As U.S mortgage interest rates fall to a record low, it may be highly beneficial to consider refinancing.

Is It Worth It?

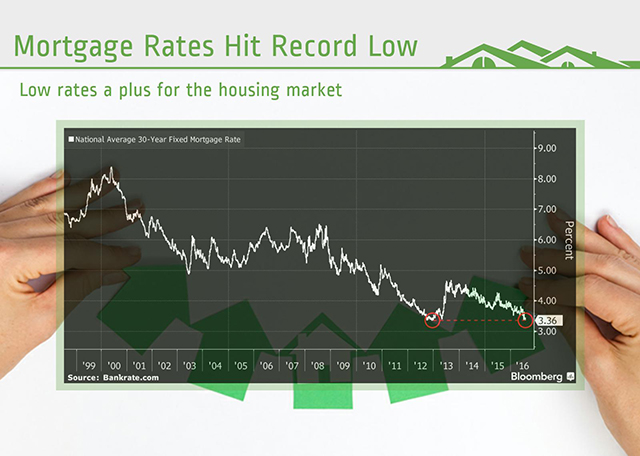

U.S. mortgage interest rates have fallen to a record low last seen in December 2012.

U.S. homeowners should consider the potential benefits of refinancing.

Currently, 30-year interest rates are at a low of 3.36%, with 20-year rates hovering in the 3’s and 15 and 10-year interest rates down and within 2%.

The drop in rates followed Britain’s decision to leave the European Union, leading to a total of 8.7 million refinanceable borrowers, the biggest refinanceable population seen since 2012.

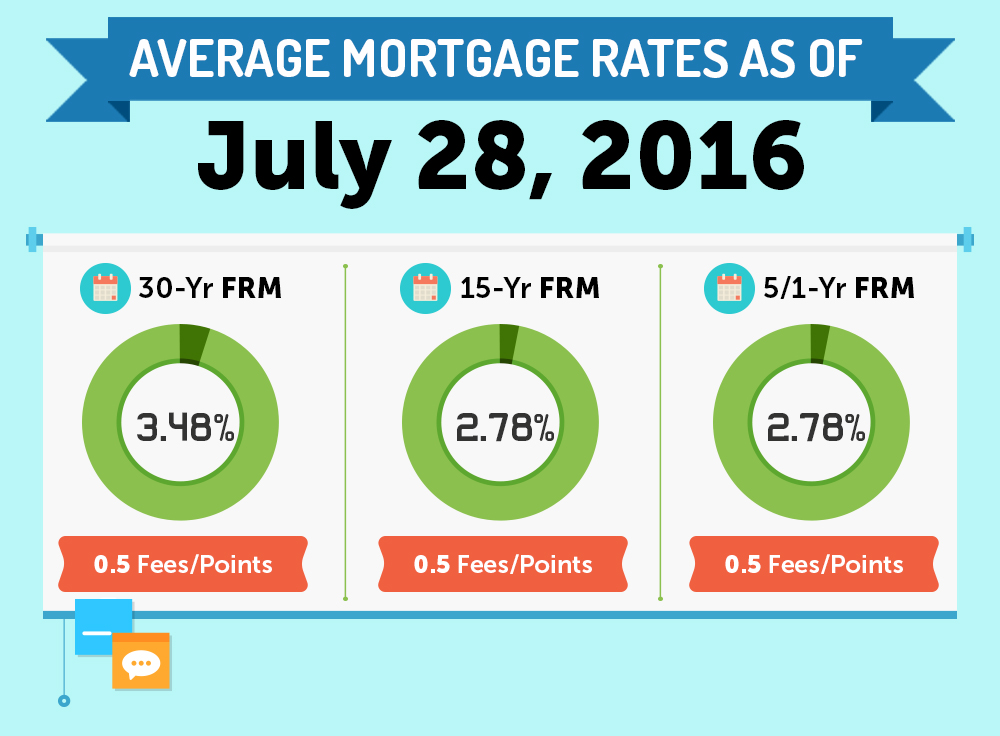

According to The Federal Home Loan Mortgage Corporation, also known as Freddie Mac, 30-year interest rates averaged 3.48% last week.

This time last year, the same average rate was as high as 4.09%.

The drop since last year alone could see a homeowner on a $300,000 mortgage, save over $100 per month.

Monthly savings are not the only factor to have in mind when considering refinancing, however.

Refinancing Explained

A refinance is a new loan to replace an existing one.

A borrower usually turns to refinancing in order to find a better interest rate or more advantageous terms.

Rate, fees, total amount borrowed, and the length of the loan are all elements that can be customized if a borrower chooses to refinance.

As the borrower would be taking out a new loan, it is highly likely they will have to go through the same process as when they took out the original loan.

It would not be uncommon for lenders to require the same information as when the house was first purchased, such as employment and income, credit reports, and other such information.

However, some lenders are an exception to the rule.

There are a handful of loan programs that accept refinancing applications from borrowers who have very little or no equity.

