Many people are considering buying second homes now because mortgage rates have been so low the past couple of years. Most Americans also believe that real estate is the best use of their extra investment funds. However, there are a few important things you should consider when you’re thinking about buying a second home.

The Most Obvious Question: How much will it actually cost you?

Obviously there is the sale price. The cost of buying or building a new home has been on the rise over the last few years. The median price of a new home is well over $230,000 at this point. There is more sales activity on the high end of the market, but that means it can be problematic for middle-class people to get in on the low-to-median- end of the market.

There are so many more repairs costs associated with second homes. Does this surprise you? That’s because if you don’t live in the home, you won’t be able to spot the problems right away.

On the contrary, if you have renters, then that’s a whole other scenario of having to deal with whatever damage and problems they cause in the home. Since renters don’t own the home, they don’t have as much incentive to keep it in tip top condition. It is also likely that you won’t have a ton of time to take care of these problems since you have your primary home and job to worry about. That means you have an added cost of having to hire someone else to make these repairs.

Not only how much will it cost, but can you actually afford it?

Mortgage requirements on second homes are not as strict as they used to be. However, you can be sure that lenders will be taking a hard look at your credit score, your debt-to-credit ratio, and much more involving your credit history.

Are you able to pay both mortgages while using less than 35% of your income? If so, that means you can truly afford a second home. If not, it might mean you should wait.

Think about why you want a second home, and make sure you’re doing it for a good reason

If you are buying a vacation home to save money, that doesn’t make sense. Sure, you will not have to pay when you go on vacation, but think about the following points:

- Most people do not vacation enough to warrant how much they will spend on their vacation home.

- Do you only have one spot you like to vacation in? You might regret the decision after you spend the fifth summer in a row in the same neighborhood!

- Finally, think about all the other costs associated with travel, like food and transportation. The actual lodging is just a small portion of the vacation cost anyways.

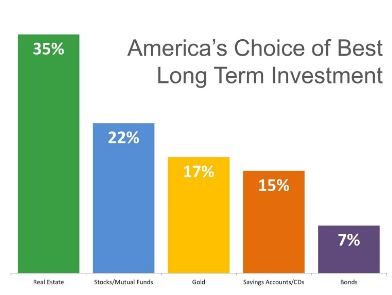

So it’s clear that buying a second home isn’t a great savings tool. However, it can be a great investment tool. You can profit by renting out your home, and owning real estate is a significant benefit when the market booms. You might be able to make big bank by reselling your home later down the road.

Are you in a good position personally to buy a home?

Your personality and position in life can have a significant impact on whether it is a good choice to buy a second home. You need to consider many different things to make sure you are personally ready for a second home.

First of all, you need to have plenty of extra money lying around, but also enough saved up in the case of an emergency. Do you get restless or like to move around and travel more than staying in one place? Then it may not be the best decision to buy a second house until you settle down a bit since the purchase of a house is such a big commitment.

You also need to make sure all of your debts are resolved. Mortgaging a second house could just put you into far more debt plus also ruin your credit, so decide carefully!