One of the biggest purchases a consumer makes is their car insurance.

Most people buy their car insurance with the hope that they will never actually need it.

It is critical that the right coverage is purchased.

It’s important that you know buying insurance for a brand-new car is much more expensive than purchasing insurance for an older model car.

The following ten tips are aimed at assisting you in keeping the premiums low while avoiding the risks that aren’t necessary:

- Conduct a Rate Check Annually

- Use an Insurer that is Rated at The Top

- Make sure That You set the Deductible Correctly

- Look Over Your Entire Coverage

- Utilize Discounts

- Multiple-Policy vs. Single- Policy

- Keep the Risk of Teenage Drivers Under Control

- Keep Your Credit Score Up

- If You Use Less Mileage, Report it

- Be Careful When Choosing Your Vehicle

Here is some more information about each to ensure that you can use these ten tricks to save on car insurance effectively.

Conduct a Rate Check Annually

Sometimes it can be difficult to beat the rates of an insurance company you have used for an extremely long time.

This is even more true if you have managed to go an extended period without making a claim.

In 2014, the Consumer Reports National Research Center found that of its 19,000 subscribers that compared premiums, only 10 percent were able to save money when the decided to switch to a new insurance company.

There are some sites that you can use the internet to compare the rates of more than one insurance company with one another.

You may not be able to get a quote over the web immediately.

However, you will normally get an email pretty quickly from agents who want you to make the switch.

You may want to consider creating a relationship between yourself and an independent agent.

An independent agent will check the rates of numerous carriers for you.

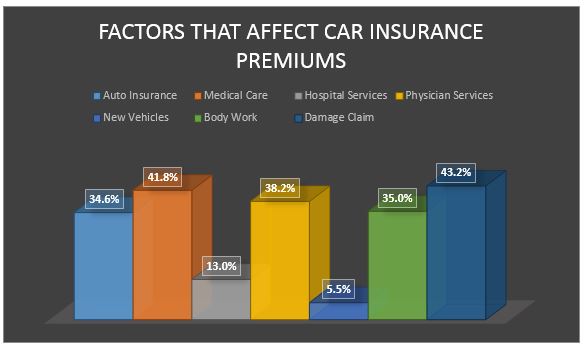

Here are how much certain factors could increase your insurance premium:

Use an Insurer that is Rated at The Top

If you want to save money, you need to look into more than which company provides the lowest premium.

However, just because the premium is low doesn’t mean the overall costs will be low.

Numerous companies can provide extremely affordable rates due to the loss estimates being extremely small, taking shortcuts when repairs are needed, and making their insured parties pay more to purchase original equipment when any parts need to be replaced.

Numerous companies will even raise the premiums unjustly if an accident occurs.

Consumer Reports surveyed over sixty-four thousand subscribers on their site that had filed a claim in between the years of 2011 and 2014.

Of these, when it came to how their claims were handled, 88% stated that they were highly satisfied.

Amica, NJM, and USAA were some of the groups that were the highest rated.

These companies had scores that were at or above 90.

Below are the rates for five of the biggest insurers in the United States.

These rates are based on male and female new-customer single drivers that have a clean driving record and an excellent credit score:

Make Sure That You Set the Deductible Correctly

The higher your deductible is, the less your premium is going to be.

This is because the higher deductible means that when you file a claim, you are going to pay more.

Premiums can be reduced by 15-30 percent if you raise the deductible from 200 dollars to 500 dollars.

If you raise the deductible to 1,000 dollars, you could even save as much as 40 percent.

If you maintain a clean driving record and go an extended period without getting into an accident that is your fault, then deciding to go with a higher deductible can be a good idea.

However, you want to make sure that you set the deductible to an amount you can afford to pay if you happen to get into an at-fault accident.

Look Over Your Entire Coverage

Liability coverage is obtained to pay for any bodily injury or any property damage that occurs in an accident that is your fault.

You do not want to reduce your liability limit to match the minimum that is set by the state.

