Find yourself stressing about your finances?

With nearly three-quarters of Americans identifying money as the leading cause of stress in a recent study, you’re not alone.

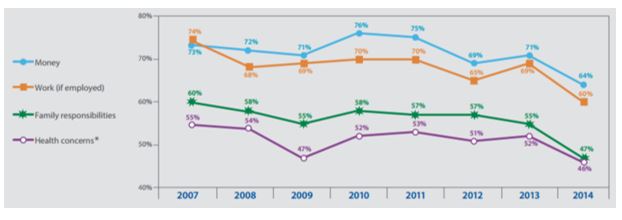

The graph below shows the stress levels for four different life concerns from the year 2009 to 2014.

While the sources of money woes are countless, financial stress can lead to very real psychological and medical problems.

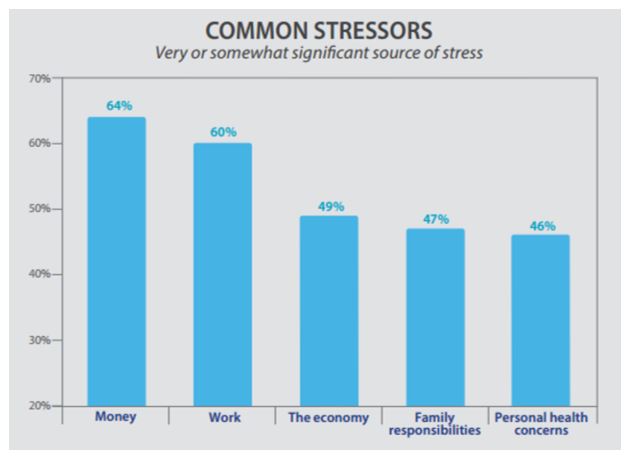

Money is the most common stress factor amongst people followed by work.

The economy, family responsibilities, and personal health problems are other significant factors as shown in the graph below:

Following the below tips should help you manage your financial stress, and put you on the path to a happy and healthy life.

Think and Talk Positively

Maintaining a positive outlook is a great way to manage stress from any source.

If your stress is a result of your financial situation, thinking about the positive aspects of your finances should help alleviate the strain.

Matters to be considered include:

- Your 401k or IRA investment account

- Any upcoming bonuses or increase in salary

- Your long-term financial plan

- What your money is being spent on

It may happen that your current lack of finances are due to a large chunk of your salary going into your investment account, or your financial situation is due to change in the foreseeable future.

Remember that even if it seems like you are low on cash now, it won’t always be that way.

It is also important to remember that money isn’t everything – maybe your finances are not what they could be, but you’ve sacrificed a higher wage for a more rewarding job or a more enjoyable lifestyle.

Focusing on the positive aspects of your financial situation and talking positively about your finances with others should make your financial stress decrease significantly.

