Having a large family can cause a lot of financial pressure.

Check out these money saving tips for some financial relief.

Why you should make the most of your money

Looking after your finances should be just as important to you as your health.

Poor financial health can lead to stress, so it is imperative to get into good financial habits as soon as possible.

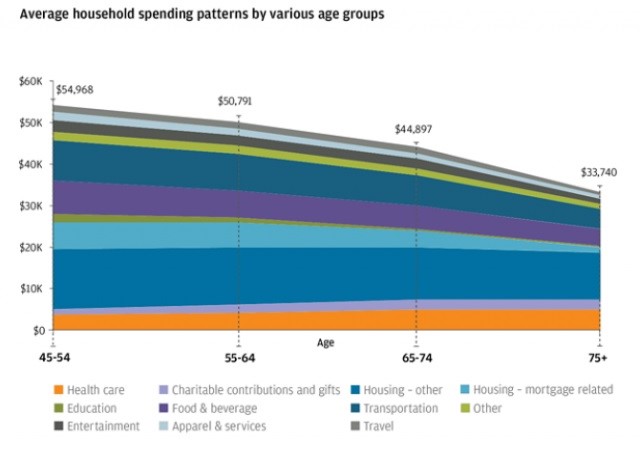

Many households find it difficult to get their household spending under control, despite all their planning and budgeting.

Researchers have found that this is because people can foresee future income, but they are not able to predict their future expenses as accurately.

There is also an element of willpower involved.

People quickly fall victim to impulse buys which they do not account for in their budgeting.

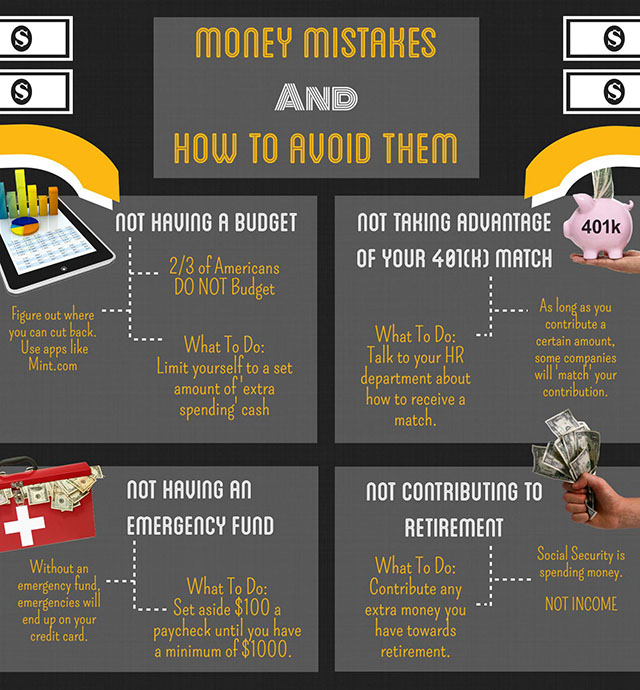

There are several common financial mistakes that people frequently make.

Be careful to avoid these.

By having backup funds and planning for your future you’ll be able to ensure that you and your family remain financially secure.

Shop Smarter

Simply changing your shopping habits can instantly save you money.

Try looking for sale items, using coupons, and buying everyday essentials in bulk.

You’ll need to do your research and figure out the cheaper options.

It may seem like buying food in bulk is inexpensive, but if you’re unable to eat all of it before it spoils, you’re just wasting money.

Don’t fall victim to impulse buys.

If it’s not on your list when you get to the store, don’t buy it.

Recycle and Improve

You can save a lot of money by reusing or improving items that you already have in the house.

Instead of buying garbage bags, reuse your old plastic bags.

If your couch is looking worn out, you can quickly restore it with new upholstery and save yourself the cash you’d spend on a new one.

Grow your own fruit and vegetables

If you eat a lot of fruit and vegetables (which we all should), then you could potentially save lots of money by growing your own.

You’ll have to spend money up front in order to get your garden in working order, but if you compare the long term savings of building your own, against the long-term cost of buying store bought produce, you may find yourself saving a lot of money down the road.

Plan all your meals

At the start of each week sit down and plan out what you’ll eat for every meal.

Then make a list of everything you’ll need from the grocery store.

Doing this will enable you to stick to a plan and budget.

You’ll also be less likely to splurge on a meal out when you already have one prepared at home.

Be energy efficient

There are two ways to be more energy efficient.

The first way is to invest in solar panels for your home.

These will greatly improve your utility bills.

Are solar panels too big of an investment for you?