Homeowners should be aware of the type of loan that they currently hold so that they are able to make well-informed decisions if they decide to refinance.

Low-documentation Refinances

The FHA Streamline Refinance aims to be a fast process, often allowing borrowers to cut down on paperwork and refinance without the need for an appraisal. The borrower’s original loan must be a good standing FHA loan, however. If their loan is currently a conventional loan, they would need to apply with the normal considerations, such as employment and credit reports.

The HARP Program offers loans to those who may struggle to find one with other lenders. If the borrowers have remained on top of payments and are with either Freddie Mac or Fannie Mae, HARP can enable them to refinance. The program is specifically aimed at those with little or no home equity.

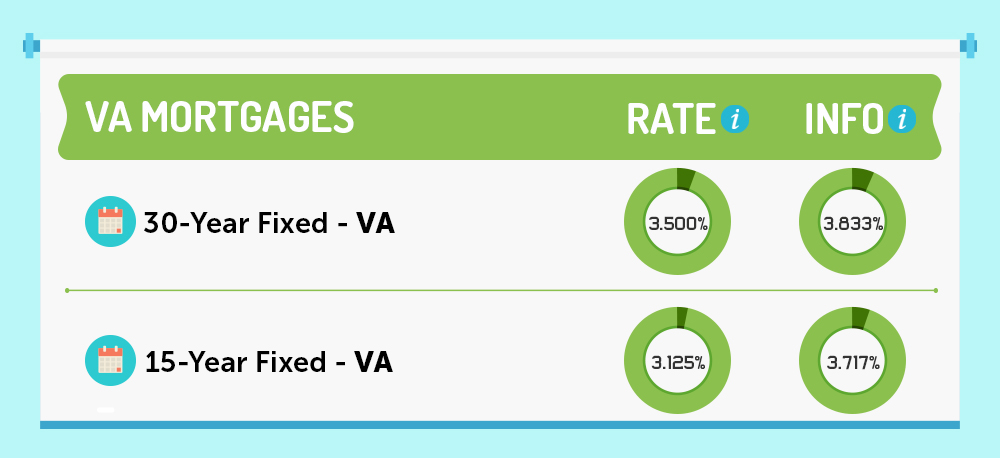

The VA Interest Rate Reduction Refinance Loan, though specifically designed for Veterans, is a great example of low-documentation refinancing. No appraisal, credit check or income verification are required.

It is worth noting that refinancing standard, conventional loans will likely have lenders requiring employment history, income, credit scores, appraised value, and other key information.

Homeowners should check their loan statements with their lenders to know for certain exactly which type of loan they currently hold.

What are the benefits?

Aside from the obvious benefits of lower interest rates and lower monthly payments, there are some other reasons to consider refinancing.

As interest rates fall, homeowners can refinance their loan to shorten the term on their mortgage, with little change in their monthly payments.

If the borrower can afford a small increase in payment, they can half their mortgage from a 30-year to a 15-year.

For example, refinancing a 30-year mortgage at 5% to a 15-year mortgage at 3.25% would increase payment by $200, a no-brainer if it fits within the borrower’s budget.

It may be worth refinancing if the borrower has an adjustable-rate mortgage.

With interest rates at record lows, the borrower would be protected from any increase in rates in the future: rates are not likely to stay this low forever.

Fixed-rate mortgages are also easier to plan and budget for.

With some lenders, it may be possible to cash-out the borrower’s home equity by refinancing.

Depending on the borrower, doing so may be a good move financially.

Refinancing is entirely dependent on the overall benefits to the borrower; it is not unknown for homeowners to refinance and face higher interest rates and monthly payments.

The interest in interest rates

The common aim of refinancing is to receive a lower interest rate and make lower monthly payments.

But when is it worth refinancing?

Whilst some experts in the field may recommend waiting to refinance until there is at least a 1% drop in interest rates, depending on the current loan, refinancing may still be beneficial in making savings on monthly payments.

