With the alarming student loan crisis in the country, it is not surprising that borrowers are now looking for student loan relief counselors.

Experts on student loan help are out there and they are more than happy to help struggling borrowers.

However, borrowers must consider a number of factors to determine if their situation is in need of a counselor.

If you are still undecided about the next step in repaying student loan debt, here are the things you should consider.

Student Loan Relief Counselors Pros and Cons

What is a Student Loan Relief Counselor?

First, what is a student loan relief counselor?

These are people whose expertise lies in the accommodation of student loan debt concerns.

Their knowledge and experience allow them to help borrowers and show them the best way out of their debt.

Student loan relief is the general term for your federal programs such as repayment plans and student loan forgiveness.

There are quite a number of relief programs, and they can be overwhelming.

Counselors manage this information along with your financial situation.

In doing so, they design a plan for you to follow until you are debt-free.

Pros of Having a Student Loan Relief Counselor

1. Guidance and Motivation

Student loan counselors exist because they offer a service that cannot be reproduced by mere research.

They have insider knowledge and will hold your hand every step of the way as you attempt to retrieve your student loan relief.

Good student loan relief counselors are able to provide this support and are therefore sought out by borrowers.

2. Expertise

Coupled with their ability to guide borrowers, the expertise of counselors is comprehensive and encompassing.

Thus, they are able to offer borrowers both a bird’s-eye view and a deeper examination of their student loan problems.

Cons of Having a Student Loan Relief Counselor

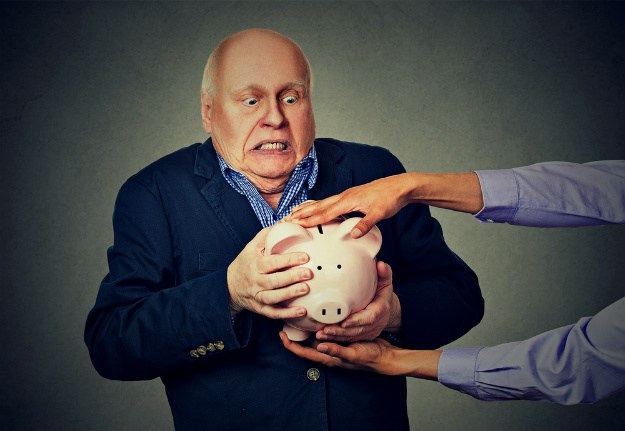

1. Fraud

The problem with claiming to be an expert is that anyone can do it.

Student loan relief counseling is not an institutionalized profession.

Thus, it is easy for frauds to get away with claiming to be an expert.

In this respect, doing your own research is better than seeking a student loan counselor.

Various kinds of information can be read and absorbed side-by-side so that you notice discrepancies and inconsistencies.

This leads to a better understanding of your student loan problem.

With fraudulent student loan counselors, it is almost impossible to be sure of the information you are getting.

2. Scam

The idea of having a student loan relief counselor does not appeal to some people because they believe you are paying money for a service your loan providers already give.

To an extent, this is true.

Talking to your student loan servicers about options and guidance is already a form of counseling.

If you find a student loan counselor that does not ask for a fee, then great.

But today, there are more scams than there are legitimate services.

In fact, even “counselors” who do not ask for a counseling fee find other “creative” ways to pull a scam.

The fear and talk of scam, of course, are not unfounded.

Reports on the staggering amount of complaints against student loan “counselors” prove that these scams have become a norm, and they must be avoided.

Watch this video from AJ+ and see the different faces of student debt crisis in America:

Sure, the help that student loan counselors provide is undeniably useful.

However, consider your options and avoid fraud at all costs. Seeking Student Loan help?

We recommend visiting USStudentLoanCenter.org!

You know your financial situation best.

The next best move is up to you.

What are your thoughts on student loan relief counselors? Let us know in the comments section below.

Up Next: Who Is Eligible for Student Loan Forgiveness?