Student loan debt in the United States continues to grow as the seconds pass by.

The total amount of student loan debt is above $1.3 trillion right now…

And it’s adding up as you continue to read this.

Some say it’s the borrowers’ fault that the total student loan debt is so high.

But the people that never took out a student loan during college…

Don’t know the struggle of paying off student loan debt.

People with student loan debt may blame the struggle on a few things:

- the current job market

- higher cost of living

- lack of information about student loans

- shady tactics by student loan providers

So we decided to dig up some more information about the student loan crisis to see why the situation continues to get worse each day.

And some graduates don’t think their student loans were worth the investment anymore.

The Girl Who’s Selling Her College Education on eBay

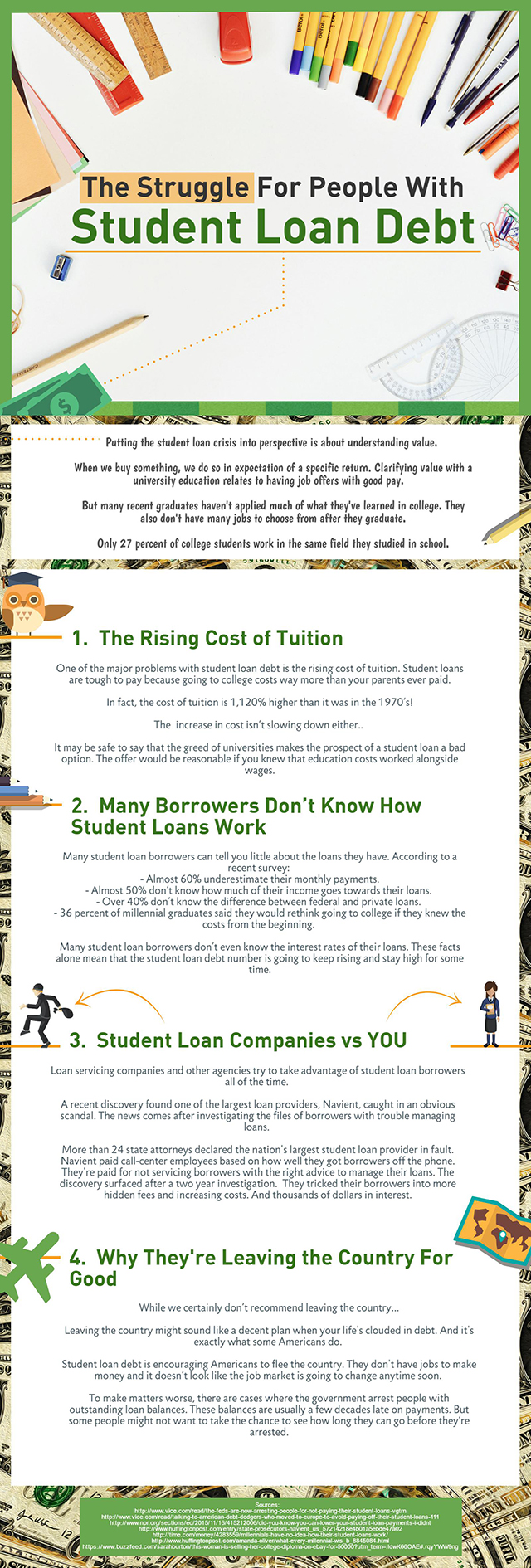

Putting the student loan crisis into perspective is about understanding value.

When we buy something, we do so in expectation of a specific return. Clarifying value with a university education relates to having job offers with good pay.

But many recent graduates haven’t applied much of what they’ve learned in college. They also don’t have many jobs to choose from after they graduate.

Only 27 percent of college students work in the same field they studied in school. When we look at this one woman’s situation with her college degree, we start to see the picture. After not finding work, Stephanie Ritter decided that her diploma just wasn’t worth it.

That’s why she put it up for sell on eBay.

Reading between the lines is simple. The value in university education is losing its relevance. The rising prices for education makes the prospect even less appealing.

The Rising Cost of Tuition

One of the major problems with student loan debt is the rising cost of tuition. Student loans are tough to pay because going to college costs way more than your parents ever paid.

In fact, the cost of tuition is 1,120% higher than it was in the 1970’s!

The increase in cost isn’t slowing down either..

It may be safe to say that the greed of universities makes the prospect of a student loan a bad option. The offer would be reasonable if you knew that education costs worked alongside wages.

Consider what you’re going to make after school.

If it increases faster than the rate of tuition does, then you’re in good hands.

But. …when the cost of college overshadows what you’re going to make in your career…

How do you pay back the loans?

Many Borrowers Don’t Know How Student Loans Work

Many student loan borrowers can tell you little about the loans they have. According to a recent survey:

- Almost 60% underestimate their monthly payments.

- Almost 50% don’t know how much of their income goes towards their loans.

- Over 40% don’t know the difference between federal and private loans.

