Do you have trouble budgeting all of your monthly expenses? Sometimes people have no idea how to budget their income. Maybe they don’t have the right budgeting tools in from of them. And those problems can exist whether you make $20,000 or $100,000. Some people simply can’t budget their money.

If you’re one of those people, don’t worry. We help people solve their budgeting issues daily. And there are ways to get better.

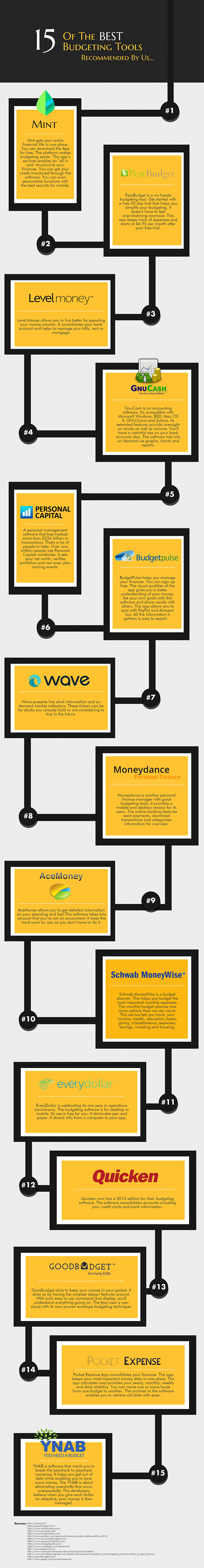

I don’t know if you know this, but there are many budgeting tools available to you online and as apps. These websites and apps provide budgeting tools that help millions of people take control of their finances.

So we’ve created a list of the best budgeting tools you should use if you’re looking for a way to make budgeting easy. And signing up for these services is even easier. So there is no excuse for not starting today.

Here are some of the best budgeting tools we recommend:

Mint

Mint gets your entire financial life in one place. You can download the App for free. The platform makes budgeting easier. The app’s services enables an “all in one” structure to your finances. You can get your credit monitored through the software. You can even personalize functions with the best security for mobile.

PearBudget

PearBudget is a no-hassle budgeting tool. Get started with a free 30-day trial that helps you simplify your budgeting. It doesn’t have to feel overwhelming anymore. This app keeps track of expenses and starts at $4.95 per month after your free trial.

Level Money

Level Money allows you to live better by spending your money smarter. It consolidates your bank account and helps to manage your bills, rent or mortgage. The app has already tracked more than $25 billion in user transactions worldwide. Level Money provides some of the most safe and secure software on the market.

GnuCash

GnuCash is an accounting software. It’s compatible with Microsoft Windows, BSD, Mac OS X, GNU/Linux and Solaris. Its extended features provide oversight on stocks as well as income. You’ll have a watchful eye on your bank accounts also. The software has info on demand via graphs, charts and reports.

EveryDollar

EveryDollar is celebrating its one year in operations anniversary. The budgeting software is for desktop or mobile. Its use is free for you. It eliminates pen and paper. It directs info from a computer to your app. Start your first budget in as little as 10 minutes. You’ll get to track remaining balances, money spent and your near plans.

Quicken

Quicken now has a 2016 edition for their budgeting software. The software consolidates accounts including your credit cards and bank information. The group has been operating for 30 years today. It’s 256-bit encryption security protects your account’s information with ease.

YNAB

YNAB is software that wants you to break the paycheck to paycheck nonsense. It helps you get out of debt while enabling you to save more money. The YNAB is about eliminating overdrafts that occur unexpectedly. The developers believe when you give each dollar an objective, your money is then managed.

Personal Capital

Personal Capital is just that. It’s a personal management software that has tracked more than $226 billion in transactions. That’s a lot of people to help. Over one million people use Personal Capital worldwide. It sets your net worth, verifies portfolios and can even plan coming events.

BudgetPulse

BudgetPulse helps you manage your finances. You can sign up free. The visual qualities of the app gives you a better understanding of your money. Set your own goals with this software and share results with others. The app allows you to sync with PayPal and Amazon too. All the information it gathers is easy to export.

Wave

Wave presents live stock information and on demand market indicators. These tickers can be for stocks you already hold or are considering to buy in the future. The personal financial management options are great for business and personal use. The app’s accounting tool monitors bank accounts and expenses.

Moneydance

Moneydance is another personal finance manager with great budgeting tools. It provides a mobile and desktop version for its users. The online banking features send payments, download transactions and categorizes information for overview. The graphs and reports have detailed charts that keep you up to date.

AceMoney

AceMoney allows you to get detailed information on your spending and fast.This software takes into account that you’re not an accountant. It does the hard work for you so you don’t have to do it. The software is compatible with Windows or Mac OS X. The website offers a free-30-day-trial for the first month of use.

Schwab MoneyWise

Schwab MoneyWise is a budget planner. This helps you budget the most important monthly expenses. The monthly budget planner has more options than we can count. This service lets you track: your income, health, education, loans, giving, miscellaneous, expenses, savings, investing and housing.

Goodbudget

Goodbudget aims to keep your money in your pocket. It does so by having the simplest design features around. With such easy to use command and display, you’ll understand everything going on. The App uses a new cloud with its own proven envelope budgeting technique.

Pocket Expense App

Pocket Expense App consolidates your finances. The app keeps your most important money data in one place. The app calculates and provides your yearly, monthly, weekly and daily statistics. You can move one or more funds from one budget to another. The archives in the software enables you to retrieve old data with ease.

Visual Budget

Visual Budget makes budgeting easy on the eyes. You have a free of charge account granted up to 10 transactions monthly. Analytics are available to users 24/7 and under all circumstances. The software is great for desktop or mobile accounts. You can set currencies and various accounts with ease of use.

Any one of these budgeting tools can help a budgeting rookie. They can also help an experienced “budget-er” that is looking for some help with their finances.

No matter what level you’re at, we recommend these budgeting tools to help you with your monthly finances going forward.

So stop making excuses and stop wasting your money. Start looking for the right budgeting tools for you.