In this day and age, it is imperative to start putting aside money for your pension.

It’s very easy to get caught up in the present moment, and not give a second thought to your future.

But you must act now, so you’re financially secure when the time comes to retire.

There are many obvious reasons why you shouldn’t ignore retirement planning.

You’ll need to consider things like:

• Do you have any tax deferred accounts? These will reduce your income tax.

• The welfare system is beginning to show cracks. It would be wise not to rely on it.

• Will you have the means to live alone? Or will you become a hindrance to your children’s financial futures?

• Have you accounted for the fact that the cost of living is going up? You may need to have more retirement savings than you originally planned for.

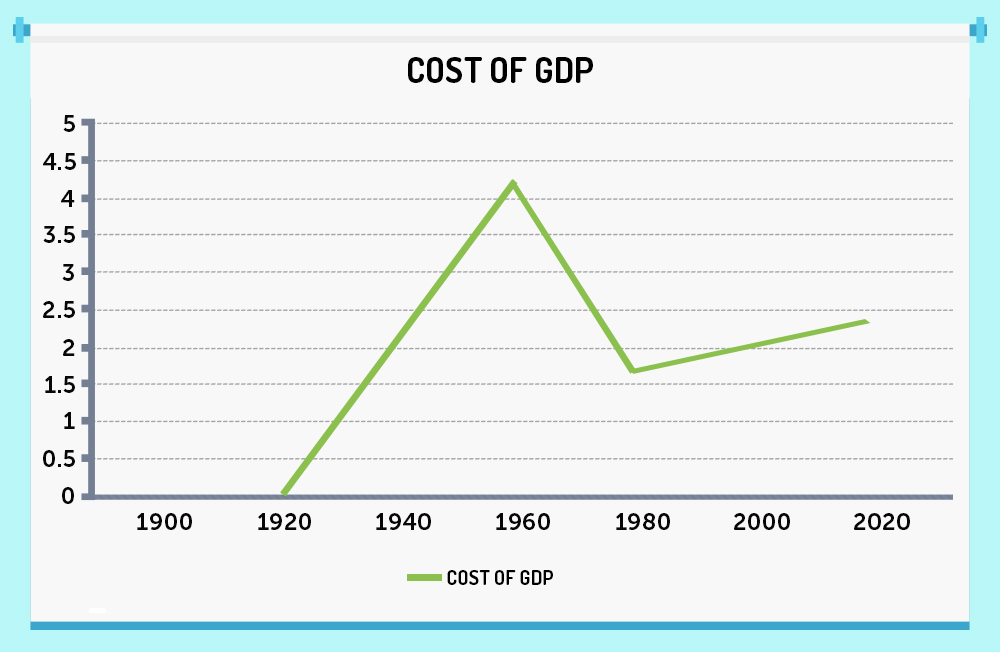

We mentioned the instability of the welfare system.

In order to give you a better idea on the size of welfare spending, check out this graph:

The trend from 1980 shows a substantial rapid growth, resulting from the cost of the baby boomer generations now starting to retire.

The next twenty years will be very tight for the welfare system, as the numbers will continue to grow.

So with that in mind, it’s best not to rely on the system, and instead make things happen for yourself.

Let’s look at the top 3 ways to start saving for retirement:

1. Invest A Big Chunk of Time into Making Plans for Your Retirement

You don’t want to wait until it’s too late to get started.

It’s imperative to spend the time now so you can create a plan and have the time needed to execute it.

Think of it this way:

Let’s say you’re going to have a dozen guests over for Christmas dinner.

It would be foolish to start prepping your menu the day of.

A dinner like that is obviously going to take more time to plan and prepare.

You need to put the same energy into sitting down and planning your future in terms of your finances.

While it may not be the most fun activity, you should have a lot of motivation.

Make goals for your retirement; let your imagination go wild and think of what you would love to achieve.

Do you plan on doing a lot of traveling?

Or are you concerned with paying off your mortgage, and living debt free?

Create A Budget Plan

You’ll need a great system in place in order to keep track of your finances.

This can be done with a financial budgeting tool.

We recommend checking this one out.