- 36 % of millennial graduates said they would rethink going to college if they knew the costs from the beginning.

Many student loan borrowers don’t even know the interest rates of their loans. These facts alone mean that the student loan debt number is going to keep rising and stay high for some time.

One could say that it’s the borrowers fault that they don’t know how their loans work.

But their loan servicers should take some of that blame too.

Student Loan Companies Vs. YOU

Loan servicing companies and other agencies try to take advantage of student loan borrowers all of the time.

One way they do this is by charging late fees whenever they can.

When a borrower doesn’t have enough to make a payment on all their loans… they try to make the minimum payment on a few of their loans so they’re not late on all of their loans.

But the student loan servicers take the total payment amount and evenly divide the amount across all of the loans.

This means every loan the borrower has gets charged a late fee.

But that’s not all the tricks they do…

A recent discovery found one of the largest loan providers, Navient, caught in an obvious scandal. The news comes after investigating the files of borrowers with trouble managing loans.

More than 24 state attorneys declared the nation’s largest student loan provider in fault. Navient paid call-center employees based on how well they got borrowers off the phone. They’re paid for not servicing borrowers with the right advice to manage their loans. The discovery surfaced after a two year investigation.

Navient serves over 12 million students across the USA.

And they tricked their borrowers into more hidden fees and increasing costs. And thousands of dollars in interest.

Instead, they should have told their borrowers they can lower their monthly payments…

They should have told their borrowers about the different types of repayment plans…

And the ones that can actually help borrowers manage their monthly payments.

I know… top notch customer service right?

Why They’re Leaving the Country For Good

While we certainly don’t recommend leaving the country…

Leaving the country might sound like a decent plan when your life’s clouded in debt. And it’s exactly what some Americans do.

Student loan debt is encouraging Americans to flee the country. They don’t have jobs to make money and it doesn’t look like the job market is going to change anytime soon.

To make matters worse, there are cases where the government arrest people with outstanding loan balances. These balances are usually a few decades late on payments. But some people might not want to take the chance to see how long they can go before they’re arrested.

DO YOU HAVE STUDENT LOAN DEBT?

What is the most challenging part of paying off your student loan debt?

Tell us about it in the comment section!

Being at minimum wage and not being allowed to pay what I can.

Hey, you’ve got to start somewhere, right?

Have you looked into changing your repayment plan?

I remember being hard-headed & refusing to go to a church college in Idaho (when I was born & raised in SC) that my father was willing to pay for. I also did not have a firm handle (still don’t, really, even over 2 decades later) exactly how much tuition would cost – especially out-of-state tuition, as my choice was to use my small Pell Grant amount (less than $1,000 per semester) & student loans to pay for tuition at Appalachain State University in Boone, NC which is where I chose to go to school. I used the grant & student loans to pay out-of-state tuition there for 6 semesters before complaining to the financial aid department there & being told that if I took a year off & worked in NC to establish residency I could re-apply & be given in-state status (a MAJOR reduction in tuition costs.) I did what I was told but when I went to apply for in-state tuition I was told that because I was under 23 years old, & even though I had a NC drivers license & NC tags on my car, etc., I was still considered under my parents’ salaries & wouldn’t be given in-state status. I had to drop out of school, & I worked hard for minimum wage for the next 7 years until I was sick of it & went back to school (again, having to use student loans to pay for it.) During that 7 years, I ignorantly consolidated all of my confusing student loans with the U.S. Dept of Education (don’t even get me started on how unnecessary THAT federal department is,) not knowing or even being informed that once that’s done, nothing can be done about all of the buckets of interest that had accrued on the loans. I did finally get a BS in Bus Admin from an in-state school, but it DEFINITELY is/was not worth over $100,000, which is is the total of what I currently owe in student loan debt.) I’ve been struggling with finding (& keeping) jobs in the past decade – 12 years since getting my degree & have used up all of my deferments & forbearances.

Just keep looking Jenny! Focus on getting that better job!

We have other articles on getting a better job and getting out of debt. Hopefully they can point you in the right direction.

Do you still live in the Boone area? I know high paying jobs are pretty scarce over there.

I graduated with a BS in Athletic Training in ’95 and am still paying off my loans. Of coarse never found work in my field. Worked as an administrator for 10 yrs was laid-off and went back to school. Graduated with my AS in Nursing and now have more loans ~$45,000. I know it’s not a lot, but my loans are serviced by 2 different companies. Hasn’t been easy. If I didn’t have the supportive family I have I would be drowning. If I did a better job saving and cutting back I might not of needed to take out so many loans. Going to try and do better for my children.

Well, at least you know how you got here and you have the right attitude for getting out of debt. We have plenty of other articles on Budgeting and Getting Out of Debt. Hopefully those can help!

I would recommend doing a Federal Direct Loan Consolidation to help you manage your loans in an easier way. This will give you only one loan, one fixed interest rate, one monthly payment and one loan servicer.

Best of luck Kay!