Owning your own home has long been part of the American dream.

This has been the case since Roosevelt’s New Deal, which worked under the idea that owning property was integral to the American way of life.

Roosevelt introduced several programs that aimed to help the average American buy their house and stop renting properties, and in doing so paved the way for long-term mortgages.

It worked in the sense that home ownership increased, but it also helped introduce a level of debt that many of us continue to struggle with today.

Home ownership rates are not the strongest indicator of economic prosperity.

Some countries, such as Switzerland, have a strong economy, but a low home ownership rate.

Nevertheless, increasing home ownership has remained a priority since the ‘30s.

Along the way, many programs and institutions have been set up to benefit the housing market and help Americans become homeowners.

Examples of government intervention in the housing market

Fannie Mae

- The Federal National Mortgage Association, otherwise known as Fannie Mae, was created in 1938 as a government-sponsored enterprise (GSE). The organization was set up to provide local banks with federal money so that more people could take out home mortgages. Fannie May has since been turned into a private corporation but is still associated with the government.

- Fannie Mae helped created the secondary mortgage market in 1970, which facilitates the sale of securities or bonds, which offers another source of capital. The idea behind this is that allowing lenders to reinvest by more lending should increase the number of lenders in the market. In 2004 the Fannie May organization was caught committing fraud.

Other examples

- The American Dream Downpayment Assistance Act was put into practice in late 2003 by George W. Bush. This act aimed to help over 40,000 families a year pay their down payments and closing costs, in another attempt to strengthen the housing market.

- The central bank has long tried to influence the housing market by keeping interest rates low.

The government has significantly increased regulations relating to mortgages and banking, in an attempt to help regulate and benefit the market.

Unfortunately, that doesn’t seem to be working.

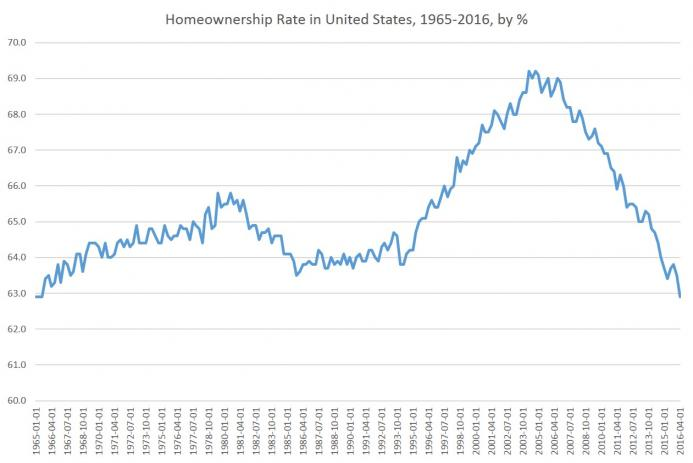

The most recent data suggests that the number of Americans who own their homes did initially go up, but has since decreased, and is now at the same level it was when records began.

This is pretty much the same as it was back in 1965.

You can see from the graph below that while home ownership spiked in the mid-2000s, it has rapidly decreased since and is now at the same level it was in 1965.

GDP

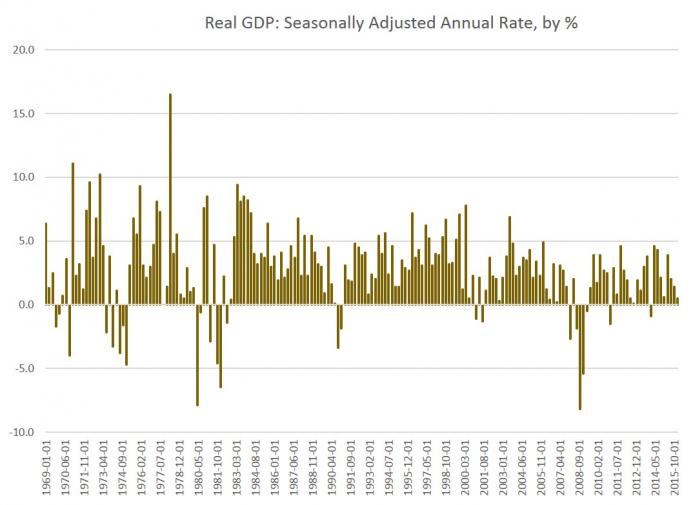

America’s GDP has been quite sluggish for the latter half of this century; in fact, it has not risen above 5% since 2007.

GDP had slowed considerably since the 70s and 80s when recessions were typically followed by periods of high growth.

Although small home ownership levels are not necessarily linked to a weak economy, the fact that the USA’s GDP has been diminishing for decades means its unsurprising that personal income is doing the same.

Why are less people buying their homes?

The home ownership rate peaked at 69.2% in 2004, and since then appears to have decreased rapidly.

Possible reasons for this decline include:

- Home prices are rising rapidly, while wages are not. In fact, house prices are rising faster than both inflation and wages.

- The average personal median income appears to have fallen since 2006

- Demographics have changed since 1965, and as people are choosing to get married and have children later in life, they may also be putting off buying a home until they have established a family and a career.

- Some people may prefer renting, as it allows for a more flexible lifestyle and makes it easier to move.

- The government’s efforts to promote home ownership have had some negative effects

- Easy money policies are making housing prices and the cost of living, in general, more expensive, which makes buying a home tough for the less affluent household.

The housing bubble

This bubble was created because so many people were buying houses, and this led to the growth of jobs in construction and real estate.

From 2001 to 2006, employment rates in the mortgage industry increased by 119%.

This came to an end during the recession, where some large banks were bailed out by the taxpayers.

When this bubble burst, over three million people lost their jobs, often after spending a lot of time and money trying to gain employment in the industry.

The Mises Institute argues that the government’s obsession with increasing home ownership has resulted in terrible results.

They blame the housing bubble, not just for making those employed in the home owning industry unemployed, but they blame it for encouraging so many people to seek employment in the housing industry in the first place.

If there hadn’t been a housing bubble, millions of workers may have taken up other trades, opened other business and created other products, all that could have benefited the US economy.

As it stands, home-ownership hasn’t increased, taxpayers have had to spend millions of dollars bailing out the banks, and millions of people are unemployed.

The Mises Institute follows free market liberal principles and therefore are ideologically opposed to governmental intervention in the market, so it’s not surprising that they are opposed to the government’s involvement in the housing.

This doesn’t refute their evidence, however, and they have raised significant doubts about how successful government participation in the real estate market has been.

In conclusion

There are many factors which could help explain why more people aren’t buying their homes; some of these have nothing to do with the government or the economy but are related to demographic changes.

It does seem, however, that government intervention in the housing market hasn’t achieved the results it wanted, and has made things worse.

If home ownership rates are the same as they were in 1965, in spite of increased governmental intervention, perhaps it’s time to cut their losses and seek a new approach.