Everything in the world today has gone digital. We hangout online, we shop online, we pay our bills online and we bank online. For the most part, money is now an intangible object.

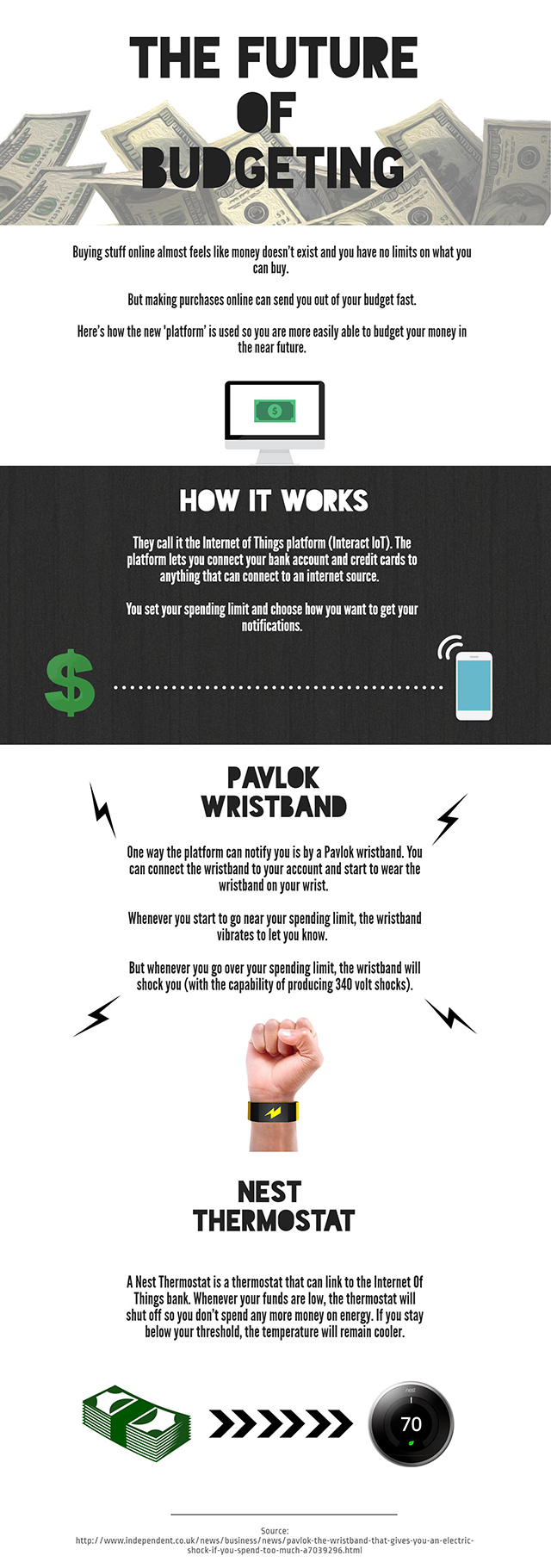

Buying stuff online almost feels like money doesn’t exist and you have no limits on what you can buy.

But making purchases online can send you out of your budget fast.

A British company called Intelligent Environment had a goal to create a platform where people don’t have to worry about their money disappearing online.

And it looks like they’ve succeeded.

We do our best to help our clients in their financial situations.. Whether it’s getting out of debt, saving for retirement or making extra money.. We know the right budgeting tools to reach their goals.

And this new platform might be the answer for people that don’t know how to budget their money.

So we decided to break down how the platform works and how it can help you budget your money in the near future.

How It Works

They call it the Internet of Things platform (Interact IoT). The platform lets you connect your bank account and credit cards to anything that can connect to an internet source.

You set your spending limit and choose how you want to get your notifications.

A text message is one form of notification, but Intelligent Environment was able to find more creative ways to receive notifications.

Pavlok Wristband

One way the platform can notify you is by a Pavlok wristband. You can connect the wristband to your account and start to wear the wristband on your wrist.

Whenever you start to go near your spending limit, the wristband vibrates to let you know.

But whenever you go over your spending limit, the wristband will shock you (with the capability of producing 340 volt shocks).

This method attempts to change your spending behaviors to keep you from spending too much money.

But if electric shocks are too much for you to handle..

There are other ways to receive notifications.

Nest Thermostat

A Nest Thermostat is a thermostat that can link to the Internet Of Things bank. Whenever your funds are low, the thermostat will shut off so you don’t spend any more money on energy. If you stay below your threshold, the temperature will remain cooler.

This option might work better for people that don’t want to get shocked.

Banks have not signed on for this new platform yet. But it seems like this way of budgeting can become popular.

The big idea here is not getting shocked like a dog to get you to stop spending money (but it is pretty bizarre).

This new idea of banking can help people from overspending their money in the digital world. This can help people budget their money better, and possibly fix the debt problems in our country.

Maybe the Internet of Things is the platform that will change how we spend and budget our money in the near future.