Focus on Quality Sleep

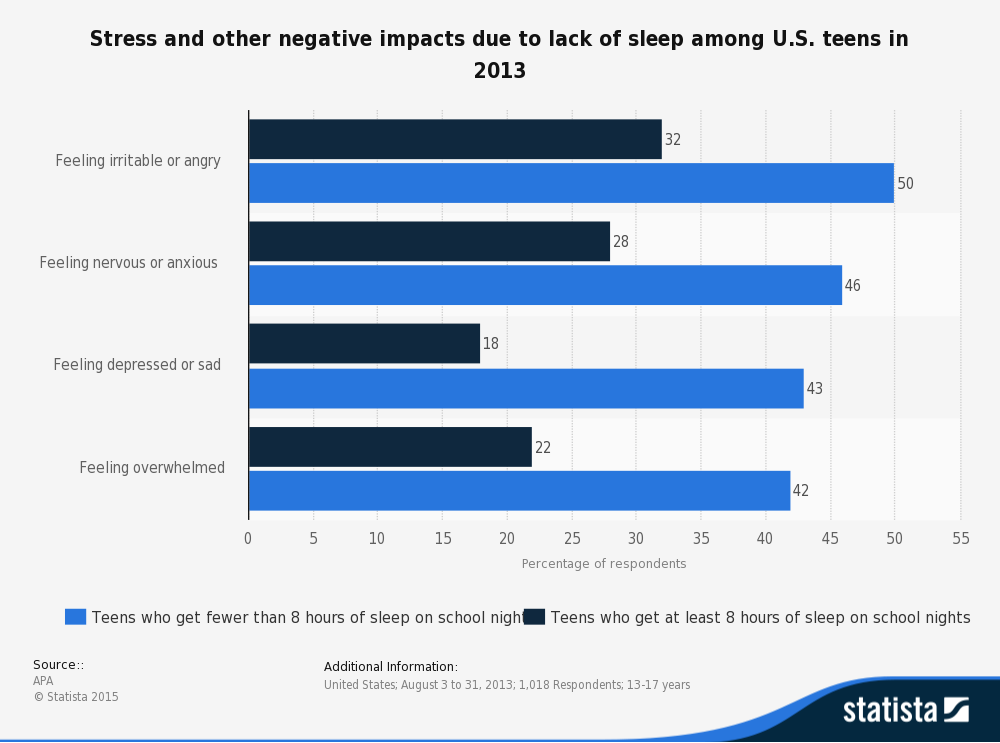

Studies have shown that the more sleep a person gets, the less likely they are to feel stress in day-to-day situations (see below graph).

If you find it hard to switch off your brain and get to sleep while your financial concerns are running through your mind, try:

- Avoiding or decreasing caffeine intake throughout the day

- Giving yourself a bedtime and sticking to it

- Dedicating some time before bed to relaxing and unwinding, whether in the bath, doing yoga, or reading

As well as decreasing your overall stress levels, developing healthy sleeping patterns should leave you with a clearer mind and more energy to approach your financial problems heads on.

List Your Concerns

Writing down your financial concerns and their solutions is an excellent way to visualize your problems, and challenges should become far more surmountable when you can see them in front of you.

Thinking about your financial troubles as problems that you can address and solve as opposed to overwhelming issues should decrease your levels of stress, and will probably make your finances seem to be in a much better condition than you previously realized.

Although it may seem counter-intuitive, it may also be helpful to identify and write down the worst case scenario.

Recognizing and acknowledging your fears is the best way to overcome them.

Determining the worst possible financial situation you could be in will allow you to develop a contingency plan.

Once you’ve spent some time thinking about it, you may even find that the worst case scenario is in fact very manageable.

Regardless, having a financial plan in place for any eventuality will make you feel much more in control and less stressed.

Manage Your Money

Having a solid financial plan in place should help prevent you from worrying too much about your finances in the first place.

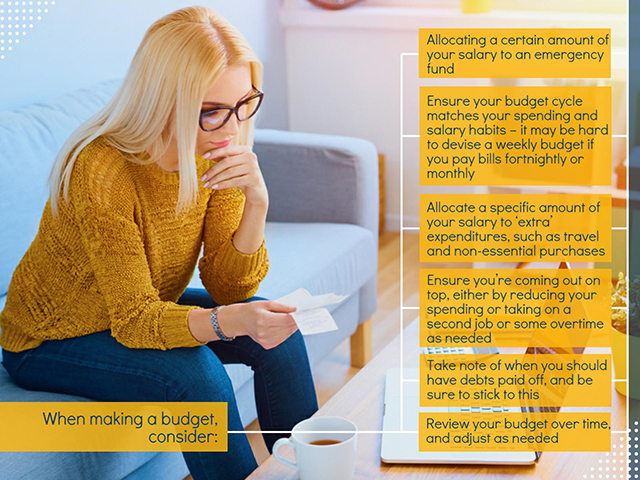

If you don’t have a financial system prepared and find yourself feeling stressed about your spending, creating a budget is vital.

Seeking advice from a financial expert is one of the best ways to decrease your financial stress.

A good financial adviser can make a substantial difference to your budget, will help you understand where your money should be going, and should make you feel much more relaxed and in control of your finances.

When seeking help from a professional, it is important to consider your financial goals and ensure you find an adviser with a portfolio and experience that matches these.

Whether you’re hoping to save more for retirement, free up a bit more spending money, or just understand your finances more, an adviser will be able to help.

Think Differently About Money

If you find yourself getting worried and stressed about your finances, consider the way you think about money.

It is vital not to feel ashamed about your financial situation, and if you feel like you know nothing about managing money, remember that you can always educate yourself.

Taking the time to increase your knowledge of sound financial practices and seeking advice from others about their financial plans may feel awkward at first.

But, it will set you up for a much healthier and stable financial future.

Start by approaching the subject with your partner, parents, or a close friend, and get your financial mind on track.

Stress of any kind can lead to a variety of psychological and medical problems, so it is important to face it head-on.

Following the tips outlined above should put your finances in your control, and help alleviate financial stress.