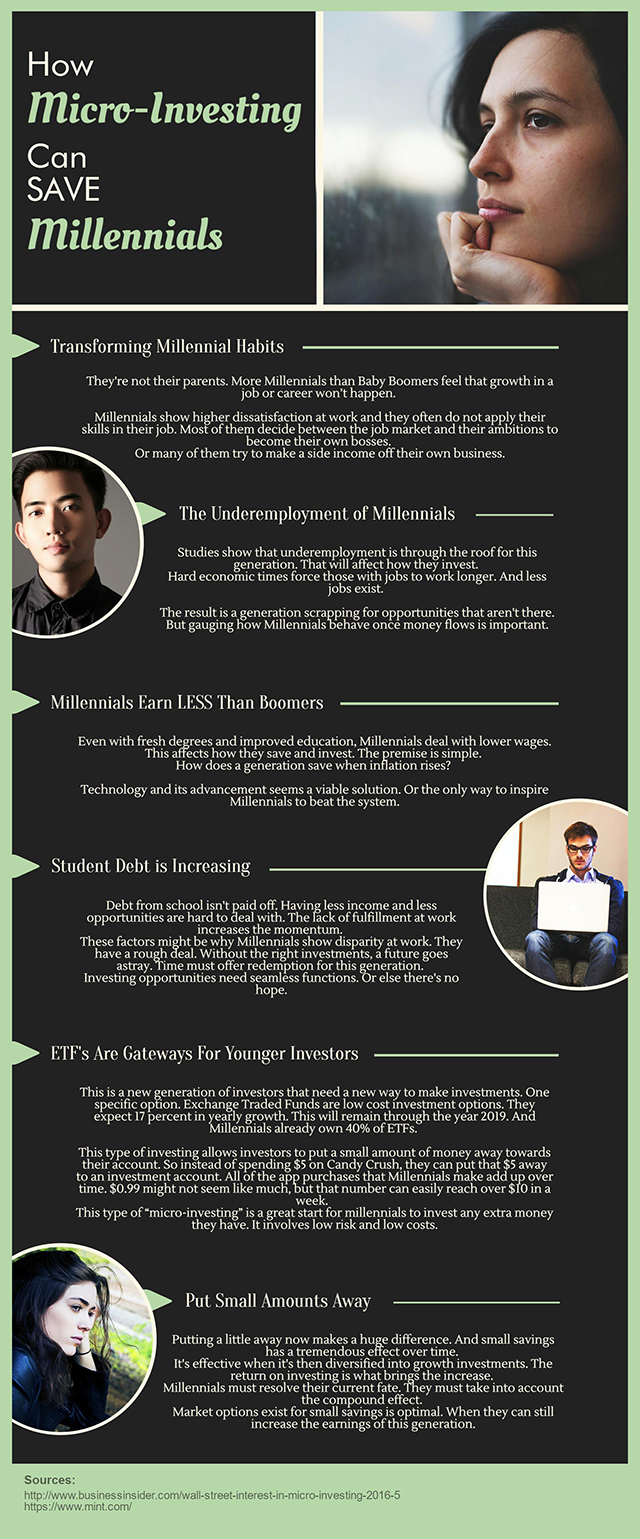

They’re not their parents. More Millennials than Baby Boomers feel that growth in a job or career won’t happen.

Millennials show higher dissatisfaction at work and they often do not apply their skills in their job. Most of them decide between the job market and their ambitions to become their own bosses.

Or many of them try to make a side income off their own business.

The Underemployment Of Millennials

Studies show that underemployment is through the roof for this generation. That will affect how they invest. The condition comes from the economy and its recent Great Recession. You can call it basic math.

Hard economic times force those with jobs to work longer. And less jobs exist.

The result is a generation scrapping for opportunities that aren’t there. But gauging how Millennials behave once money flows is important.

Millennials Earn Less Than Boomers

Even with fresh degrees and improved education, Millennials deal with lower wages. This affects how they save and invest. The premise is simple.

How does a generation save when inflation rises?

The cost of living does too. All while Millennials earn less than the generation preceding them.

Technology and its advancement seems a viable solution. Or the only way to inspire Millennials to beat the system.

Student Debt is Increasing

Another factor creating this gloomy outcome for Millennials is student loan debt.

Debt from school isn’t paid off. Having less income and less opportunities are hard to deal with. The lack of fulfillment at work increases the momentum.

These factors might be why Millennials show disparity at work. They have a rough deal. Without the right investments, a future goes astray. Time must offer redemption for this generation.

Investing opportunities need seamless functions. Or else there’s no hope.

ETFs Are Gateways For Younger Investors

Financial specialists suggest savings as everything for Millennial investing. Wall Street is starting to notice that millennials won’t be able to invest like the generations before them. They don’t have the funds to invest that way.

This is a new generation of investors that need a new way to make investments. One specific option. Exchange Traded Funds are low cost investment options. They expect 17 percent in yearly growth. This will remain through the year 2019. And Millennials already own 40% of ETFs.

This type of investing allows investors to put a small amount of money away towards their account. So instead of spending $5 on Candy Crush, they can put that $5 away to an investment account. All of the app purchases that Millennials make add up over time. $0.99 might not seem like much, but that number can easily reach over $10 in a week.

This type of micro investing is a great start for millennials to invest any extra money they have. It involves low risk and low costs.

It might be an easier option for Millennials to invest. As they say, “Out of sight out of mind.” This is an important strategy to increase savings.

Put Small Amounts Away

The most important step is starting.

Whether it’s micro investing or regular savings.

No matter where they are.

Modern budgeting and investment tools are one way to track spending and saving. Budgetings apps like Mint can help anyone learn how to budget any type of income.

Putting a little away now makes a huge difference. And small savings has a tremendous effect over time.

It’s effective when it’s then diversified into growth investments. The return on investing is what brings the increase.

Millennials must resolve their current fate. They must take into account the compound effect.

Market options exist for small savings is optimal. When they can still increase the earnings of this generation.

And technology is standing up to do so.