The only thing that’s almost as bad as being in debt is your debt collectors.

Yes, we get it. Your job is to collect our debt.

But the truth is…

There are laws that your debt collectors must follow.

And many debt collectors break these laws in attempt to collect the debt you owe.

We’ve provided a list of things your debt collectors are forbidden to do.

So next time you notice they’re breaking the law… it’s your job to report them.

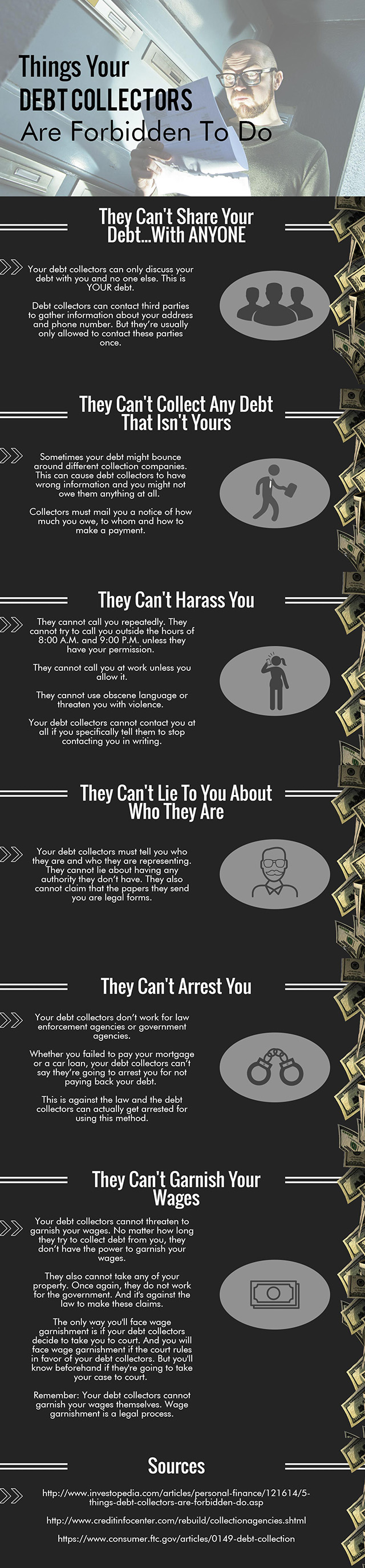

They Can’t Share Your Debt With Anyone

Your debt collectors can only discuss your debt with you and no one else. This is YOUR debt.

Other than your spouse and your attorney (and the credit bureaus), your debt is no one else’s business. They cannot publish your debt into shaming you for not paying your debt back and they cannot contact you through postcard.

Debt collectors can contact third parties to gather information about your address and phone number. But they’re usually only allowed to contact these parties once.

They Can’t Collect Any Debt That’s Not Yours

Sometimes your debt might bounce around different collection companies. This can cause debt collectors to have wrong information and you might not owe them anything at all.

Collectors must mail you a notice of how much you owe, to whom and how to make a payment. If you receive a notice, and you are not sure if you own this debt, then question it. Send them a letter through certified mail asking for more information or letting them know it is a mistake.

It’s possible that they won’t send you any type of notice. They might just start calling you.

This is when you should send a letter through certified mail asking for more information without assuming responsibility.

They Can’t Harass You

Your debt collectors will probably call you many times to try and receive payments. They will almost do anything to get people to pay their debt off. But there are things they are not allowed to do.

They cannot call you repeatedly. Many debt collectors continue to call people until they answer their phones. They cannot try to call you outside the hours of 8:00 A.M. and 9:00 P.M. unless they have your permission.

They cannot call you at work unless you allow it. This is another annoying attempt where they think they have you trapped at work and you will have to answer the phone there.

They cannot use obscene language or threaten you with violence.

Your debt collectors cannot contact you at all if you specifically tell them to stop contacting you in writing. If you’re tired of them trying to contact you, send them a letter through certified mail.

Don’t put it off.

They are not allowed to contact you unless you continue to let them contact you.

They Can’t Lie To You About Who They Are Or Who They Work For

Your debt collectors must tell you who they are and who they are representing. They cannot lie about having any authority they don’t have. They also cannot claim that the papers they send you are legal forms.

If anyone calls you saying they are a lawyer or an attorney, then it’s important for you to verify who they are. It’s against the law for any debt collector to lie about who they are. But this doesn’t stop some of them from attempting it.

They Can’t Arrest You

No matter how much debt you owe, your debt collectors cannot arrest you or charge you for not paying back your debt. Your debt collectors don’t work for law enforcement agencies or government agencies.

