The average American household has more than $15,000 of debt.

With young adults learning their spending habits from their parents, it is not surprising that they do not know how to break these habits.

In some cases, parents are financially savvy, and their children will pick up positive spending habits.

However, that isn’t always the case.

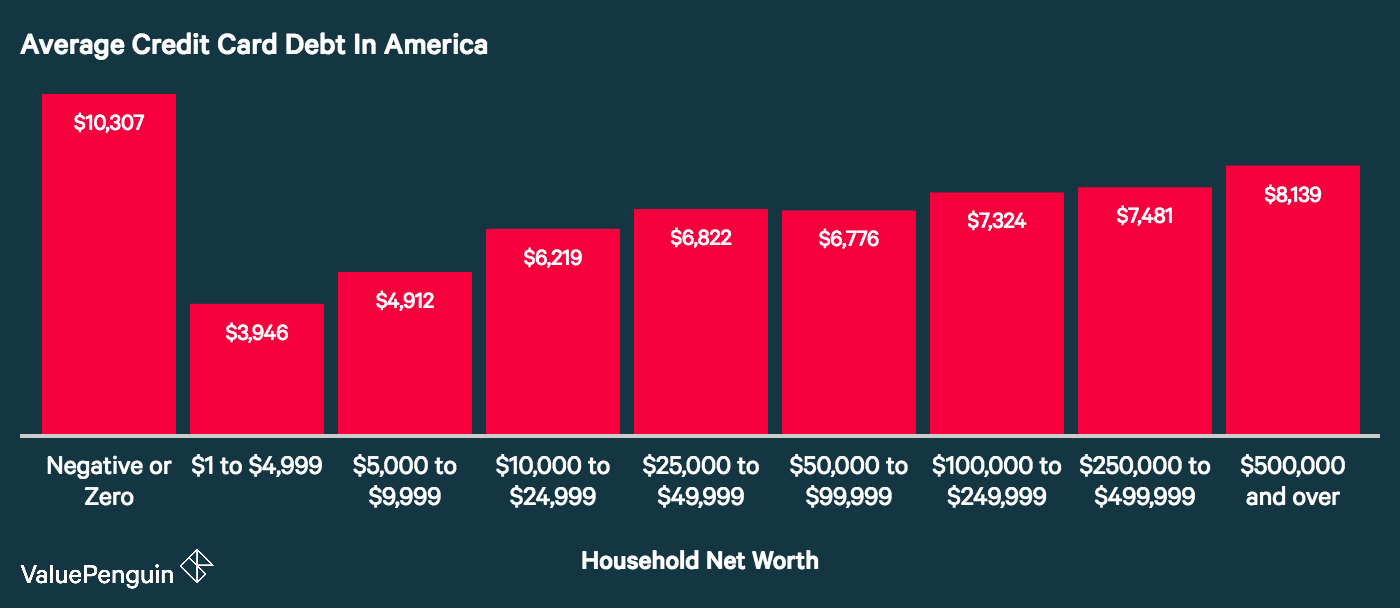

As you can see from the chart below, credit card debt is rampant.

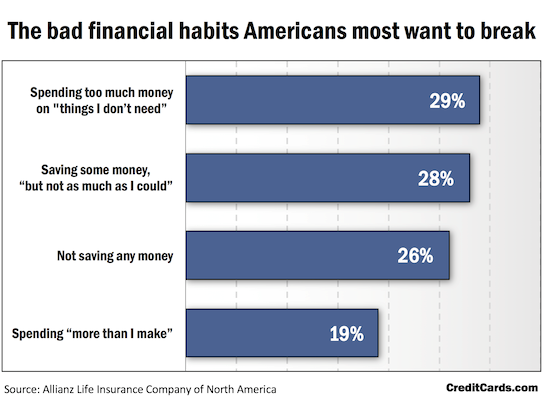

The chart below shows the bad habits that Americans direly want to change.

So how can you break this cycle of debt?

Make sure you keep your spending habits in check.

Analyze the Situation and Determine the Changes that are needed

The first step to fixing a bad habit is to identify that it is there.

One must examine their finances and determine if and where the issues are.

Is there debt that has accumulated over time?

Are credit cards being used to pay for all purchases?

Is there a savings account?

Before a change can be made, the cause of the problem must be identified.

A miracle is not needed to improve finances.

Following simple steps can, with time, eliminate debt.

If debt is being accumulated, where is it coming from?

Where and why is there overspending?

Is there a situation that triggers this spending?

Emotional spending can lead to dangerous habits.

While a quick shopping trip may lift one’s mood at the moment, it can quickly become a bad habit.

Unplanned and poor decisions, as well as using credit cards to pay for them, can completely ruin a budget if the purchases happen often.

Shopping can easily become addictive if it is not controlled.

If the savings account looks a little small, determine how much should be saved.

Why isn’t this value being saved?

Is the money that should have been saved spent elsewhere?

Some Tips to Follow

- Write down financial goals and share them with a friend: studies have shown that sharing a goal makes an individual more accountable. Having a written record of the changes to be made and the reason will encourage people to stick to their plans and not revert to old habits.

- Make mini-goals to stay motivated: repaying a large debt will take time, so try breaking it up into more manageable parts. Setting short-term goals will encourage more positive habits.

- Use technology and online banking to your advantage: use automatic payments to set bills to be paid when they are due. When a paycheck has been deposited, create a system that will automatically move a portion into a savings account and to repay a debt.

- Changing habits take time: change one habit at a time to avoid discouragement. As rules that were written down become habits, new rules can be introduced. Changing too many things at once can be overwhelming.

- Accept that there may be setbacks: mistakes may happen. However, sticking with new goals will lead to positive habits.

Paying Off Credit Card Debt

There are two popular, but contrasting, methods to paying off credit card debt.

The first is to put as much towards the highest interest balance, making minimum payments for the rest, and making all fixed monthly payments, like mortgages or car loans.

Alternatively, pay off the smallest balance first, while still paying the minimum on other balances and fixed monthly payments.

This gives a sense of accomplishment quickly.

Continue paying off the smallest balance using the extra money from the first card that was repaid.

If neither of these strategies are appealing, prioritize the debts according to what feels best.

Keep in mind that paying the minimum on balances will not repay the debt promptly.

Likewise, avoid taking out a loan, refinancing a mortgage, or dipping into a retirement fund.

Of course, credit card debt can only be fully repaid if cards are not used.

This will help control unnecessary purchases while the financial situation is under control.

Additionally, look for opportunities to save on monthly expenses.

There may be some spending habits, like a daily coffee, that can be put on hold while saving for a credit card payment.

A $3 daily coffee can lead to an extra $1,000 annually.

The savings can help repay the debt faster.