Marriage has often been seen as the end goal of a committed relationship in the past, but this is rapidly changing.

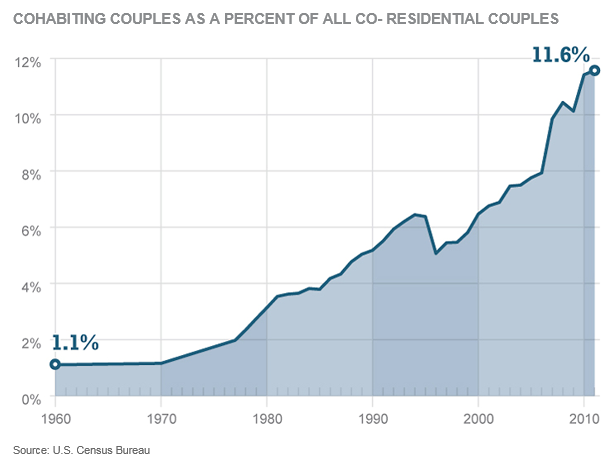

It is becoming more and more common for unmarried couples to remain that way (see graph) while sharing bank accounts, buying a house, and starting a family.

Unfortunately, leaving the knot untied leaves you without many legal protections that married couples benefit from, even though you are likely to have the same financial concerns.

If you are in a committed relationship, but you and your partner are not interested in walking down the aisle, it is worth considering the following tips for financial security.

Have the Money Talk

You will also need to establish whether you will merge your finances or keep them separate.

Maybe you will pool all the money you both earn, or have a joint account for household expenses while keeping some of your personal income for individual use.

Whatever you decide, having a well-developed financial plan will leave you and your partner feeling much more confident.

Make a Retirement Plan

Remaining unmarried means that spousal benefits from both Social Security and pension plans will not be applicable to either partner.

It does not have to mean you will have less of a retirement income than married couples, but you may have to consider other options to provide for your partner during retirement.

Increasing your current savings, or designating each other as the beneficiary of your own retirement plan or life insurance policy, are all possible ways for you and your partner to ensure a comfortable retirement for one another.

Plan Your Estate

Unmarried couples are not protected by the laws applicable to married couples – if not addressed, this could result in your partner having no access to your estate, or being unable to make medical decisions if you become critically ill or seriously injured.

To avoid being in this situation, you should consider;

- Consulting an estate planning expert for advice

- Giving your partner power of attorney for health care and finances

- Executing a will

Make a Parenting Agreement

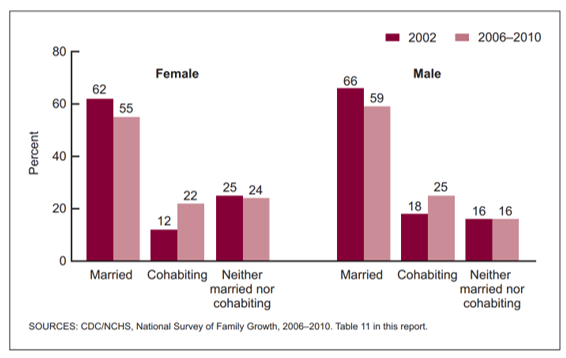

The proportion of children born to unmarried couples in the USA has increased in recent years (see below graph).

If you and your partner have children together, adopt, or one partner has children from a previous relationship, it is vital to ensure you are both legally recognized.

In an unmarried relationship with children, fathers may need to get a court-approved parenting agreement.

If you are the non-biological parent of your partner’s child, formal adoption proceedings will need to be carried out.

Ensuring that both partners are recognized as legal parents guarantees children will be entitled to Social Security benefits, and may be important for child custody.

Talk about Home-Ownership

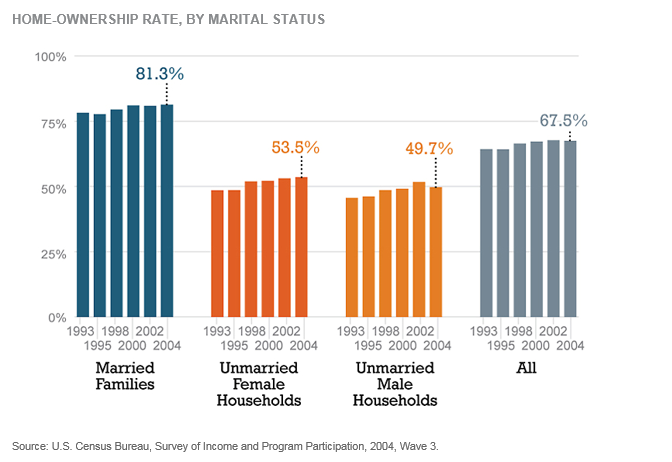

Not as many unmarried couples own homes together as married couples (see below graph).

There are several things to be considered when buying a house together, first and foremost whether it will be an individual or joint lease.

Regardless of who has paid the mortgage and down payments, having only one name on the lease means that the home can be sold at any time without the other partner gaining any of the proceeds.

In addition to this, if the person with their name on the lease passes away, the house is not guaranteed to go to the silent partner unless it is designated in a will.

In contrast, having both names on the lease means both partners are legally entitled to the proceeds if the house is sold, even if the house is financed entirely by one person.

Make a Breakup Plan

While break-ups are never good, having to argue over assets and custody can make the end of a relationship much worse.

Inspired by prenuptial agreements, it is recommended that unmarried couples organize a ‘no-nup’ to be prepared for this eventuality.

This is a legal document explaining the agreed upon terms and the division of assets in the event of a break-up.

With a legally sound no-nup and following the earlier tips outlined in this article, it should be easy for unmarried couples to comfortably and confidently build lives together, safe in the knowledge that they are as prepared as possible for any eventuality.