Have you already started to teach your kids about money?

If not… do you even know where to start?

Well depending on the age of your kids…

You should definitely start to think about how to teach your kids about money if you haven’t started yet.

And just in case you need any guidance or advice… we did some research for you.

We found some of the top tips for how to teach your kids about money.

And we’ve explained them in the sections below.

So let’s get started!

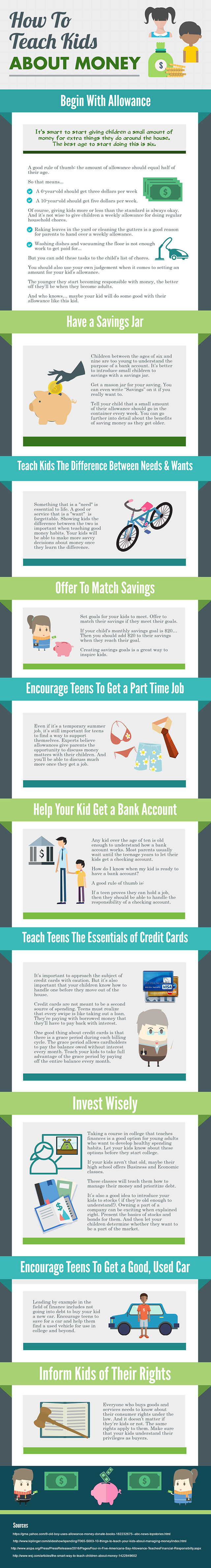

Begin with allowance

It’s smart to start giving children a small amount of money for extra things they do around the house. The best age to start doing this is six.

A good rule of thumb: the amount of allowance should equal half of their age.

So that means…

- A 6-year-old should get three dollars per week

- A 10-year-old should get five dollars per week.

Of course, giving kids more or less than the standard is always okay. And it’s not wise to give children a weekly allowance for doing regular household chores.

- Raking leaves in the yard or cleaning the gutters is a good reason for parents to hand over a weekly allowance.

- Washing dishes and vacuuming the floor is not enough work to get paid for…

But you can add these tasks to the child’s list of chores.

You should also use your own judgement when it comes to setting an amount for your kid’s allowance.

The younger they start becoming responsible with money, the better off they’ll be when they become adults.

And who knows… maybe your kid will do some good with their allowance like this kid.

Have a savings jar

Children between the ages of six and nine are too young to understand the purpose of a bank account. It’s better to introduce small children to savings with a savings jar.

Get a mason jar for your saving. You can even write “Savings” on it if you really want to.

Tell your child that a small amount of their allowance should go in the container every week. You can go further into detail about the benefits of saving money as they get older..

Teach kids the difference between needs and wants

Something that is a “need” is essential to life. A good or service that is a “want” is forgettable. Showing kids the difference between the two is important when teaching good money habits. Your kids will be able to make more savvy decisions about money once they learn the difference.

Offer to match savings

Set goals for your kids to meet. Offer to match their savings if they meet their goals.

If your child’s monthly savings goal is $20…

Then you should add $20 to their savings when they reach their goal.

Creating savings goals is a great way to inspire kids.

Encourage teens to get a part time job

Even if it’s a temporary summer job, it’s still important for teens to find a way to support themselves. Experts believe allowances give parents the opportunity to discuss money matters with their children. And you’ll be able to discuss much more once they get a job.

Help your kid get a bank account

Any kid over the age of ten is old enough to understand how a bank account works. Most parents usually wait until the teenage years to let their kids get a checking account.

How do I know when my kid is ready to have a bank account?

A good rule of thumb is:

If a teen proves they can hold a job, then they should be able to handle the responsibility of a checking account.

Teach teens the essentials of credit cards

It’s important to approach the subject of credit cards with caution. But it’s also important that your children know how to handle one before they move out of the house.

Credit cards are not meant to be a second source of spending. Teens must realize that every swipe is like taking out a loan. They’re paying with borrowed money that they’ll have to pay back with interest.

One good thing about credit cards is that there is a grace period during each billing cycle. The grace period allows cardholders to pay the balance owed without interest every month. Teach your kids to take full advantage of the grace period by paying off the entire balance every month.

Invest wisely

Taking a course in college that teaches finances is a good option for young adults who want to develop healthy spending habits. Let your kids know about these options before they start college.

If your kids aren’t that old, maybe their high school offers Business and Economic classes.

These classes will teach them how to manage their money and prioritize debt.

It’s also a good idea to introduce your kids to stocks ( if they’re old enough to understand!). Owning a part of a company can be exciting when explained right. Present the basics of stocks and bonds for them. And then let your children determine whether they want to be a part of the market.

Encourage teens to get a good, used car

Leading by example in the field of finance includes not going into debt to buy your kid a new car. Encourage teens to save for a car and help them find a used vehicle for use in college and beyond.

Inform kids of their rights

Everyone who buys goods and services needs to know about their consumer rights under the law. And it doesn’t matter if they’re kids or not. The same rights apply to them. Make sure that your kids understand their privileges as buyers.

Do you want to share any tips on how to teach kids about money?

Or maybe you just feel like talking to us 🙂

Leave a comment for us below!