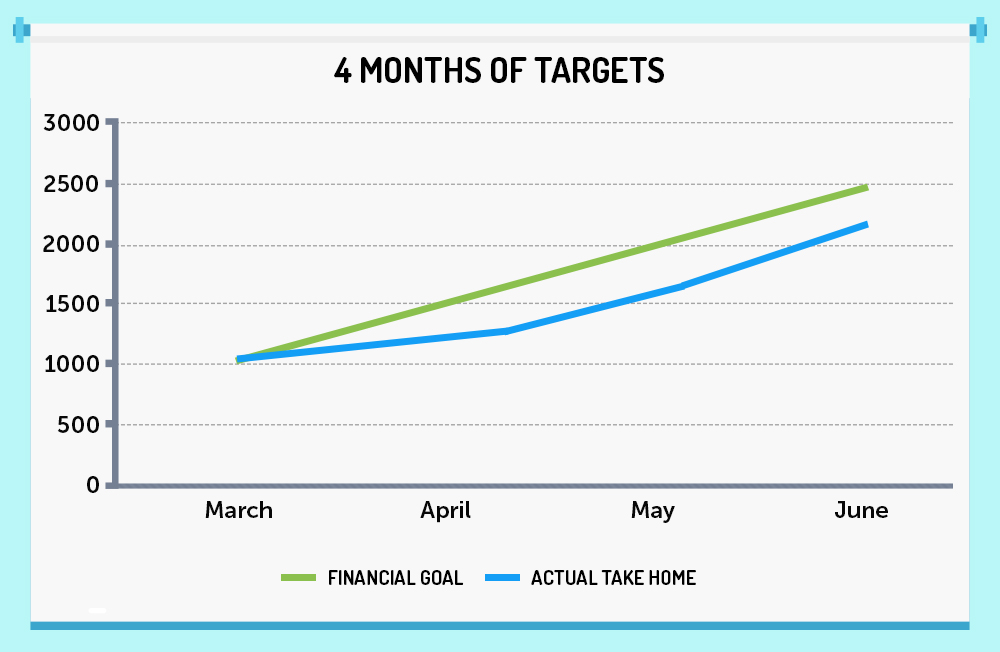

Once this has been setup, you should then check your financial plan every four months to ensure you are hitting targets.

If you are not, then make the necessary adjustments to get back on track.

It may be helpful to organize your monthly income into a chart.

Use the adjacent line to display your goal.

This way you’ll be able to see a long term trend of how you are performing.

For example:

By using a graph like this, it’s easy to compare your goals to your reality.

In this case, the take home amount is steadily under the target, so it would be necessary to analyze the financial plan and make the changes required to reach the goal.

IRA vs 401k

Take a look at the plans you have now. Are there opportunities to receive higher returns?

Check if there are any fees associated with making the changes.

If you are an employee, then your company’s HR can help you with investment funds like your 401(k).

2. Don’t Put Your Eggs in One Basket

Relying on a single investment plan could be costly.

What happens if it performs poorly and you lose everything?

Having multiple investment plans will help minimize the risks.

Example:

If you have a 401(k), then setting up a Roth IRA could be a shrewd move.

Why?

With a Roth; the money you deposit will be taxed, so this means the balance you see won’t be under any deductions – what you see is what you get.

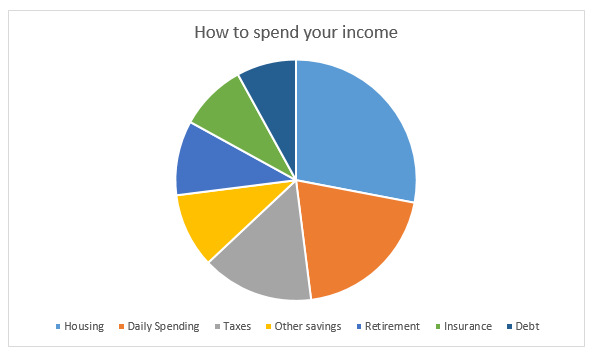

This chart will give you an idea of how to split your money:

3. Invest a Tiny Bit More into a 401(k)

If your company offers a 50% match, then saving as little as $33 a month can easily reach $70,000 within 35 years.

$33 is an example of a 1% savings from a $40,000 salary – which is the same cost as a meal out or buying some DVDs.

These simple tips can make all the difference when it comes to preparing a very prosperous future.

By spending the time now to plan your retirement, you’re guaranteeing yourself a stress free life down the road.