If you’re struggling with the question of how to get a credit card, it’s probably because you have no credit.

Fortunately, there are several options available to secure a card and begin building your credit.

Unfortunately, many of these options can come with high interest rates or fees.

This is because companies view you as a higher credit risk.

How can you convince them otherwise?

In this article, you’ll learn three ways you can begin building your credit quickly.

That way, you can establish a good credit history and qualify for other offers!

How to Get a Credit Card with No Credit

1. How to Get a Credit Card | Secured Credit Card

Secured credit cards are intended for individuals with bad, limited, or no credit history.

They use a security deposit that doubles as a credit limit.

The idea of the security deposit protects issuers from what they believe are risky clients.

If you do not have an outstanding balance at the time you decide to close your secured credit card, the whole security deposit is returned to you.

Since issuers incur little risk with secured cards, these items commonly also have low fee structures and minimal requirements for approval.

All you generally need to do to open a secured credit card is provide a valid Social Security Number (SSN) and, of course, place the refundable security deposit.

Secured credit cards are pretty much the same as other credit cards.

They give you the ability to do things like rent a car, or reserve a hotel room online, with ease.

They can also offer the same benefits, like purchase protection or cash rewards.

In addition, just as when you apply for other credit cards, the secured card issuer will run a credit check.

They’re looking to see how you’ve handled your bills or whether you’ve declared bankruptcy within the previous year.

However, unlike conventional credit cards, once you’re approved, there’s an alternate process for building up your credit limit.

You’ll pay a cash deposit to the card issuer — usually a minimum of $200 to $500 — and your credit limit will equal that deposit.

The issuer then holds, as collateral, your deposit in a savings account that will pay you interest.

This is different from a debit card or prepaid card, which both begin with a set balance that you withdraw money.

With a secured credit card, you won’t have access to your deposit.

It’s there to give the bank security that you will pay the bill when it’s due every month.

2. How to get a Credit Card | Store Card

If you don’t want to go through the entire process of a secured credit card, then maybe a store card is for you.

Brands like Shell, PayPal, or Amazon offer brand-specific cards.

You can use these cards for purchasing essential items like food, fuel, or other recurring necessary items.

Store credit cards are usually offered when you make purchases at a store.

Store credit cards began almost exclusively with department stores, but now you can get them from home improvement and chain stores.

For example, Target now offers store cards.

The main selling point on a store credit card is that it offers you an extra 10% off of your purchase price every time you use the store’s credit card.

How Do Store Credit Cards Work?

Store credit cards work similarly to traditional credit cards.

You make purchases on the card that you can pay off over time.

Every month you will be required to make a minimum payment.

The interest rates on store credit cards tend to be higher than you would have with a traditional credit card.

However, many stores will offer rebates if you use their credit card to make a purchase.

They may also offer incentives like additional money off your next purchase.

One item to note is that many of these cards are specific to the store, meaning you can only use it there.

This is the primary limitation to store credit cards that make them less appealing.

With this in mind, now a large number of dealers offer something called a branded credit cards.

These cards are tied to a specific store and offer advantages to those who choose to carry their card.

The processor of the card is generally Visa or MasterCard with the logo of the merchant showed on it.

These cards are a good choice for individuals who have little to no credit and are still wondering how to get a credit card.

The disadvantage to these store credit cards is that they can charge significantly higher interest.

You will have to weigh your options to check if this card is worth the benefits.

In case you’re an Amazon Prime subscriber and a fan of cash back rewards, Amazon’s Store Credit Card may be worth a look.

The store card gives owners 5% cash back on Amazon purchases every day, along with special promotional financing.

Here’s the skinny.

This card — which is different than the very popular Amazon Rewards Visa from Chase — offers 5% cash back on eligible Amazon purchases and comes in the form of a statement credit.

3. How to Get a Credit Card | High Rate Card

The Cost of a High Interest Rate

It costs more to carry a balance on a high interest rate credit card.

That’s because your monthly finance charge is based on your interest rate and your balance.

Therefore, the higher your interest rate, the higher your finance charge will be.

Not just that, but the longer you take to pay off the card, the more cash it costs you, because you pay more in finance charges when you pay the debt off slowly.

Paying off high-loan cost obligation debt first saves money and usually lets you pay off the debt faster.

Something else to keep in mind is that high interest rate credit cards usually have a higher penalty APR.

The credit card company may charge a higher APR on new transactions after the customer has made late payments, or otherwise did not abide by the Card Member Agreement.

If you become more than sixty days late, some credit card companies may apply the penalty APR to your existing balance.

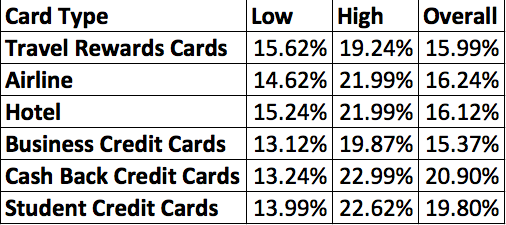

Average Credit Card Purchase Interest Rate (APR): By Card Type

The average credit card interest cost differs fundamentally relying on the type of card you’re looking at.

Rewards credit cards will generally have a higher average APR as a group to compensate for the additional benefits that these cards give.

Most credit cards have a scope of offer APRs that will rely upon your credit value, so here’s a look at the low and high ranges of cards:

The Lower end of the APR range is generally for those consumers with excellent credit, who therefore get the most favorable interest rates.

In contrast, the higher end financing cost range is for consumers on the base end of eligible credit scores.

One of the biggest factors that influences your credit score is your timeliness of payment.

As such, scheduling automatic payments can help you build credit while using a high interest card.

Automating your bill payments takes considerably less time and effort than manually paying them each month.

It guarantees you won’t miss a payment, because it comes out of your account automatically.

Therefore, you don’t need to remember an entire calendar of due dates.

Whether you’re just building your credit or have an impeccable score, most people can profit from automating their bill pay.

It makes things simpler and helps avoid late payments and the fees associated with them.

Find the Right Option for You

Like most things in finance, your best option for a first credit card will depend on your situation.

Our advice is to begin by considering the three options listed below.

Once you have opened up a credit card, monitor your credit regularly and look for more opportunities to build your credit.

Have you struggled with getting your first credit card? Do you still have questions on how to get a credit card? Let us know in the comments below!

UP NEXT: Buying a House with Bad Credit: How to Make It Possible