There are a wide variety of IRAs available, here’s how to pick the one that’s most suited to you.

What’s an IRA?

If your employer doesn’t offer a tax-efficient 401 (k) savings plan, or even if they do and you wish to save more for your retirement on top, an Individual Retirement Account (IRA) could well be the most sensible form of investment you could make.

But with such a varied range of these products on the market, picking the one that’s most suited to you can be tricky.

Why an IRA?

Up to $5000 per annum can be taken from your wage and salted away for your retirement, and you won’t pay a cent in tax.

But the tax benefits vary widely, so picking the one that’s right for you is important.

Standard IRAs vs. Roth IRAs

With a standard IRA, you pay no tax on your contributions, but, when you come to draw down that income in your retirement, it does become taxable.

You may wish instead to consider a Roth IRA.

With these saving plans, a tax is payable on the contributions but the withdrawals and any money earned on the investment are tax-free.

Planning for the future

Essentially, deciding whether to invest in a Roth IRA or a standard one should be based on minimizing the tax risk.

If you think you’ll pay higher tax now, then a standard IRA is the way to go.

But if you think your income tax rate will be higher when you retire, then give a Roth IRA some serious thought.

The money coming in

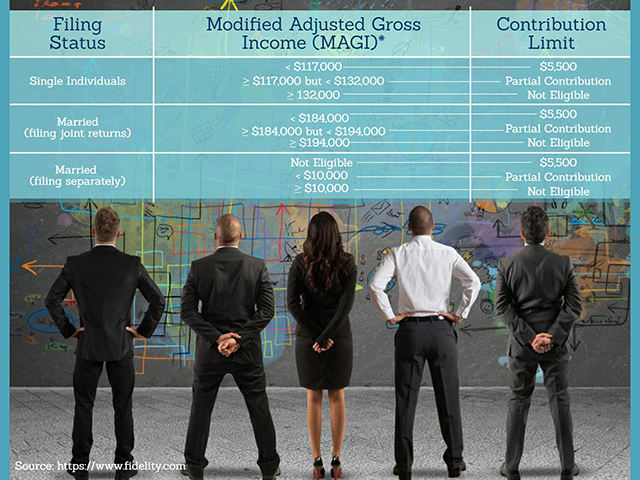

Roth IRAs are also restricted in terms of who can pay in.

Whilst a standard IRA is an option for anyone under 70.5 years old, Roth IRAs have upper limits on the income of those eligible.

2016 Roth IRA income requirements

As this chart shows, how much you earn is another factor in deciding which IRA’s best for you.

A world of choice

Whilst Traditional and Roth IRAs are the two most well-known types, there are a variety of other tax efficient IRA plans out there.

SEP IRAs are set up by employers and have the advantage of being open to businesses of any size, even the self-employed.

myRA is a simplified version, which has the advantage of being US Treasury backed.

As this chart shows, there are many factors to consider when deciding which IRA to invest in.

Do your research

With so many products available, choosing wisely can make a vast difference in terms of managing your money effectively.

It pays long-term to really understand which IRA is best for you.

To this end, it’s worth considering professional advice.

Whilst a Financial adviser may be a short-term expense, in the longer term they can pay for themselves many times over.

Pick your planner carefully.

IRAs are looked after by a range of financial institutions, and the type of custodian will affect which sorts of investments they make.

An IRA offered by a Mutual, for example, may well invest your income in stocks and bonds.

A bank would be more traditional and conservative in its investing.

IRAs are also offered by Insurance companies and brokerage firms.

Range of investment

You need to think about what’s right for you at the stage of investment you’re at.

For those early in their investing career, higher-risk longer term options may be attractive.

For those closer to retirement, or worried about market volatility, a more restrained strategy may seem more attractive.

Consider the flexibility of the fund and what range of investment is offered within the IRA, before deciding which one’s right for you.

Conclusion

As such it can seem confusing.

But essentially it’s important to consider planning for the future and investing wisely.

Shop around, ask for advice, and take the decision armed with the best information available.