You’d be surprised to know how easy it is to have your identity stolen.

That’s an increase of more than 100,000!

Here are 9 musts to keep your identity secure.

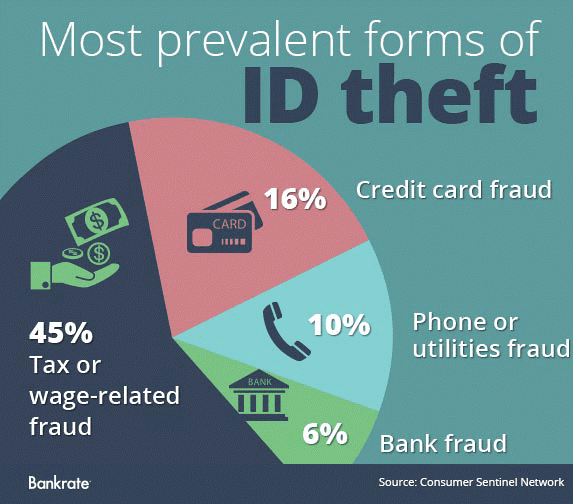

1. Know The Signs Of Identity Theft

The first thing you need to know is what to look out for.

Here are some common signs:

- Your card is suddenly declined

- Unexplained drop in your credit score

- Unexpected activity in your account balance

- Unauthorized inquiries on your credit report

- Debt collectors suddenly chase you

- There are new accounts you didn’t open

2. Routinely Check Credit Reports

You can receive a free annual report from the three credit bureaus: Equifax, Experian and TransUnion.

You can find this at annualcreditreport.com.

By checking your credit report regularly, you’ll be able to notice signs of identity theft when they happen.

If you do come across a problem, contact your creditor immediately.

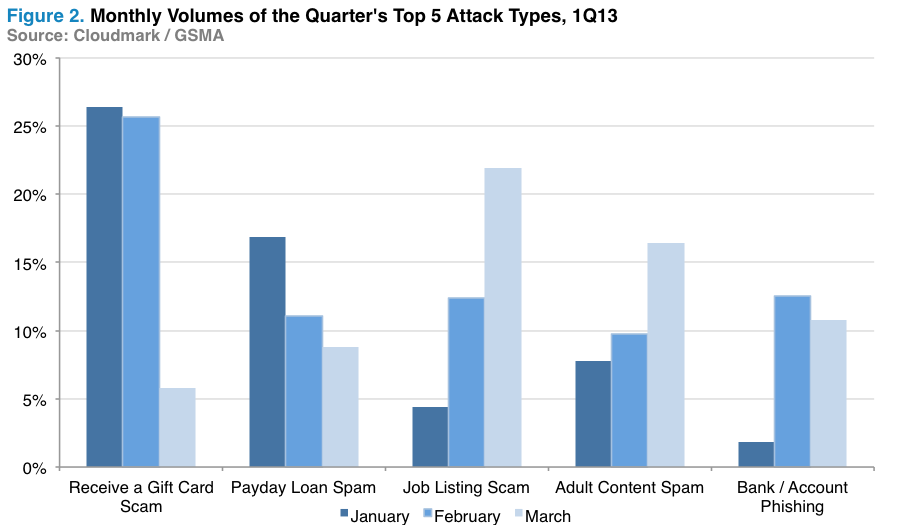

3. Be Educated On Scam Messages

Many scammers will use scare tactics.

They might tell you there is a problem with your payment, or that you have been hacked.

Others might say you’ve won a prize.

If it is an email, you can check if the email address is legitimate.

If they request credit card numbers or Social Security numbers, you must be wary!

Contact the company or institution in question.

Do keep in mind that if you call them, they might need personal information to verify your identity.

All the more reason to keep your identity safe!

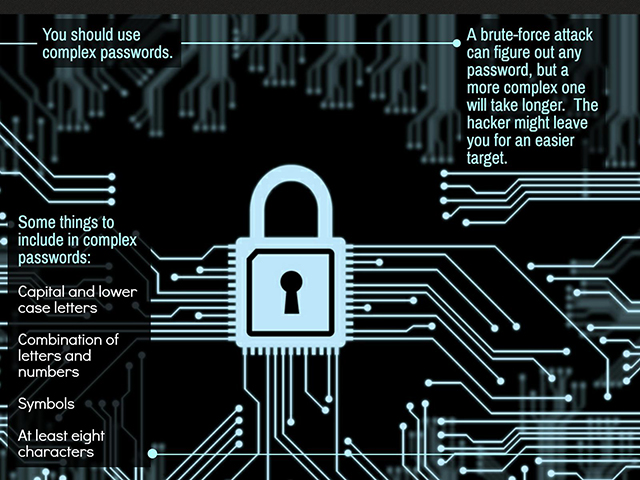

4. Do Not Be Lazy With Passwords

You’ve probably heard this multiple times, but let us reiterate: do not use the same passwords for multiple accounts.

If a hacker gets hold of one account, they will try your other ones.

5. Be Smart With Security Questions

Similarly, many people overlook security questions.

However, the answers can differentiate between you and a hacker.

You don’t have to use true answers.

Try using inside jokes or nicknames that few people know.

You can even purposely misspell words.

These tricks will do much to confuse a hacker.

Just make sure you remember what you put!

6. Do Not Go Without Anti-Virus Software

Even if you’re careful with what you download, malicious malware can still find its way into your computer.

Once it’s there, it can steal your passwords.

It has access to sensitive information.

No anti-virus software is 100% fool proof, but it will definitely give you the protection you need.

7. Secure Your Internet Browser

Don’t show the entire world your transactions and online activity.

Use an encryption software to protect the information you send.

It is safe to transmit information if you see a lock icon in the status bar of your window.

Make sure to use HTTPS connection whenever possible.

Most sites, such as Google and Facebook, have this option.

It encrypts and protects your data.

This is particularly important when you’re on a public Wi-Fi network.

These tips are essential for those who work in cafes and coffee shops!

8. Put A Lock On your Phones

While it may not seem like much, there’s a huge difference between a locked and unlocked phone.

Nowadays, phones are embedded into our daily lives.

Still, they are easy to lose.

It is even easier to access all accounts, messages, and information if the phone has no password or lock.

If you can’t be bothered by a passcode, try a design or pattern lock.

Just like passwords, remember to change these often.

And keep them complex!

9. Secure Important Information Offline

Identity theft is more and more rampant online.

But it is still important to protect yourself offline.

Keep valuable objects, such as Social Security cards, at home.

Only bring what you must.

You do not need to carry all of your credit cards and ID cards to a coffee date.

Never leave important files in your mailbox overnight.

Putting your mail on hold is a good safety measure if you’re going out of town.

Anything with personal information should be destroyed after use.

This includes expired credit cards, receipts, and bank statements.

With the advanced technology today, it’s easy to let down your guard.

And it’s easier for hackers to steal your passwords and your identity.

Keep these tips in mind to keep yourself protected!