Debt can be overwhelming, but it does not have to be.

The thought of negotiating with your creditors may feel scary but by doing so, you can help yourself and your finances tremendously.

Household debt is on the rise

A recent report found that household debt had increased $434 billion from last year.

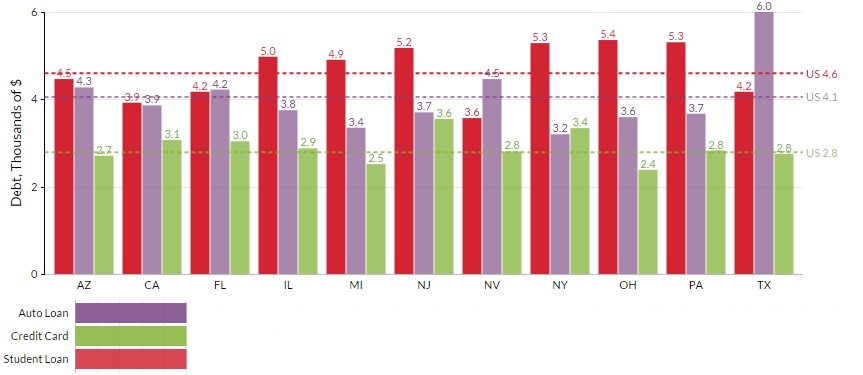

Auto debt has grown $97 billion; and student loan debt rose $69 billion, while mortgage debt has grown a staggering $246 billion.

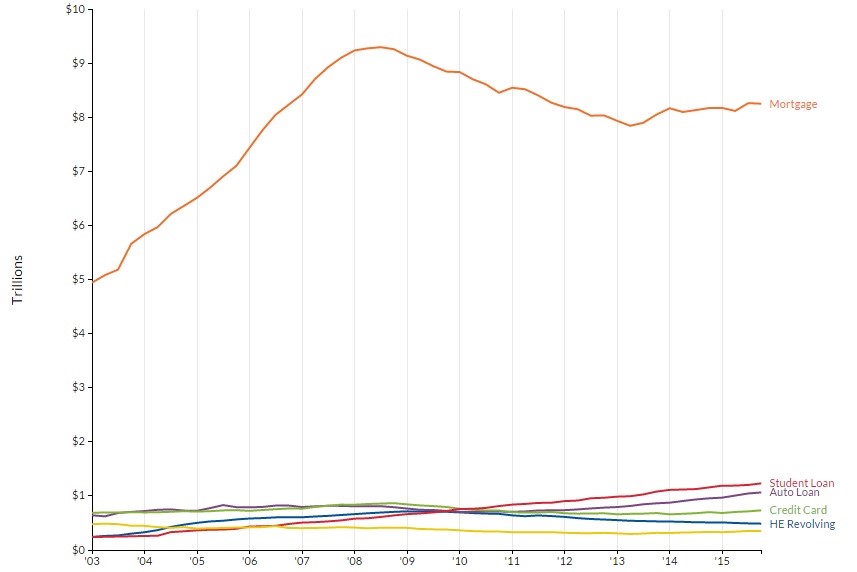

Mortgage debt has always remained the leading contributor towards debt.

However, since 2010/2011, student debt has started to increase, and finally broke the $1 trillion mark.

While in most states student loan debt far surpasses auto loans and credit card debt, Texas and Nevada are two of the few states where auto loans exceed other debts.

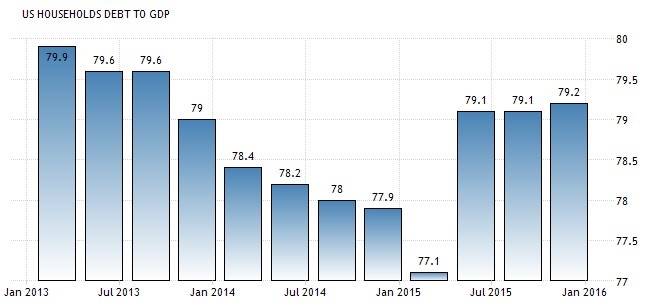

Household debt to GDP increased to 79.2 from 79.10 at the end of 2015.

Household debt to GDP has started to decrease from 79.9 down to 77.1 however by mid-2015 figures rose to 79.1.

Since 1952, the highest recorded figures were 95.50 at the end of 2007, and the lowest recorded figures were 23.40 at the beginning of 1952.

What will negotiating with my creditors mean for me?

The best way to deal with creditors is by ensuring you keep up with your monthly payments and pay in full each month.

This, however, is not always possible because unexpected circumstances can mean that we are unable to continue to pay creditors.

Many Americans remain unaware of their options when they find themselves in debt, many may feel that bankruptcy is their only option.

Bankruptcy, however, should be a last resort as the financial repercussions can be severe.

While negotiating with your creditors can have a positive impact on your finances you may have to pay taxes on your agreement and find your credit score negatively impacted.

So, how should you go about negotiating with creditor?

Be honest

When you initially contact your creditors, it is important to be frank with them.

You do not need to give them a long drawn out explanation, but you should be direct and explain your circumstances to them as truthfully as possible.

It does not matter why you have fallen behind on your payments, do not attempt to lie or hide facts.

If you have found yourself unemployed or sick, then let them know.

Creditors will appreciate your honest approach and willingness to work with them to come to an agreement.

Do not allow your emotions to show

It is not unheard of for creditors to hire negotiators trained to expose your emotions and use them against you.

If you do feel that your emotions are getting the better of you, then it is advisable that you end the call and try again once you have calmed down.

Do not make excuses for putting an end to the call; just calmly tell them you need to go.

Prepare yourself by knowing your rights

It is important that you know your rights before you start negotiating with creditors.

It is illegal for creditors to harass you, so it is important for you to know what counts as harassment.

The FDPCA are in place to ensure that your consumer rights remain protected.

Keep records of everything

Maintain records of all incoming and outgoing communication.

If you speak to a creditor on the phone, record the time, date, who you talked to, and a brief summary of your conversation.

If you send a letter, ensure that you send it via certified mail.

All of these steps will ensure that you have a comprehensive record of all communication; this may come in handy for future reference.

Create a financial plan beforehand

It will be beneficial if you work out exactly what you can afford to pay before you start to talk with your creditors.

By creating a financial plan you can work out exactly how much you can afford to repay each month or if you can afford to pay a lump sum.

It is important that your financial plan is realistic and that you can keep to any payment plan you offer.

Avoid collection agencies

If your debt goes to a collection agency, then this will not only affect your credit score, but will also affect your ability to obtain credit in the future for seven years.

Get all agreements in writing

It is critical that you get any agreement between you and your creditor in writing.

This will minimize the risk of your creditor backtracking, changing, or denying any agreement at a future date.

Ensure that your written consent include details of how much you owe, fees, interest rates, all payment details, and terms.

This should include the amount and length of payments if you are paying in monthly installments.

Seek help from a credit-counselling agency

If you find the negotiating process overwhelming then, a reputable credit counseling agency will handle the whole process for you.

They will be able to go through your finances and work out how much you can afford to repay.

They can also contact and negotiate with creditors on your behalf.

It is in a credit counselling agencies best interest to ensure that they get the best deal for you; they will also find it easier to remain detached since they are doing their job.

Sponsored Link: If you need help dealing with creditors, click here

Move forward

It is important that you learn from your debt and move on so that you can look towards a brighter and financially healthy future.