Whether you failed to pay your mortgage or a car loan, your debt collectors can’t say they’re going to arrest you for not paying back your debt.

This is against the law and the debt collectors can actually get arrested for using this method.

They Can’t Garnish Your Wages

Your debt collectors cannot threaten to garnish your wages. No matter how long they try to collect debt from you, they don’t have the power to garnish your wages.

They also cannot take any of your property. Once again, they do not work for the government. And it’s against the law to make these claims.

The only way you’ll face wage garnishment is if your debt collectors decide to take you to court. And you will face wage garnishment if the court rules in favor of your debt collectors. But you’ll know beforehand if they’re going to take your case to court.

Remember: Your debt collectors cannot garnish your wages themselves. Wage garnishment is a legal process.

Remember! Your Debt Collectors Can’t Make These Claims:

Debt collectors make many claims that they have no authority to do. They use these tactics as a desperate attempt for them to get debts paid off. However, it’s important for you to know that these practices are against the law!

Here are some claims they might make:

- You’re going to get arrested

- You have committed a crime

- They are attorneys

- They are government representatives

- They work for a credit reporting company

- The papers they send you are legal forms

- They will garnish your wages and/or take your property

- They’re selling off your debt

If your debt collectors threatens you with any of these claims, it’s important for you to tell them to stop this behavior. You can even take them to court if they fail to stop this behavior.

Did you find this information helpful? Click here to learn How To Get Out Of Debt!

Do YOU have any other tips for people dealing with the debt collector issues mentioned above?

We want to hear from YOU in the comment section!

I have been threatene be put in jail bout debt that’s not even.mine. I have had identity theft and my attorney is working to clear them. They call nasty saying I am going to garnish your wages and hang up in your face. I have experienced it all!!

That sounds terrible Anita! I hope your attorney works that out for you.

Nobody has time for that!

Me too i can peove with DNV that the Car they are tryingbto get me for is not ever been mine according to DNV not even a registration or tag because the car is not mine, thos company has hurrased me, threatened to put me in jail, pretended to be someone they are not and so much more they even took and reput it on my credit as a new purchase Crap like this needs to Stop!!! No creditor should be allowed to put credit on as a new purchace if its not according to them i bought the car in 2005 brand new for 14,000 its a 2006 modle but they have it as i rebaought it in 2013 yet they had the car and sold it at a Action in 2009 for 10, 900 which the full price value for thst vehical at that time would have been only 6,900 for a very basic stick shift Pt Cruiser! Which by the way car was suppposidly in my name only but i cant even drive stick shift and if car was in my name only a title and tag would have had to be in my name only too according to DNV but it never was , Go figure

Wait… they’re going after a car that isn’t even yours? Do these people have no boundaries?!

I can only pay on my living expenses. Ok, now here are 2 things a debt collector has violated. A debt collector has sent me a multi-page document explaining how they are going to garnish my wages. This same debt collector has called my work and a coworker answered the phone and handed off the phone to me, saying they asked for me. The guy on the other end started talking his lines about the conversation is going to be recorded and he is a debt collector. I said nothing and hung up the phone.

Wow Chuck, they’re getting pretty creative there, huh?

Have you ever tried to report them? Or just ignore them each time?

What do you mean they can’t garnish my wages? They did take $2,000+ for what they claim I owed $200+ for. The went to court and they won by default because I did not show up. I was unemployed then and was on public assistance. They didn’t listen. Then, I got a job! They found out about it, of course, and the $1200+ judgment became $2000+. I went to Atty Gener’s office….I thought they’d do something. Collectors just waited for what the Atty General was going to do. They contacted them and they sent the AG paperwork showing that now they were awarded $1800+…but they kept collecting until I went to AG. They stopped ow after a couple of months and taking all more than $2,000.00. Yesterday finally I received a letter – copied me telling my employer to stop the garnishment and return all the funds the employer was holding. I called my employer and they said they took all the money! Collector is Messerli and Kramer. So, now I don’t know I hope I can get the money that they took for that judgment be default.

Yes, you can face wage garnishment. But only if they take you to court and a judge rules in their favor. They cannot access your bank account or take money out of your paycheck without going through the legal process.

Thanks for your comment! I updated the article to prevent any more confusion about wage garnishment!

They always find a way to get you, and yes they can garnish your wages, Ive had it happen to me plenty of times

They don’t have the power to garnish your wages. They can take you to court, and they can win the case. But you won’t face wage garnishment unless a court rules in favor of your debt collectors.

Thanks for your comment! I updated the article to prevent any more confusion about wage garnishment!

I couldn’t refrain froom commenting. Very well written!

Awe shucks, thank you!