Are your finances spiraling out of control? Can’t see past your debt? If this situation sounds familiar, you may already have considered filing bankruptcy. We’ll explain to you when bankruptcy makes sense so you can figure out if it’s the right decision for you. Or, if you should explore other options of becoming debt free.

What is bankruptcy?

Bankruptcy is a legal system designed to help people who are too deep in debt to get themselves out. It’s a way for them to start fresh in relation their finances. There are two main types of bankruptcy for individuals.

Chapter 7 bankruptcy could be thought of as liquidation or ‘straight bankruptcy’. In this process, your non-exempt assets are sold off to pay off as much debt as possible. Any remaining debt is then written off.

Chapter 13 bankruptcy is often called a ‘reorganization bankruptcy’. It is based on your income and sets a structure to help you repay as much debt as possible in a 3-5 year time-frame. Any outstanding debts will then be written off.

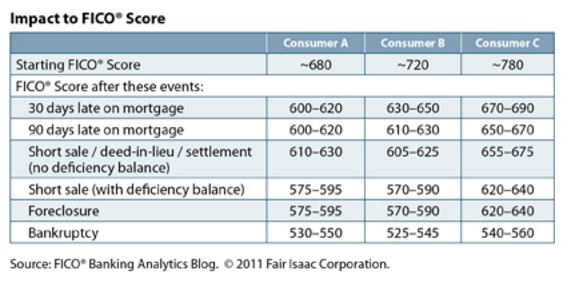

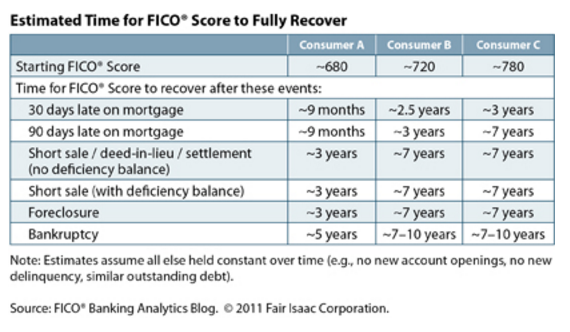

A major disadvantage of bankruptcy is its effect on your credit score. As shown in the tables below, your score will drop dramatically and stay low for a long time – usually 7-10 years. This means that it is vital to be certain that filing bankruptcy is the best option for you.

Before you file bankruptcy

If you are thinking of filing bankruptcy, you need to be certain that things are as bad as you think. First, find out how much your assets are worth. Remember to count all stocks, bonds, retirement accounts, savings accounts, real estate, and retirement funds. Estimate the value of each and find a rough total figure for your assets.

Next, do the same for your debts, remembering to include all bills and credit statements.

When shouldn’t I file bankruptcy?

Keep in mind that bankruptcy may not be the only way to solve your problems. Here are some situations where other options may be better.

- If your debts are mainly child support payments, income tax, student loan payments, or court judgments, bankruptcy does not make sense. None of these will be written off by it.

- If collection agents are pestering you – under the Fair Debt Collection Practices Act (FDCPA) they have to leave you alone if you ask them to stop. Keep in mind that this does not apply to the original lender, though.

- If you have no assets or income – creditors cannot recoup their money from Social Security income or other benefits such as unemployment.

- If you are struggling to make payments on relatively small, unsecured debts – you may be able to negotiate with the lenders for a lower interest rate or pay them a lump sum instead. Creditors know they are likely to lose money on the debt if you file for bankruptcy, so they will often be open to negotiation.

Avoiding bankruptcy

Even if none of these situations apply to you, you may still be able to avoid declaring yourself bankrupt. Ask yourself these questions first.

- Could I find another way to earn money? Taking another job or selling some of your assets might bring in enough money to reduce the amount you owe without taking more drastic action. If you filed for Chapter 7 bankruptcy, many of your assets would be sold anyway, and you will probably get a better price for them if you sell them yourself.

- Could I budget or economize more? Using an online budget program to check your spending, downsizing your home, or changing to a more efficient car could all help make your financial situation more comfortable.

- Could I attend credit counseling? Enlisting the help of a professional might help you to take control of the situation without declaring yourself bankrupt.

- Could I negotiate with lenders? Your mortgage may be eligible for a loan modification program, and it is often possible to request a deferment on your student loan.

When should I file bankruptcy?

In some situations, filing bankruptcy may be the best option. Warning signs might include:

- Having to use credit for groceries and other everyday items

- A creditor garnishing your wages

- Paying off credit with credit

- Considering using money from your retirement funds

- Working two or three jobs, if this isn’t solving the problem

- Dealing with debt related stress

In these circumstances, it could be a good idea to seek professional advice about declaring bankruptcy.

In conclusion, bankruptcy may seem like your only option, but there are things you can try before going down that route. It is worth exploring these because of the disadvantages associated with filing bankruptcy. You’ll have to deal with the effect on your credit score and the possibility of losing sentimental assets. However, if you have done your research and explored the other possibilities, then bankruptcy can be a useful way to press the reset button on your financial life.