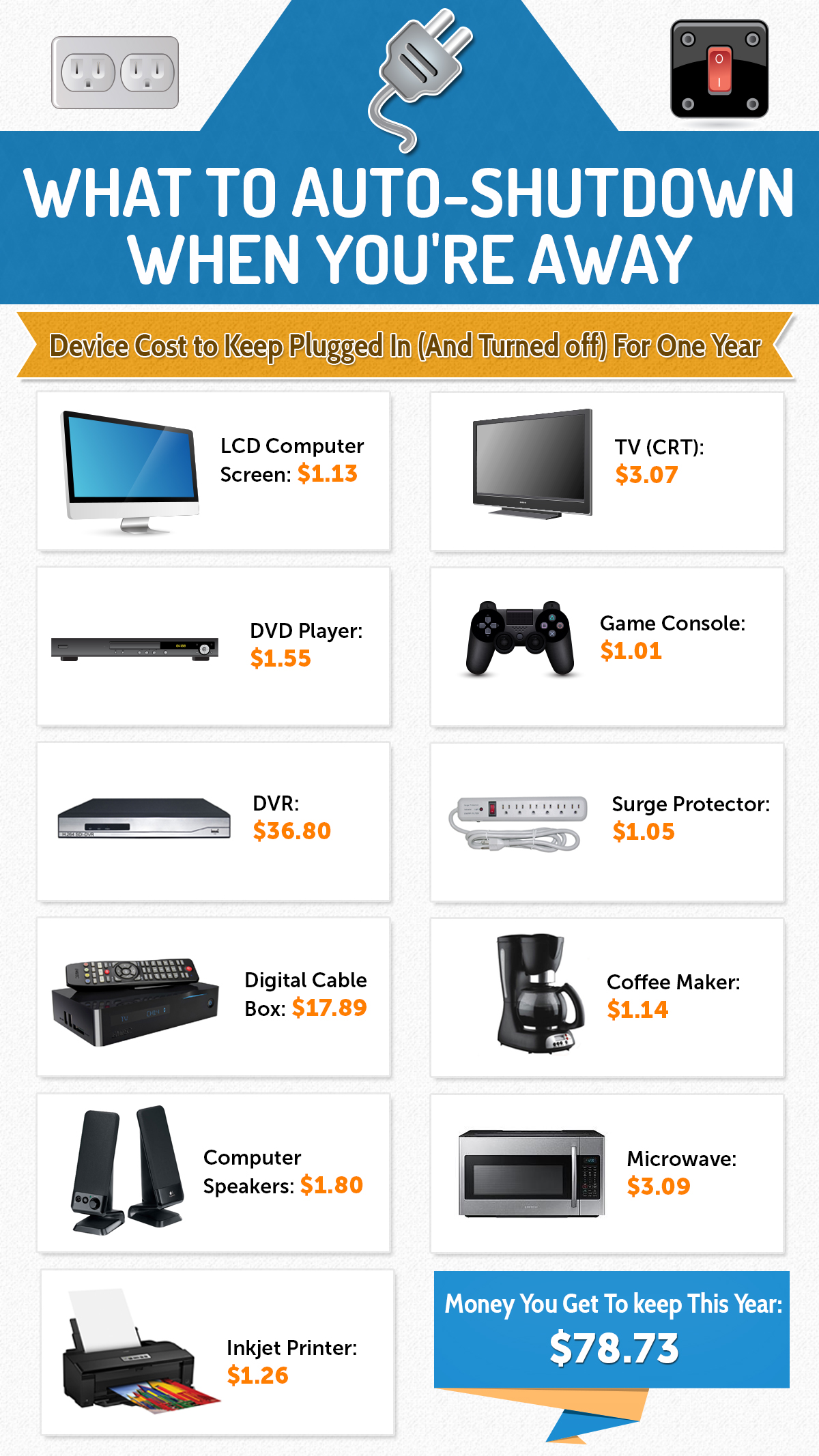

Don’t fret, you can easily be more energy efficient by simply unplugging items when you are not using them.

A lot of people assume that turning off an appliance means that it will no longer use electricity.

But, this isn’t true.

Many items still consume power while switched off.

This includes cell phone chargers, microwaves, TVs, and DVD players.

The amount of power consumed will depend on the appliance, but it could range from anywhere between 1 to 50 watts of electricity while its turned off or in standby mode.

Making either of these changes can bring down your utility bills and improve your finances for years to come.

Learn to Budget

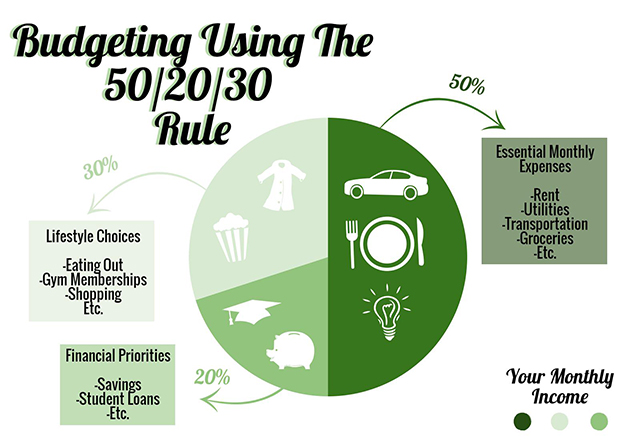

The 50/20/30 budget is a guideline designed to help you proportion your monthly income appropriately.

The recommendation is that 50% should go towards essential monthly expenses, 20% to financial priorities, and the remaining 30% should go towards lifestyle choices.

The 50/20/30 budget is just a guideline, so there is room to adapt the budget to suit your personal needs.

But, sticking as close to the guidelines as possible will ensure that you stay on financial track.

The plan will act as a framework that you can build upon and use for years to come.

Once you have worked out your total income and expenses, you will then be able to use this information to make the most of your money.