You may be thinking that purchasing more coverage is an odd method to save yourself money.

Think about the benefits of having more coverage if you find yourself facing an expensive claim.

When you are facing an expensive claim without adequate liability insurance, you may find yourself giving up your entire life’s saving.

You can forego rental reimbursement coverage if you have more than one vehicle.

This is because you already have something to drive while your car is being fixed.

If you have a membership with an auto-club that is better than roadside assistance, skip getting the road-side assistance.

You can also skip roadside assistance if it is included in the warranty with your vehicle.

You want to examine purchasing coverage critically for medical payments and personal injury.

If you do not have good health insurance, or the people that usually travel with you are under insured, then you should purchase it; if not, throw it out.

Utilize Discounts

Many discounts are based on whether or not your lifestyle means you are at low-risk.

You should inquire with your insurance company about the following things if they fail to bring them up.

- Whether or not they offer discounts for good grades.

- Whether or not they offer discounts for new drivers who have undergone some driver-training classes.

- Whether or not they offer discounts for those who have been driving for a while and have taken a refresher driving training course.

- Whether or not they offer discounts for taking defensive driving classes

- Whether or not they offer discounts for those who have membership with some affinity group (college alumni or professional organizations for example.)

- Whether or not they offer discounts for having anti-theft equipment or safety equipment

Multiple-Policy vs. Single- Policy

Some different insurance companies will provide discounts to those who combine their auto insurance, life insurance, homeowner’s insurance, or renter’s insurance together.

However, make sure that you look at how much the total cost is going to be each way.

Compare premiums from getting these types of insurances together and separately before making a decision.

Keep the Risk of Teenage Drivers Under Control

Everyone knows that adding a teenage driver to your car insurance can cause your rates to spike.

However, did you realize that the costs could raise as much as 50 to 100 percent more than you are used to paying?

It is important that you ensure you child has completed a safe-driving class before they obtain their driver’s license.

Parents should ensure their teens understand any unsafe driving techniques will result in a loss of the privilege of driving.

You should also tell your insurance company if your child has not acquired a driver’s license.

The company should also be informed if your child is in college, lives more than 100 miles from home, and if they do not own a car.

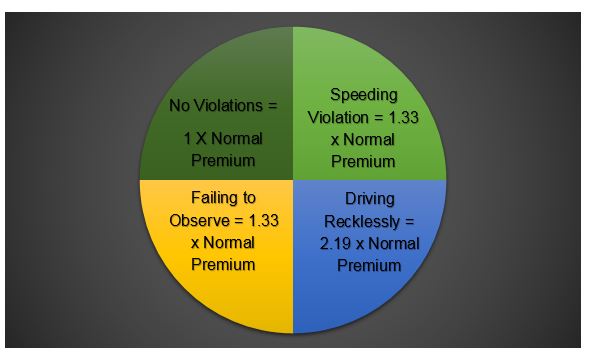

The following shows how different traffic violations will affect the premium for your car insurance:

The average miles driven in a year is around 12,000.

However, sometimes people drive much less than this.

Keep Your Credit Score Up

The truth is that insurance companies are allowed to take your credit score and use it while considering your premiums in most states.

Whether they do or not, make sure that you check your credit score and correct any errors you find on a regular basis.

When your finances are negatively affected by things outside of your control, such as a death in the family, medical issues, deployment, loss of a job, divorce, or a recession, you can ask the company to make an exception.

If You Use Less Mileage, Report it

It could be that you have started a new job closer to home or that you have retired.

Whatever the reason, it is important that you let your insurance company know anytime your mileage is reduced.

Reduced mileage could save you between 5 and 10 percent when it comes to the amount you pay on your premium.

Be Careful When Choosing Your Vehicle

The final thing that could save you money is the car that you want.

Incentives change based on the model of your vehicle because the largest cost for the insurance companies is vehicle damage.

When you begin comparing different model cars, it is essential that you ask your insurer to provide quotes for the various model vehicles you are considering.