Why go studying abroad?

In comparison to studying on your home turf, getting qualifications from a foreign country can dramatically increase your prospects to future employers – and not to mention the benefits for your self-growth:

- Experiencing a different culture for yourself will open your eyes more than any book or internet article will ever do.

- Gain independence

- Learning a new language if the nation doesn’t speak English

- A massive boost in confidence

The culture difference may take you a few weeks or even months to adjust to, but once you are in full swing, you’ll realize it was the right thing to do.

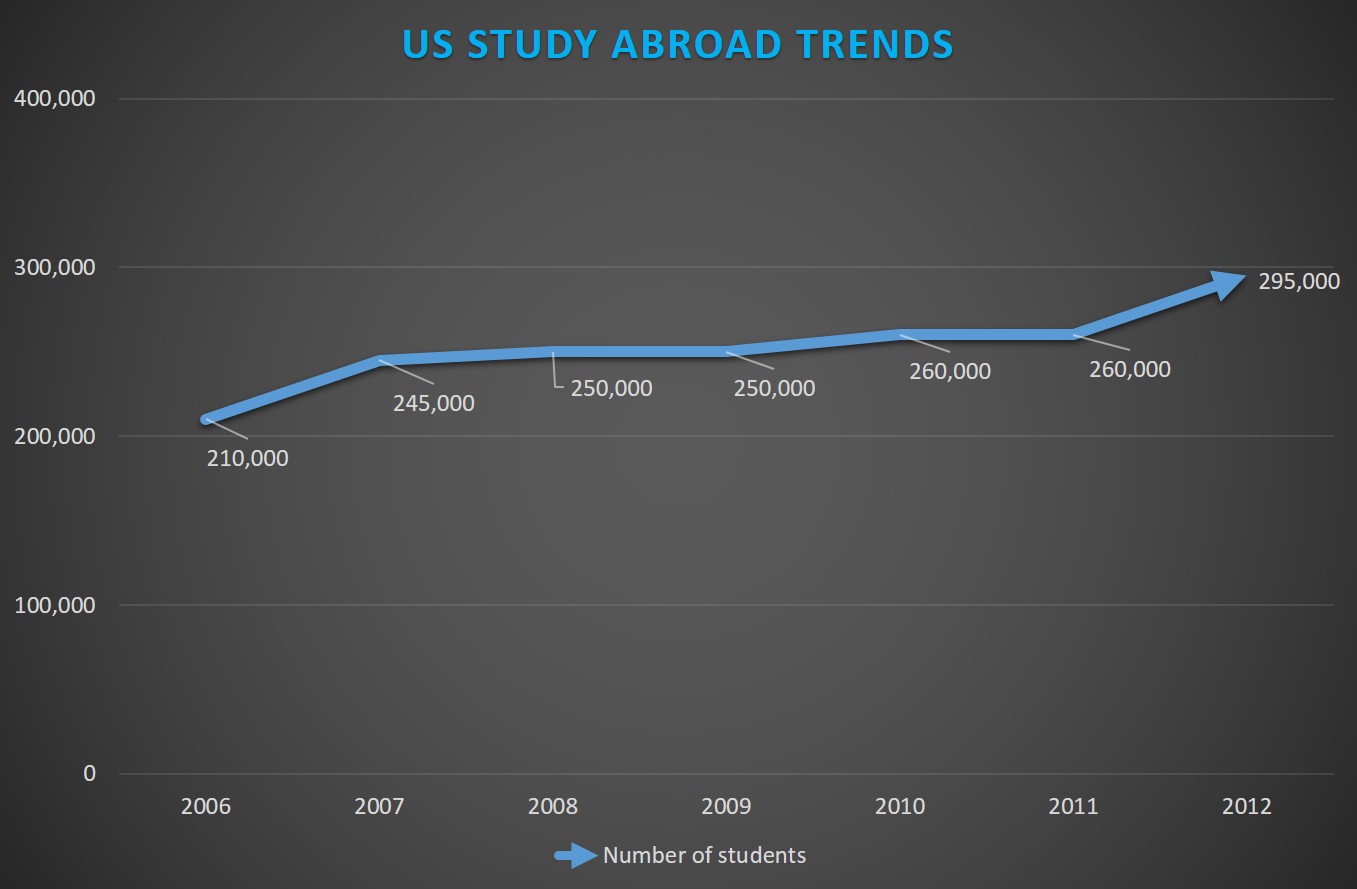

More and more students from the US are choosing to study abroad every year.

Here is a graph showing the increase in popularity:

Graph Analysis:

The reasons can range from Americans wanting to see more of the world or maybe the courses back home have more restrictions on the topics.

Isn’t it more expensive to study abroad?

Not if you budget smart and be sensible with your money.

With a bit of homework at the beginning, you should manage to live comfortably.

In this article, we will take a look at the top 6 ways to study abroad on a budget.

1. Direct Enrollment

This means registering with a university overseas, instead of through a U.S based college – the benefits of this are:

- It can work out cheaper

- Lower tuition fees

- Organized excursions

- Setting a meal plan

The international university may even offer financial aid or scholarships, which are always worth checking out.

The negatives

The process can be a lot more complicated, as you’ll need to administrate your paperwork and ensure earned credits transfer to your college.

You will also need to set-up your insurance and emergency plans.

2. Look for the cheapest places to study abroad

When looking for your perfect faraway university, always take into account for the country’s living expenses.

Use Value Penguin to get a total expenditure on airfare, food, rent, and other necessities.

Guatemala, Mexico, and India are currently ranked the lowest, whereas Switzerland, Norway, and Singapore have come up the priciest.

If you can be flexible with which country, then this factor will reduce a lot of cost to your adventure.

Chart of most popular foreign destinations by US students:

3. Include a budget for holidays

If you are studying abroad, then you will want to explore the country further by going on adventures, or having a break in a nearby location (ideally a hot sunny beach).

Even worse, maybe your student friends are going off to another destination, and you don’t want to get left behind.

So make sure you have enough cash on standby for these types of scenarios.

4. Use a budget calculator

This can help you reach an accurate estimate for your study-abroad expenditure.

A calculator will take things into account that you didn’t even think of e.g. public transportation, rent, utilities, food, entertainment, clothing, personal items, and mobile phone coverage.

Recommended budget calculator:

5. Get Travel Insurance

This is essential as it will sort out any stress that you may stumble upon – health issues, minor mishaps, and other emergency situations.

For example

One incident may be the airline losing your luggage, and you unexpectedly need to buy new clothes (which may diminish your budget) – however, with insurance you would be covered.

Another example:

If a relative has fallen ill, then the travel insurance will reimburse you for any financial loss incurred, like the cost of a round trip flight.

Warning:

It is wise to have yourself covered, especially as we don’t have a crystal ball to see what’s in store for the future.

6. Keep an emergency stash of cash

Having this available while studying abroad may save you a lot of headache and stress, especially if something does go wrong! So always hide emergency money in an envelope or somewhere safe.

Tip:

Ideally not in a bank, as it may be too tempting to use in non-emergency situations.