There is one thing you can’t ignore when saving for retirement: 401(k).

Knowing how to maximize on your 401(k) is important in saving for retirement. And for good reason, it should also be important to you. The 401(k) plan is a legitimate way to manage your money for retirement. A method many people will discredit.

You may have negative connotations with it because of what others have said or done.

None of that matters anymore. You’re at the right place for understanding the fundamentals of saving. A strong 401(k) makes saving for retirement easier for you. But you must know what you’re doing.

The only caution with this investment option are in your choices.

We’re here to help you make the right ones.

Saving For Retirement and Maximizing Your 401(k)

Is your 401(k) suffering from a lack of faith on your part? You can do better with your 401(k).

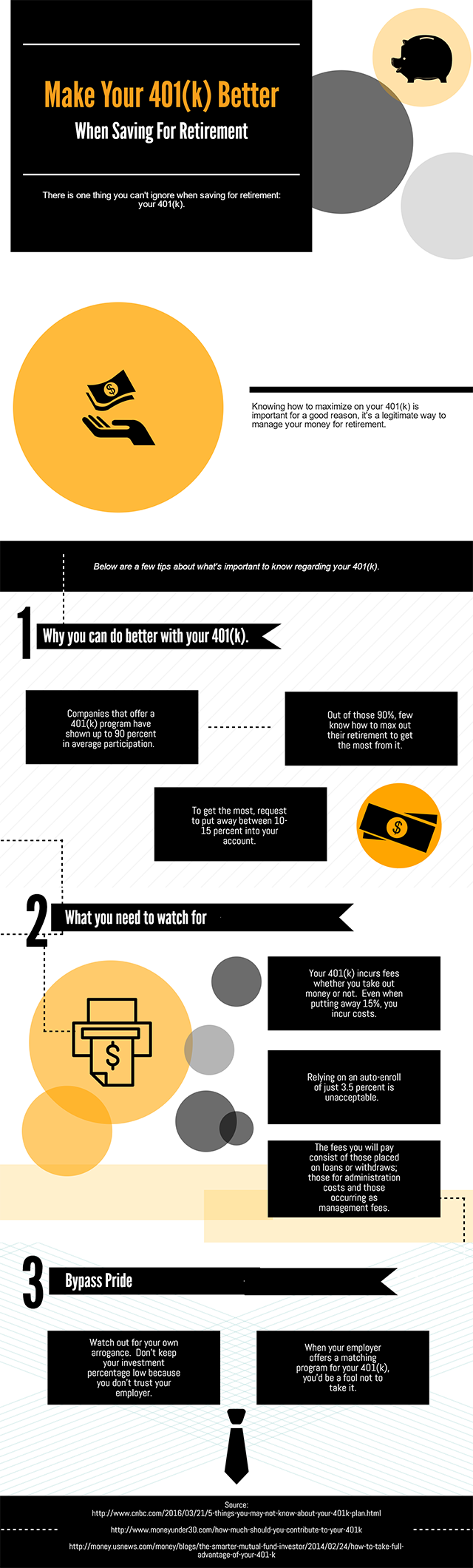

Companies offering a 401(k) program have shown up to 90 percent in average participation. But there is one problem. Out of those 90 percent, few know how to max out their retirement to get the most from it.

That’s why you need to learn to manage your 401(k) better. There are many small steps you can take.

Many with these investment tools are not automating 10 percent into the account either. They, therefore, miss out on what a 401(k) is really all about. You don’t want to follow their steps in saving for retirement.

The 401(k) is about YOU securing a life worth while during retirement. It’s about taking advantage, yes, even exploiting an opportunity. How often are you thinking about this? Your life after work, that is?

To make that life memorable, you have to first start avoiding your employer’s auto-enroll. It will set you up for failure in more ways than one, so you’d be glad to not have it. It’ll get you positioned with a 401(k), but at such a low percentage, you’re better off not putting any money away, and you’re better off running away fast.

There is only one way to avoid this.

Request a higher percentage.

Tell your employer to put away at least 15 percent into your account. If you can’t do that, then request 10 percent as the least. You can even manage your fund by increasing your percentage yearly until it meets 10 or 15 percent.

Why not go higher?

Your basic plan is ALWAYS 10 to 15 percent though. Dare yourself if you have to.

The common auto-enroll will set you at roughly 3.5 percent.

Here’s why that amount is effectively no good for you.

What You Need To Watch For

Did you know that your 401(k) incur fees whether you take out money or not? Even with a solid plan of putting away 15 percent of your income, you incur costs. This is why relying on an auto-enroll of just 3.5 percent is not enough.

The fees you will pay, for having a 401(k) plan, consists of those placed on loans or withdraws; those for administration costs and those occurring as management fees. The total sum of one percent will come out of your money. One percent is the percentage in fees you pay over each year.

One percent yearly can reduce any fund by 28 percent over the next 35 years. You must put away more than 3.5 percent of your total income. Three and one fifths of your salary at $50,000 is only $1,750.

Over 35 years, $1,750 equals $61,250–hardly anything you can live on. This minus 28 percent from 35 years of fees is a reduction down to $44,100.

Forget The Ego

There is one thing you need to watch for when saving for retirement: your own arrogance.

Have you ever felt like keeping your investment percentage low because you didn’t trust your employer, and because you’ve bad experiences with them? Or because you thought you could do it better yourself? All we have to say is, “Lay down the ego.”

Many have been there. An example is when your employer offers a match for your 401 (k). You’d be a fool not to take that match. Your money can double based on the contributions you make yearly.

For every dollar you save, your employer will provide a match. They choose a certain amount they will match on each dollar you put in. Sometimes the match is dollar for dollar. Sometimes the match is 50 cents for every dollar.

Let’s make this a bit simpler though. At the end of 2016, you have put in $1,000 into your 401(k). This will turn into $2,000 with the matching plan your employer provides (if the match is dollar for dollar). Yes. This is free money.

Employers set a limit to the dollar amount they will match on. But, who cares?

You’re preparing for retirement, so any match is a good thing . You’d be happy for the extra cash and the little effort it took to get it.

As we bring this to a close, we want you consider one more thing. We want to encourage you NOT to take out any money from you account. This defeats the purpose of everything you did while saving for retirement. The fees you would pay, in the long run, regardless of great market gains, could be as much as your remaining balance, and that is unacceptable on all levels.

Be wise. Hold on to your retirement, put away 15 percent, max out employer’s match and enjoy your benefits in the end.

Do YOU have any 401(k) tips or stories you would like to share?

Or any 401(k) questions in general?

Let’s meet up in the comment section and talk it up!