Many people struggle to set up a monthly budget that they can stick to.

For those of you that can’t keep your budget together…

You should think about using a spreadsheet to help you follow your monthly budget.

You’ve probably already tried using a spreadsheet already…

But you probably didn’t use the spreadsheet the best way you possible could.

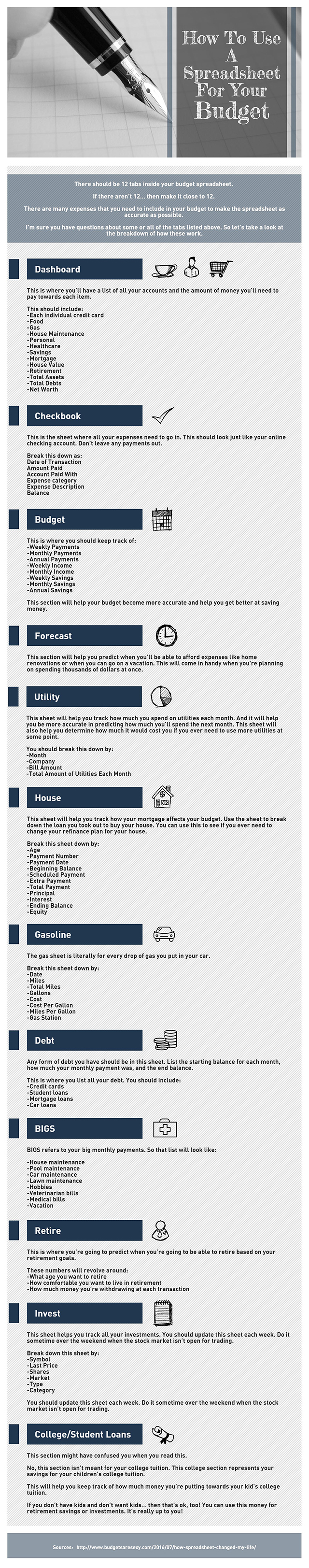

Here is a great example of how your spreadsheet should look (use this for a reference) for your budget and how many different tabs you should have on it.

Here are the different tabs you should have at the bottom page of your spreadsheet:

- Dashboard

- Checkbook

- Budget

- Forecast

- Utility

- House

- Gas

- Debt

- Bigs

- Retire

- Invest

- College

That’s right…

There should be 12 tabs inside your budget spreadsheet.

If there aren’t 12 tabs…

Then make it close to 12.

There are many expenses that you need to include in your budget to make the spreadsheet as accurate as possible.

I’m sure you have questions about some or all of the tabs listed above. So let’s take a look at the breakdown of how these work.

Dashboard

This is where you’ll have a list of all your accounts and the amount of money you’ll need to pay towards each item.

This should include:

- Each individual credit card

- Food

- Gas

- House Maintenance

- Personal

- Healthcare

- Savings

- Mortgage

- House Value

- Retirement

- Total Assets

- Total Debts

- Net Worth

Checkbook

This is the sheet where all your expenses need to go in. This should look just like your online checking account. Don’t leave any payments out.

Break this down as:

- Date of Transaction

- Amount Paid

- Account Paid With

- Expense category

- Expense Description

- Balance

Budget

This is where you should keep track of:

- Weekly Payments

- Monthly Payments

- Annual Payments

- Weekly Income

- Monthly Income

- Weekly Savings

- Monthly Savings

- Annual Savings

This section will help your budget become more accurate and help you get better at saving money.

Forecast

This section will help you predict when you’ll be able to afford expenses like home renovations or when you can go on a vacation. This will come in handy when you’re planning on spending thousands of dollars at once.

Utility

This sheet will help you track how much you spend on utilities each month. And it will help you be more accurate in predicting how much you’ll spend the next month. This sheet will also help you determine how much it would cost you if you ever need to use more utilities at some point.

You should break this down by:

- Month

- Company

- Bill Amount

- Total Amount of Utilities Each Month

House

This sheet will help you track how your mortgage affects your budget. Use the sheet to break down the loan you took out to buy your house. You can use this to see if you ever need to change your refinance plan for your house.

Break this sheet down by:

- Age

- Payment Number

- Payment Date

- Beginning Balance

- Scheduled Payment

- Extra Payment

- Total Payment

- Principal

- Interest

- Ending Balance

- Equity

Gas

The gas sheet is literally for every drop of gas you put in your car.

Break this sheet down by:

- Date

- Miles

- Total Miles

- Gallons

- Cost

- Cost Per Gallon

- Miles Per Gallon

- Gas Station

Debt

Any form of debt you have should be in this sheet. List the starting balance for each month, how much your monthly payment was, and the end balance.

This is where you list all your debt. You should include:

- Credit cards

- Student loans

- Mortgage loans

- Car loans

Bigs

Bigs refers to your big monthly payments. So that list will look like:

- House maintenance

- Pool maintenance

- Car maintenance

- Lawn maintenance

- Hobbies

- Veterinarian bills

- Medical bills

- Vacation

Retire

This is where you’re going to predict when you’re going to be able to retire based on your retirement goals.

These numbers will revolve around:

- What age you want to retire

- How comfortable you want to live in retirement

- How much money you’re withdrawing at each transaction

Invest

This sheet helps you track all your investments. You should update this sheet each week. Do it sometime over the weekend when the stock market isn’t open for trading.

Break down this sheet by:

- Symbol

- Last Price

- Shares

- Market

- Type

- Category

You should update this sheet each week. Do it sometime over the weekend when the stock market isn’t open for trading.

College/Student Loans

This section might have confused you when you read this.

No, this section isn’t meant for your college tuition. This college section represents your savings for your children’s college tuition.

This will help you keep track of how much money you’re putting towards your kid’s college tuition.

If you don’t have kids and don’t want kids… then that’s OK too! You can use this money for retirement savings or investments. It’s really up to you!

How do YOU strictly follow your monthly budget?

If you feel like you have a better way to do it…

Then we want to hear from YOU!

Comment in the section below!