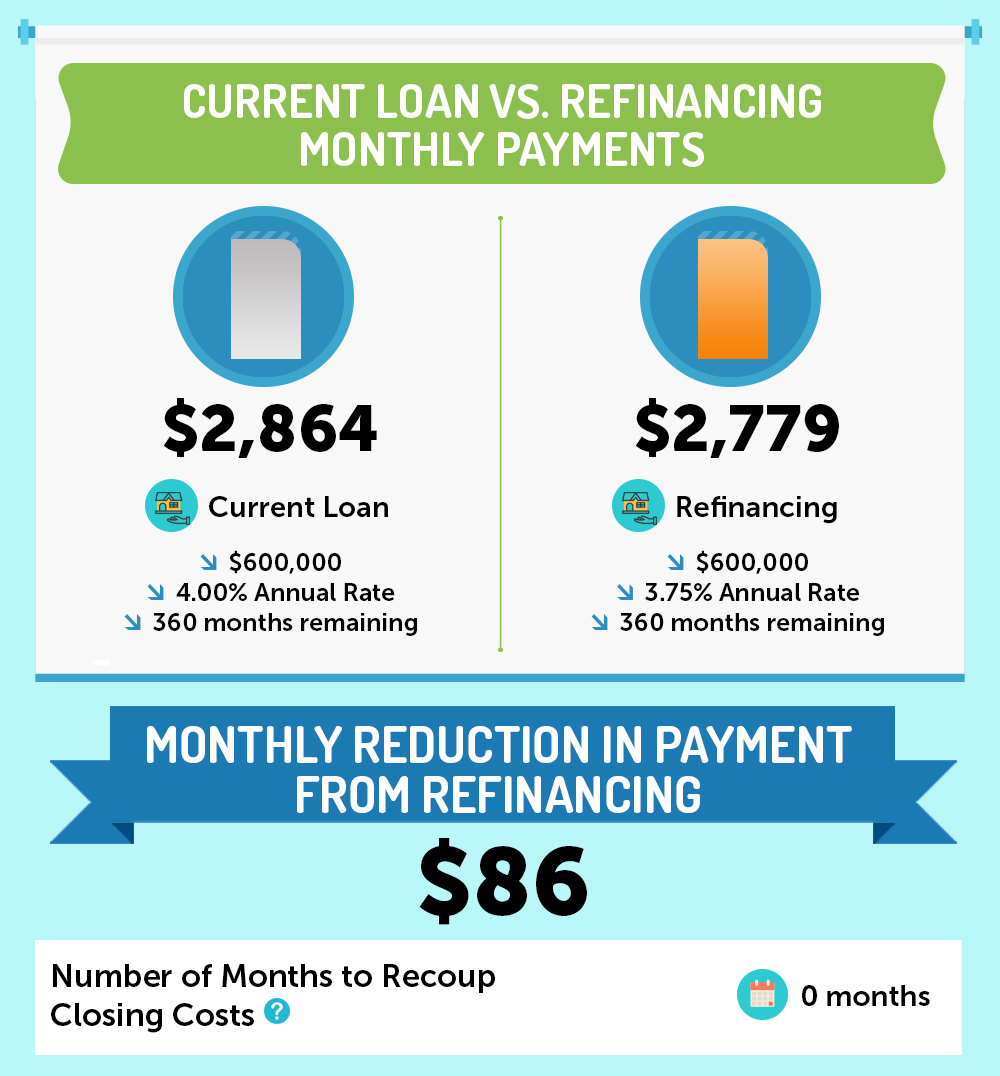

For example, a larger loan of, say $600,000, with an interest rate of 4% could see the borrower saving nearly $100 a month if the rate dropped by even 0.25%.

A homeowner with a smaller total loan, however, would find a refinance would only be worthwhile if the drop in interest rates were significantly larger.

Whilst they could still see some savings with a small decrease in interest, it is unlikely a refinance could be justified.

Closing costs

As mentioned, there are many costs to consider when refinancing.

It is essential to ensure any expenses paid can be recuperated: if the homeowner plans to move houses before their monthly savings cover the refinance costs they will lose out.

Homeowners should be considering their future within a property before considering refinancing.

For example, if refinancing costs $5000 with the borrower gaining a saving of $100 from their monthly payments, it will take 50 months to recoup the expenses and actually see the benefit of those savings.

Alternately, if the monthly savings were $200, they could recoup the expenses within 25 months.

Some lenders offer the option of ‘no-cost refinancing’, in which the borrower pays no closing costs but instead pays a slightly higher interest rate.

This is usually only an increase of around 0.125%, small enough that the borrower can still make a gain on monthly savings.

With no recuperation period, this option offers little to no reason not to refinance.

Making loans longer

Depending on how long the homeowner has been paying off their mortgage and how long they intend to stay at their property, it is important to check how long their loan could be extended by.

It is essential to be sure a refinance suits both the borrowers long and short term goals.

Refinancing a 30-year mortgage will set the borrower back to 30 years, even if they have paid for four years and had 26 remaining, after refinancing, the loan goes back to 30.

This is fine, so long as the homeowner will still see a saving with the regained years included.

The demand to refinance

Since Britain left the European Union, over 1.3 million more homeowners are now able to reap the benefits of refinancing, bringing the total amount of refinanceable borrowers to 8.7 million.

Many lenders are reporting capacity issues as they struggle to keep up with the amount of refinance applications they are receiving.

Some lenders have even reported hiring new employees to stay on top of the extra workload.

Get Informed

There is a multitude of lenders and loan programs, most of which will require documentation and some equity to approve refinancing.

However, there are many options, and homeowners should not let a lack of equity or worries of credit reports and other information prevent them from applying.

It is a good idea for potential refinancers to check their current loan type with their lenders and discuss their options.

Now, with interest rates at record lows, it is a fantastic opportunity for U.S. homeowners to get on the property ladder and refinance their current mortgages.

Homeowners looking to refinance can view live mortgage interest rates here.